- United States

- /

- Machinery

- /

- NasdaqGM:SYM

Symbotic (NasdaqGM:SYM) Warehouse Modernization Initiative Can't Prevent 15% Weekly Stock Dip

Reviewed by Simply Wall St

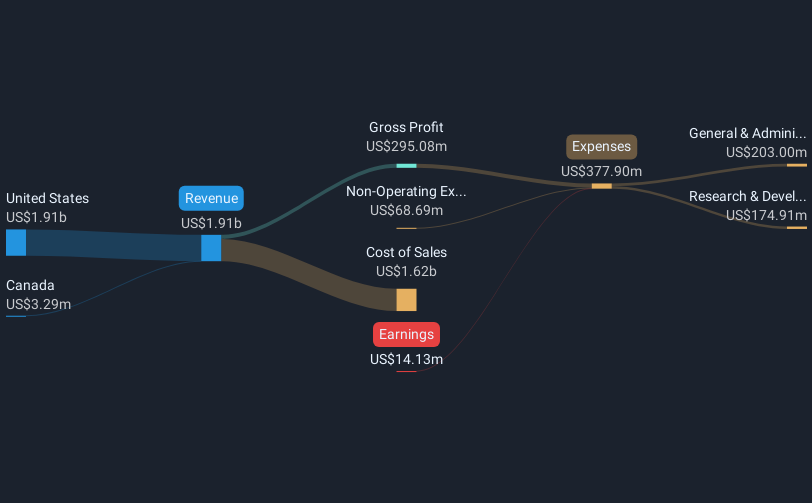

Symbotic (NasdaqGM:SYM) announced a Warehouse Modernization Initiative with Associated Food Stores which aimed to boost supply chain efficiency, making a significant mark in operational advancements. Despite this promising development, the company's shares fell 15% last week. This decline aligns with broader market turmoil, as the Dow Jones fell into correction territory and the Nasdaq Composite entered bear market territory amid escalating tariff fears. Collectively, these market pressures overshadowed positive company-specific news, leading to a pronounced decline in Symbotic's stock over the week.

Every company has risks, and we've spotted 2 risks for Symbotic you should know about.

Over the past three years, Symbotic Inc.'s total shareholder return of 84.24% stands out, highlighting robust performance despite recent short-term setbacks. During this period, the company has significantly expanded its revenue stream, reporting US$1.18 billion for 2024, a solid growth compared to previous figures. Strategic alliances, such as their joint venture with SoftBank in 2023 and partnerships with major clients like Walmart de Mexico y Centroamerica, have bolstered their automation capabilities and market reach, contributing to their overall growth trajectory.

However, potential investors face considerations, as Symbotic has been involved in legal challenges, with class action lawsuits filed in late 2024 concerning revenue recognition practices. Additionally, significant insider selling in the past quarter may have added to the volatility in stock performance. Despite these challenges, the company’s vision for increasing warehouse efficiency continues, guided by recent leadership changes, including the appointment of Dr. James Kuffner as CTO in early 2025. These elements, coupled with a follow-on equity offering in early 2024 that raised US$405 million, frame Symbotic's nuanced journey of growth and risk over these three years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SYM

Symbotic

An automation technology company, develops technologies to enhance operating efficiencies in modern warehouses.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives