- United States

- /

- Machinery

- /

- NasdaqCM:TAYD

Taylor Devices (TAYD) Margin Decline Challenges Profit Durability Narrative Despite Five-Year Earnings Surge

Reviewed by Simply Wall St

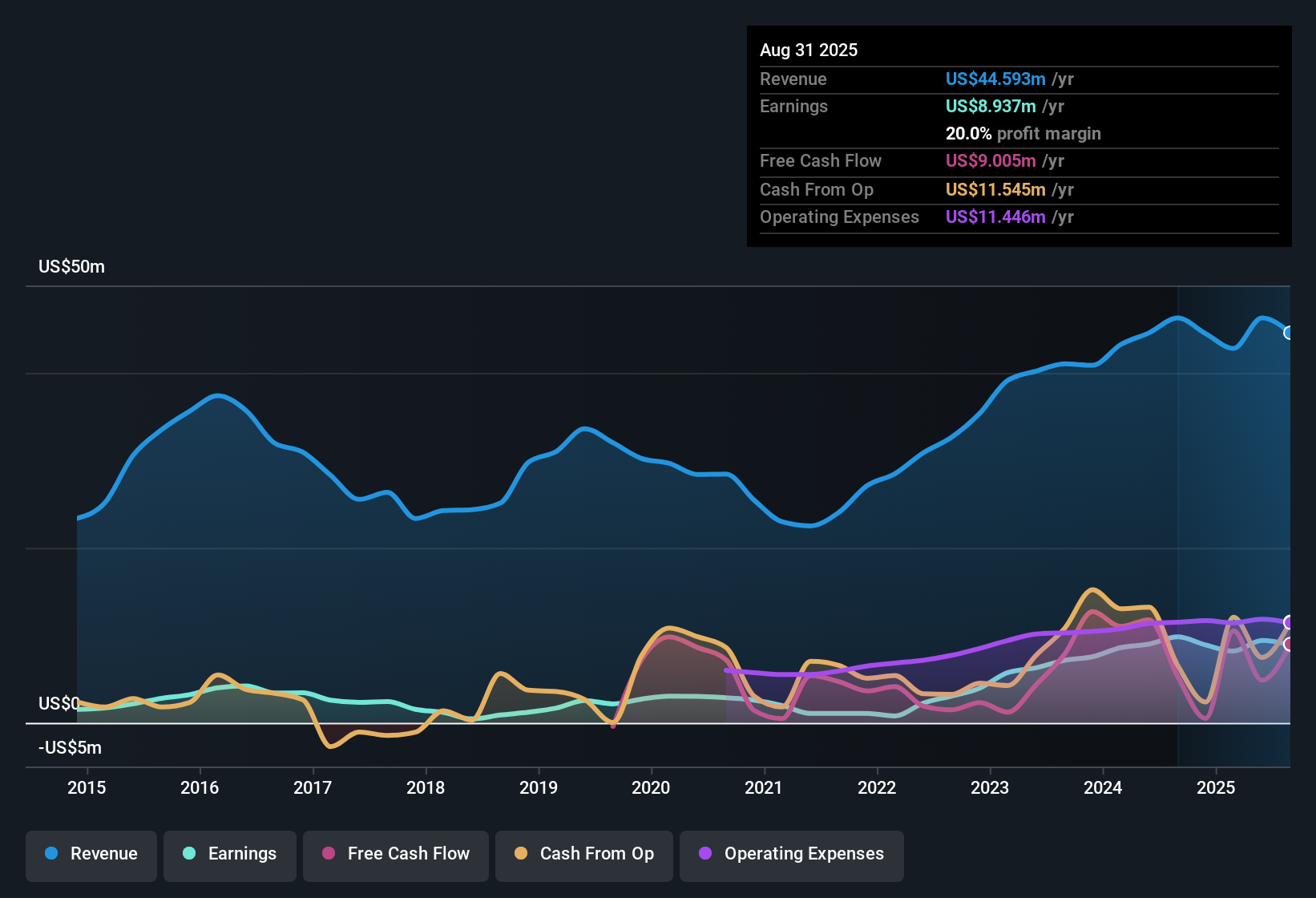

Taylor Devices (TAYD) posted net profit margins of 20%, a slight contraction from last period's 21.2%, while earnings have climbed at an impressive 37.3% annual rate over the past five years. With revenue forecast to grow 9.7% a year, just shy of the US market average, investors have an example of durable, long-term profit expansion, even as operating margins have softened moderately.

See our full analysis for Taylor Devices.Next up, we will see how these figures match up with the prevailing market narratives, and whether the recent results support or challenge those views.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five-Year Earnings Surge at 37.3% Annually

- Annualized earnings growth of 37.3% over the last five years stands out as a major achievement, well ahead of the typical pace seen among peers in the US machinery sector.

- Recent results heavily support the argument that Taylor Devices is carving out a durable leadership position in niche engineering. Robust earnings expansion coincides with growing demand for seismic protection and infrastructure resilience projects.

- Analysts point to high-quality execution and project wins as evidence that Taylor’s unique technology is increasingly valued in a fragmented sector.

- The persistent growth trend reinforces the view that small-cap “discovery” stocks with a real-world impact can outperform, especially as government resilience initiatives accelerate.

Profit Margins Drift Lower but Remain Solid

- Net profit margins slipped to 20% from 21.2% last period, reflecting mild pressure from rising costs but still positioning Taylor Devices ahead of many sector peers.

- What is notable is that, despite this modest contraction, the company’s profitability remains resilient enough to support engineering-led growth and continued attention from government and infrastructure buyers.

- The slightly lower margin does not appear to signal any reversal in Taylor’s broader growth story, particularly given its consistent multi-year earnings expansion.

- Margin durability backs up the view that, while project-related swings are common, Taylor’s specialized solutions provide a stable foundation for long-term contracts and mission-critical work.

Valuation: Fair Value Gap Widens

- With shares priced at $45.14, Taylor Devices trades below discounted cash flow (DCF) fair value of $75.41. This widens the valuation gap that value-focused investors look for in small caps.

- This pricing dynamic aligns with prevailing analysis that highlights good value even as the Price-to-Earnings Ratio of 15.9x is just above immediate peers, because broader industry multiples are even higher and DCF suggests significant upside.

- Comparative valuations still show Taylor at a discount to DCF and the broader machinery peer group, providing a buffer for investors looking for margin of safety.

- Sustained earnings growth paired with an underappreciated share price helps explain continued bullishness among those tracking niche engineering exposures in the US market.

To see why the latest growth surge is making analysts revisit long-term narratives and valuation, check out the full breakdown of the debate around Taylor Devices’ future performance. Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Taylor Devices's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust top-line expansion, Taylor Devices’ profit margins have lost some ground and now reflect mild cost pressures amid evolving industry dynamics.

If you’re seeking companies that deliver more reliable profitability and less margin volatility, take a look at stable growth stocks screener to discover stocks consistently growing through changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taylor Devices might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TAYD

Taylor Devices

Designs, develops, manufactures, and markets shock absorption, rate control, and energy storage devices for use in machinery, equipment, and structures in the United States, Asia, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.