- United States

- /

- Building

- /

- NasdaqGS:UFPI

How Investors Are Reacting To UFP Industries (UFPI) Launching TrueFrame Joist for Professional Deck Builders

Reviewed by Sasha Jovanovic

- Earlier this month, ProWood, a UFP Industries brand, launched the TrueFrame™ Joist, a new deck framing solution offering enhanced durability, stability, and wet-use performance, now available in the Denver Metro area with further geographic rollout planned for early 2026.

- This product aims to meet the needs of professional builders by featuring superior preservation treatment, consistent sizing, and a Limited Lifetime Warranty, potentially strengthening UFP Industries’ position in engineered building materials.

- We’ll explore how TrueFrame’s innovative design for professional builders could shape UFP Industries’ investment outlook and longer-term growth strategy.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

UFP Industries Investment Narrative Recap

Belief in UFP Industries hinges on ongoing innovation in high-value engineered building products to counter industry cyclicality, margin pressure, and demand softness. The launch of the TrueFrame™ Joist represents a meaningful step toward strengthening the company’s engineered materials portfolio, but its near-term impact on sales and margins is unlikely to offset broader volume and pricing pressures from a still-sluggish construction market. The most significant short-term catalyst remains execution on cost reduction initiatives aimed at protecting profitability and preserving cash flow.

A recent and highly relevant announcement is the $60 million cost reduction program designed to streamline operations through facility consolidation and automation. As industry demand stabilizes rather than rebounds, these efforts could have a more material impact on margins and earnings than new product launches alone, especially as the value of high-margin specialty products depends on uptake and geographic expansion.

By contrast, investors should remain mindful that heightened price competition and constraints on passing on input costs could...

Read the full narrative on UFP Industries (it's free!)

UFP Industries is expected to achieve $7.1 billion in revenue and $443.8 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 2.8% and represents a $109.6 million increase in earnings from the current $334.2 million.

Uncover how UFP Industries' forecasts yield a $114.50 fair value, a 23% upside to its current price.

Exploring Other Perspectives

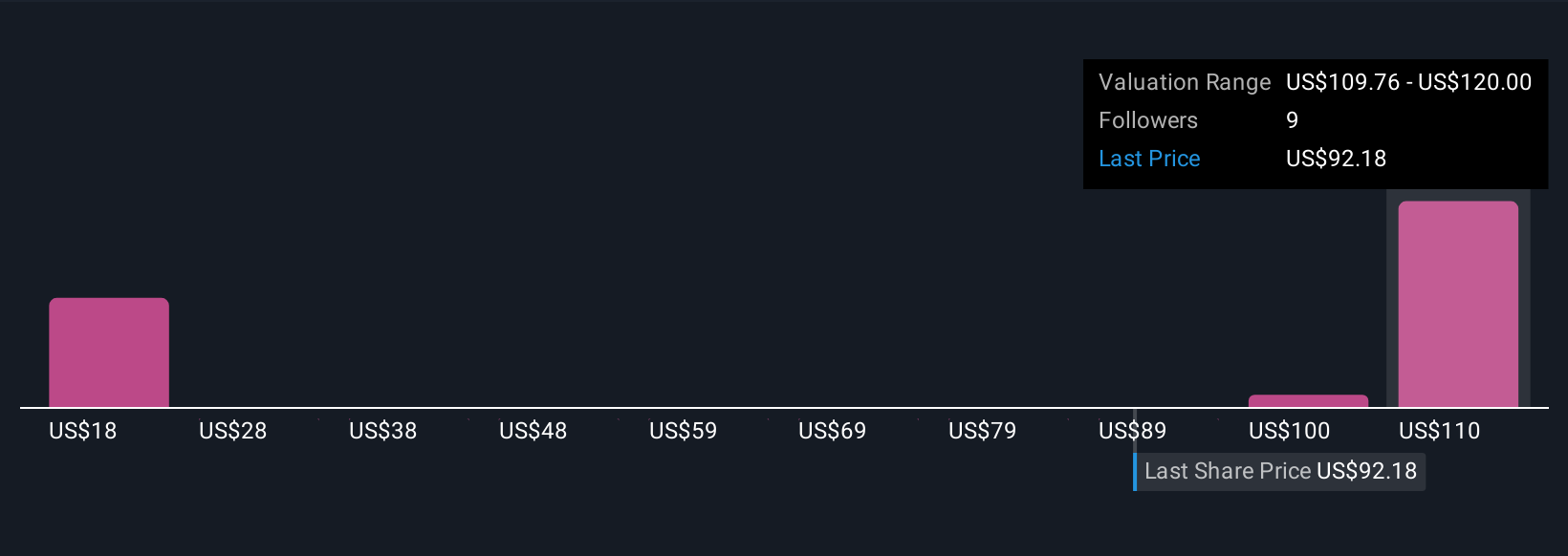

Four individual fair value estimates from the Simply Wall St Community range between US$69.73 and US$120, highlighting divergent views on UFP Industries’ share price. While investors weigh this diversity, ongoing efforts to accelerate growth through product innovation and cost control could reshape the story for both risk and reward.

Explore 4 other fair value estimates on UFP Industries - why the stock might be worth 25% less than the current price!

Build Your Own UFP Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UFP Industries research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free UFP Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UFP Industries' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UFPI

UFP Industries

Designs, manufactures, and supplies wood and non-wood composites, and other materials in the United States and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives