- United States

- /

- Medical Equipment

- /

- NasdaqCM:BMRA

February 2025's Top US Penny Stocks To Consider

Reviewed by Simply Wall St

As the S&P 500 reaches new heights and the Nasdaq Composite hovers near record levels, investors are closely watching market dynamics that continue to evolve amid mixed trading signals. In this context, penny stocks—often representing smaller or newer companies—remain a compelling area of interest for those seeking potential growth opportunities at lower price points. By focusing on financial strength and solid fundamentals, these stocks can offer upside potential without many of the traditional risks associated with this segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8625 | $6.39M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $127.27M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2698 | $9.16M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.79 | $84.63M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.4389 | $46.53M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.46 | $24.65M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $4.10 | $154.8M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.89 | $78.41M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.69 | $383.33M | ★★★★☆☆ |

Click here to see the full list of 708 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Biomerica (NasdaqCM:BMRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Biomerica, Inc. is a biomedical technology company focused on developing, patenting, manufacturing, and marketing diagnostic and therapeutic products for detecting and treating medical conditions globally, with a market cap of $15.22 million.

Operations: The company's revenue is primarily derived from the design, development, marketing, and sales of diagnostic kits, totaling $5.58 million.

Market Cap: $15.22M

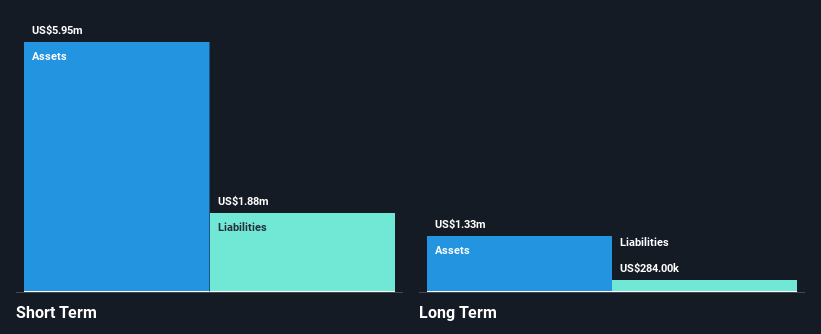

Biomerica, Inc., with a market cap of US$15.22 million, is navigating the penny stock landscape by leveraging its diagnostic and therapeutic innovations, despite being currently unprofitable. The company's short-term assets of US$5.9 million comfortably cover both its short-term and long-term liabilities. Recent developments include approval for the Fortel® PSA test in the UAE and promising clinical trial results for their inFoods® IBS test, which could enhance patient outcomes through personalized dietary therapies. However, Biomerica faces challenges such as increased volatility and a limited cash runway under one year due to negative free cash flow trends.

- Jump into the full analysis health report here for a deeper understanding of Biomerica.

- Understand Biomerica's track record by examining our performance history report.

ESSA Pharma (NasdaqCM:EPIX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ESSA Pharma Inc. is a clinical-stage pharmaceutical company developing small molecule drugs for prostate cancer treatment, with a market cap of $76.79 million.

Operations: The company does not report any revenue segments as it is currently focused on developing treatments for prostate cancer.

Market Cap: $76.79M

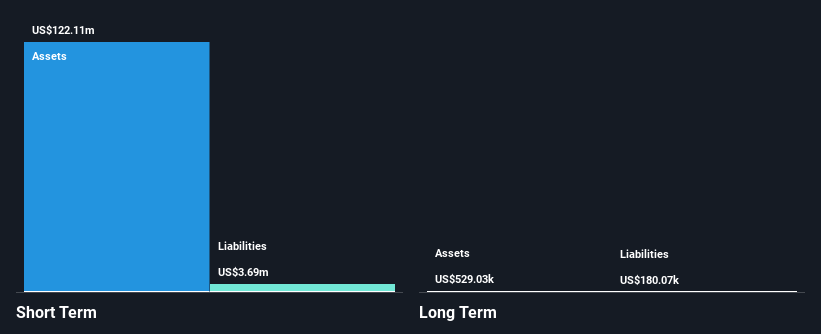

ESSA Pharma, with a market cap of US$76.79 million, is navigating the penny stock domain as a pre-revenue entity focused on prostate cancer treatments. Despite being debt-free and having short-term assets of US$122.1 million that exceed its liabilities, the company faces significant challenges. It recently halted clinical trials for masofaniten after disappointing results and is exploring strategic alternatives to maximize shareholder value, including potential mergers or asset sales. Additionally, ESSA is dealing with legal issues stemming from allegations of misleading investors about its drug's efficacy, which led to a substantial stock price drop in late 2024.

- Get an in-depth perspective on ESSA Pharma's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into ESSA Pharma's future.

374Water (NasdaqCM:SCWO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 374Water Inc. offers technology that converts wet wastes into recoverable resources in the United States, with a market cap of $51.68 million.

Operations: The company generates its revenue of $0.31 million entirely from the United States.

Market Cap: $51.68M

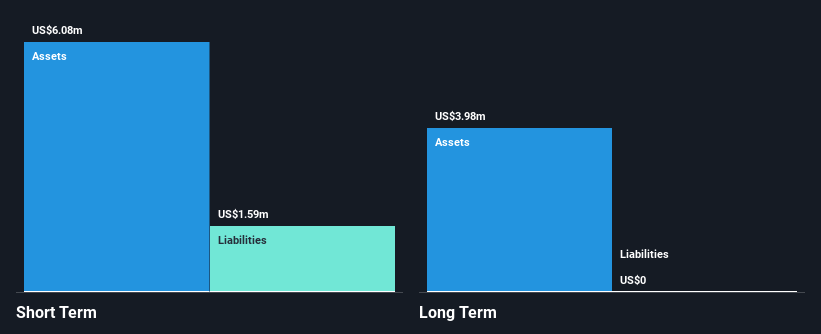

374Water, with a market cap of US$51.68 million, is pre-revenue and unprofitable, generating only US$0.31 million in revenue. Despite having no debt and short-term assets of US$6.1 million exceeding liabilities, the company faces challenges such as significant insider selling and limited cash runway, though it recently raised additional capital. Recent developments include progress on its AirSCWO system for Orange County Sanitation District Plant No. 1, projected to generate approximately US$1.3 million in revenue by year-end 2025 following system manufacturing and testing milestones scheduled for completion by May 2025.

- Dive into the specifics of 374Water here with our thorough balance sheet health report.

- Explore historical data to track 374Water's performance over time in our past results report.

Next Steps

- Reveal the 708 hidden gems among our US Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biomerica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BMRA

Biomerica

A biomedical technology company, engages in developing, patenting, manufacturing, and marketing diagnostic and therapeutic products for the detection and treatment of medical conditions and diseases worldwide.

Moderate with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives