- United States

- /

- Electrical

- /

- NasdaqCM:SKYX

Positive Sentiment Still Eludes SKYX Platforms Corp. (NASDAQ:SKYX) Following 32% Share Price Slump

Unfortunately for some shareholders, the SKYX Platforms Corp. (NASDAQ:SKYX) share price has dived 32% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 75% share price decline.

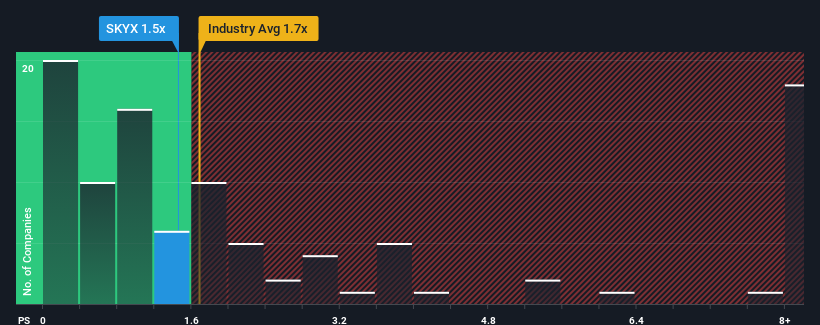

Even after such a large drop in price, you could still be forgiven for feeling indifferent about SKYX Platforms' P/S ratio of 1.5x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in the United States is also close to 1.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for SKYX Platforms

What Does SKYX Platforms' Recent Performance Look Like?

Recent times have been advantageous for SKYX Platforms as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SKYX Platforms.Is There Some Revenue Growth Forecasted For SKYX Platforms?

The only time you'd be comfortable seeing a P/S like SKYX Platforms' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 99% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 9.8% growth forecast for the broader industry.

With this in consideration, we find it intriguing that SKYX Platforms' P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From SKYX Platforms' P/S?

Following SKYX Platforms' share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, SKYX Platforms' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 4 warning signs for SKYX Platforms (1 doesn't sit too well with us!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SKYX

SKYX Platforms

Provides a series of safe-smart platform technologies in the United States.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives