- United States

- /

- Electrical

- /

- NasdaqGM:TPIC

TPI Composites, Inc. (NASDAQ:TPIC) Surges 80% Yet Its Low P/S Is No Reason For Excitement

TPI Composites, Inc. (NASDAQ:TPIC) shares have had a really impressive month, gaining 80% after a shaky period beforehand. But the last month did very little to improve the 57% share price decline over the last year.

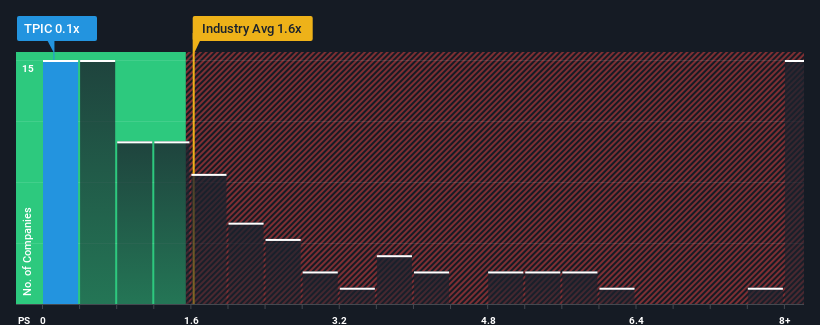

Although its price has surged higher, TPI Composites may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Electrical industry in the United States have P/S ratios greater than 1.6x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for TPI Composites

What Does TPI Composites' Recent Performance Look Like?

TPI Composites certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on TPI Composites will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, TPI Composites would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 4.1% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 6.4% each year over the next three years. That's shaping up to be materially lower than the 68% each year growth forecast for the broader industry.

With this in consideration, its clear as to why TPI Composites' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does TPI Composites' P/S Mean For Investors?

The latest share price surge wasn't enough to lift TPI Composites' P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of TPI Composites' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about this 1 warning sign we've spotted with TPI Composites.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if TPI Composites might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TPIC

TPI Composites

Manufactures and sells composite wind blades, and related precision molding and assembly systems to original equipment manufacturers (OEMs) in the United States, Mexico, Europe, the Middle East, Africa, and India.

Undervalued with reasonable growth potential.