- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:TATT

A Look At TAT Technologies' (NASDAQ:TATT) Share Price Returns

It is a pleasure to report that the TAT Technologies Ltd. (NASDAQ:TATT) is up 37% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. Truth be told the share price declined 40% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

See our latest analysis for TAT Technologies

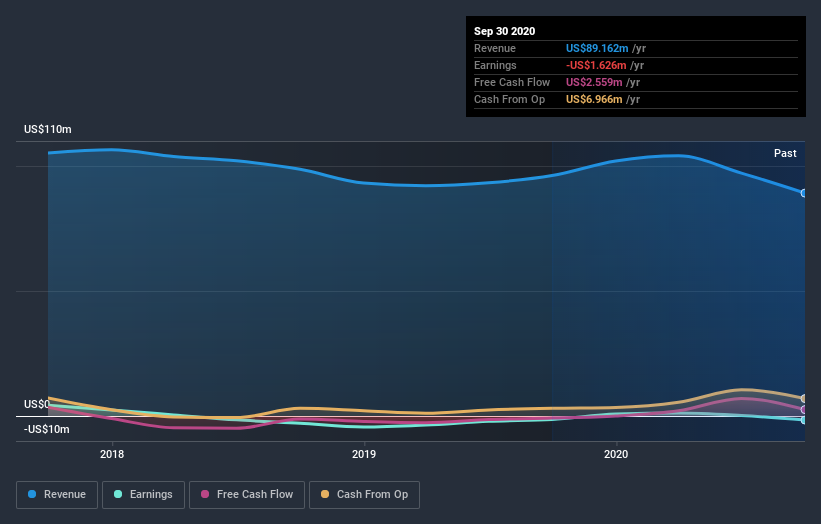

Given that TAT Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years TAT Technologies saw its revenue shrink by 3.3% per year. That's not what investors generally want to see. The annual decline of 12% per year in that period has clearly disappointed holders. And with no profits, and weak revenue, are you surprised? However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at TAT Technologies' financial health with this free report on its balance sheet.

A Different Perspective

TAT Technologies shareholders are up 14% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 2% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand TAT Technologies better, we need to consider many other factors. Even so, be aware that TAT Technologies is showing 3 warning signs in our investment analysis , and 1 of those is a bit concerning...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade TAT Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TAT Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:TATT

TAT Technologies

Provides solutions and services to the commercial and military aerospace and ground defense industries in the United States, Israel, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)