- United States

- /

- Machinery

- /

- NasdaqGM:SYM

Symbotic (NasdaqGM:SYM) Sees 1% Dip As Q1 Revenue Hits US$487M

Reviewed by Simply Wall St

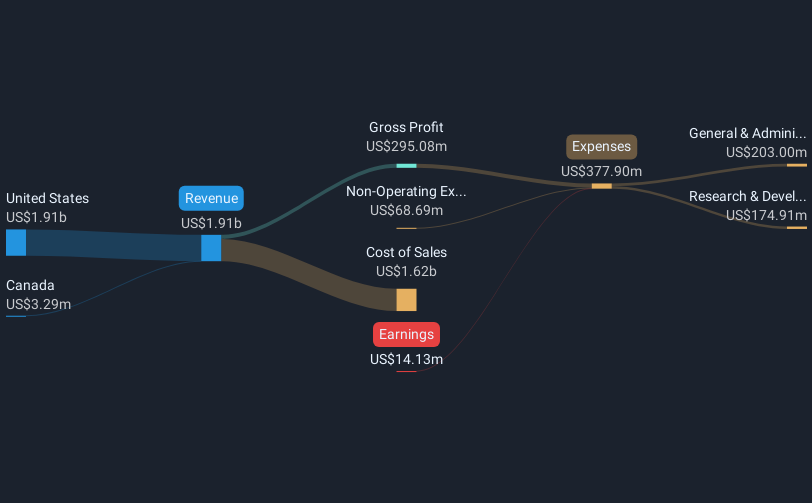

Symbotic (NasdaqGM:SYM) recently provided earnings guidance for Q2 2025 with estimated revenue between $510 million and $530 million, following its announcement of Q1 2025 results with $487 million in revenue and a net loss of $3.5 million. Despite this revenue growth from $360 million the previous year, the company's share price dipped 1.15% over the last quarter. This decline may reflect broader market trends, as the tech-heavy Nasdaq Composite slid by 0.6% amid mixed reactions to Nvidia's earnings and tariff announcements. Symbotic also dealt with executive changes and legal issues within this period, factors that may have influenced investor sentiment. Additionally, the US stock market showed volatility with a 3.6% drop in recent days due to economic concerns and potential tariff impacts. Given this landscape, Symbotic's stock performance aligns with market uncertainties and company-specific challenges during the quarter.

Get an in-depth perspective on Symbotic's performance by reading our analysis here.

Over the past three years, Symbotic's total shareholder return reached 140.08%, reflecting a robust performance despite recent market challenges. During this period, Symbotic experienced significant revenue growth, achieving US$1.82 billion in FY2024, up from US$1.18 billion the previous year. Noteworthy partnerships, such as agreements to deploy automation systems with Walmart de Mexico in October 2024, supported this upward trajectory. However, challenges included legal hurdles, notably a class action lawsuit filed in December 2024, alleging misleading revenue statements. This, coupled with high share price volatility over the last three months and substantial insider selling, may have influenced its recent underperformance relative to the market over the past year.

Additionally, Symbotic's valuation metrics ignited interest, trading below its estimated fair value despite a lower Price-To-Sales Ratio compared to peers. The company also indicated a positive outlook with expected revenue growth of 22.9% annually, outpacing the US market average. Such factors might have contributed to the long-term gains amidst short-term fluctuations.

- See whether Symbotic's current market price aligns with its intrinsic value in our detailed report

- Discover the key vulnerabilities in Symbotic's business with our detailed risk assessment.

- Is Symbotic part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SYM

Symbotic

An automation technology company, develops technologies to enhance operating efficiencies in modern warehouses.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives