- United States

- /

- Electrical

- /

- NasdaqCM:TYGO

Why Investors Shouldn't Be Surprised By Tigo Energy, Inc.'s (NASDAQ:TYGO) 46% Share Price Plunge

To the annoyance of some shareholders, Tigo Energy, Inc. (NASDAQ:TYGO) shares are down a considerable 46% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 78% share price decline.

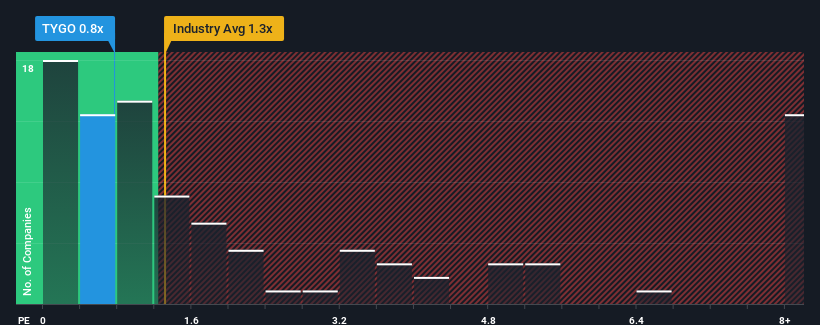

Even after such a large drop in price, Tigo Energy's price-to-sales (or "P/S") ratio of 0.8x might still make it look like a buy right now compared to the Electrical industry in the United States, where around half of the companies have P/S ratios above 1.3x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Tigo Energy

How Tigo Energy Has Been Performing

Recent times have been advantageous for Tigo Energy as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tigo Energy.How Is Tigo Energy's Revenue Growth Trending?

Tigo Energy's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 191% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 33% over the next year. Meanwhile, the broader industry is forecast to expand by 27%, which paints a poor picture.

With this information, we are not surprised that Tigo Energy is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Tigo Energy's P/S Mean For Investors?

The southerly movements of Tigo Energy's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Tigo Energy's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 4 warning signs for Tigo Energy (3 shouldn't be ignored!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Tigo Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tigo Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TYGO

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives