- United States

- /

- Machinery

- /

- NasdaqGM:PDYN

Sarcos Technology and Robotics (NASDAQ:STRC) adds US$11m to market cap in the past 7 days, though investors from a year ago are still down 85%

Sarcos Technology and Robotics Corporation (NASDAQ:STRC) shareholders should be happy to see the share price up 22% in the last month. But that hardly compensates for the shocking decline over the last twelve months. To wit, the stock has dropped 85% over the last year. It's not uncommon to see a bounce after a drop like that. The real question is whether the company can turn around its fortunes. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Sarcos Technology and Robotics

Given that Sarcos Technology and Robotics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Sarcos Technology and Robotics saw its revenue grow by 301%. That's well above most other pre-profit companies. So the hefty 85% share price crash makes us think the company has somehow offended market participants. Something weird is definitely impacting the stock price; we'd venture the company has destroyed value somehow. We'd recommend taking a very close look at the stock (and any available forecasts), before considering a purchase, because the share price is not correlated with the revenue growth, that's for sure. Of course, markets do over-react so share price drop may be too harsh.

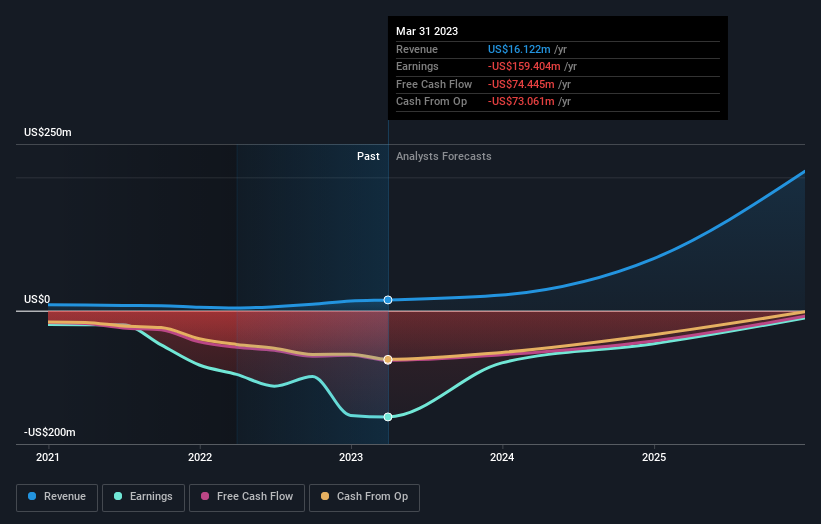

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Given that the market gained 17% in the last year, Sarcos Technology and Robotics shareholders might be miffed that they lost 85%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 10.0% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Sarcos Technology and Robotics that you should be aware of.

Sarcos Technology and Robotics is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PDYN

Palladyne AI

A software company, focuses on delivering software that enhances the utility and functionality of third-party stationary and mobile robotic systems in the United States.

Moderate with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives