- United States

- /

- Machinery

- /

- NasdaqCM:TPCS

The Market Lifts TechPrecision Corporation (NASDAQ:TPCS) Shares 61% But It Can Do More

TechPrecision Corporation (NASDAQ:TPCS) shares have had a really impressive month, gaining 61% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.3% in the last twelve months.

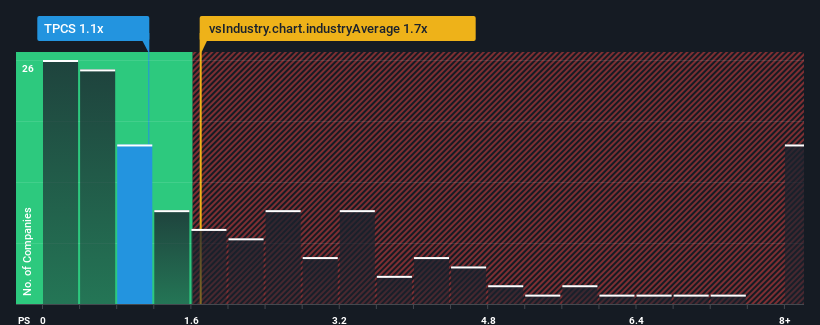

Although its price has surged higher, TechPrecision may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.1x, considering almost half of all companies in the Machinery industry in the United States have P/S ratios greater than 1.7x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Our free stock report includes 3 warning signs investors should be aware of before investing in TechPrecision. Read for free now.View our latest analysis for TechPrecision

How TechPrecision Has Been Performing

TechPrecision has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on TechPrecision's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For TechPrecision?

In order to justify its P/S ratio, TechPrecision would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.7% last year. Pleasingly, revenue has also lifted 77% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 0.6% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this information, we find it very odd that TechPrecision is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What Does TechPrecision's P/S Mean For Investors?

TechPrecision's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at the figures, it's surprising to see TechPrecision currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. We think potential risks might be placing significant pressure on the P/S ratio and share price. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with TechPrecision (at least 2 which are potentially serious), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on TechPrecision, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade TechPrecision, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TechPrecision might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TPCS

TechPrecision

Manufactures and sells precision, fabricated, and machined metal structural components and systems in the United States.

Low and slightly overvalued.

Market Insights

Community Narratives