- United States

- /

- Machinery

- /

- NasdaqGM:PDYN

The one-year earnings decline has likely contributed toSarcos Technology and Robotics' (NASDAQ:STRC) shareholders losses of 72% over that period

Even the best investor on earth makes unsuccessful investments. But serious investors should think long and hard about avoiding extreme losses. So spare a thought for the long term shareholders of Sarcos Technology and Robotics Corporation (NASDAQ:STRC); the share price is down a whopping 72% in the last twelve months. That'd be enough to make even the strongest stomachs churn. We wouldn't rush to judgement on Sarcos Technology and Robotics because we don't have a long term history to look at. The falls have accelerated recently, with the share price down 46% in the last three months.

With the stock having lost 12% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Sarcos Technology and Robotics

Sarcos Technology and Robotics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In just one year Sarcos Technology and Robotics saw its revenue fall by 25%. That's not what investors generally want to see. The market obviously agrees, since the share price tanked 72%. Holders should not lose the lesson: loss making companies should grow revenue. But markets do over-react, so there opportunity for investors who are willing to take the time to dig deeper and understand the business.

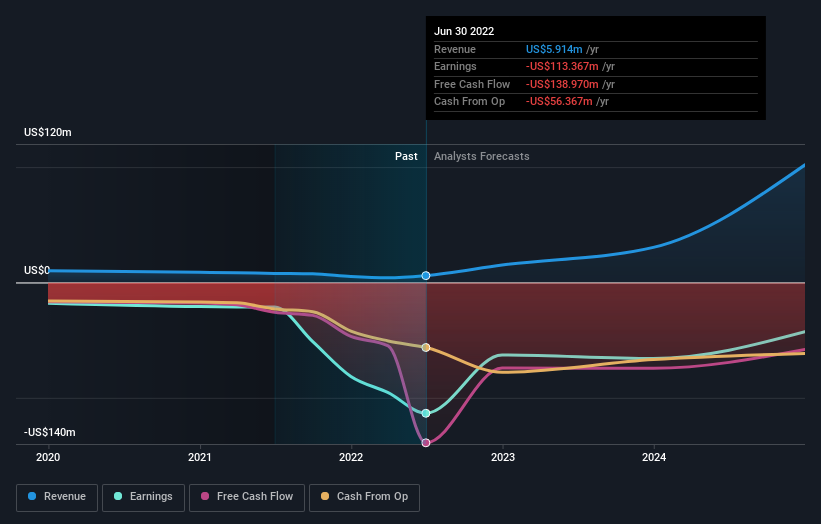

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Sarcos Technology and Robotics will earn in the future (free profit forecasts).

A Different Perspective

Sarcos Technology and Robotics shareholders are down 72% for the year, even worse than the market loss of 23%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 46% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Sarcos Technology and Robotics .

Sarcos Technology and Robotics is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PDYN

Palladyne AI

A software company, focuses on delivering software that enhances the utility and functionality of third-party stationary and mobile robotic systems in the United States.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives