- United States

- /

- Machinery

- /

- NasdaqCM:SCWO

Can New Leadership at 374Water (SCWO) Reshape Its Trajectory in Hazardous Waste Solutions?

Reviewed by Sasha Jovanovic

- On October 8, 2025, 374Water's Board appointed Stephen J. Jones as Interim President and CEO, following the departure of Chris Gannon, to accelerate project deployments and commercialization of its supercritical water oxidation technology.

- Mr. Jones's background in scaling environmental services operations signals a new phase for 374Water as it pursues significant growth in waste destruction services amid strong demand for PFAS and hazardous waste solutions.

- We'll explore how Jones's leadership and expertise in rapid business scale-up could impact 374Water's investment narrative and future technology adoption.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is 374Water's Investment Narrative?

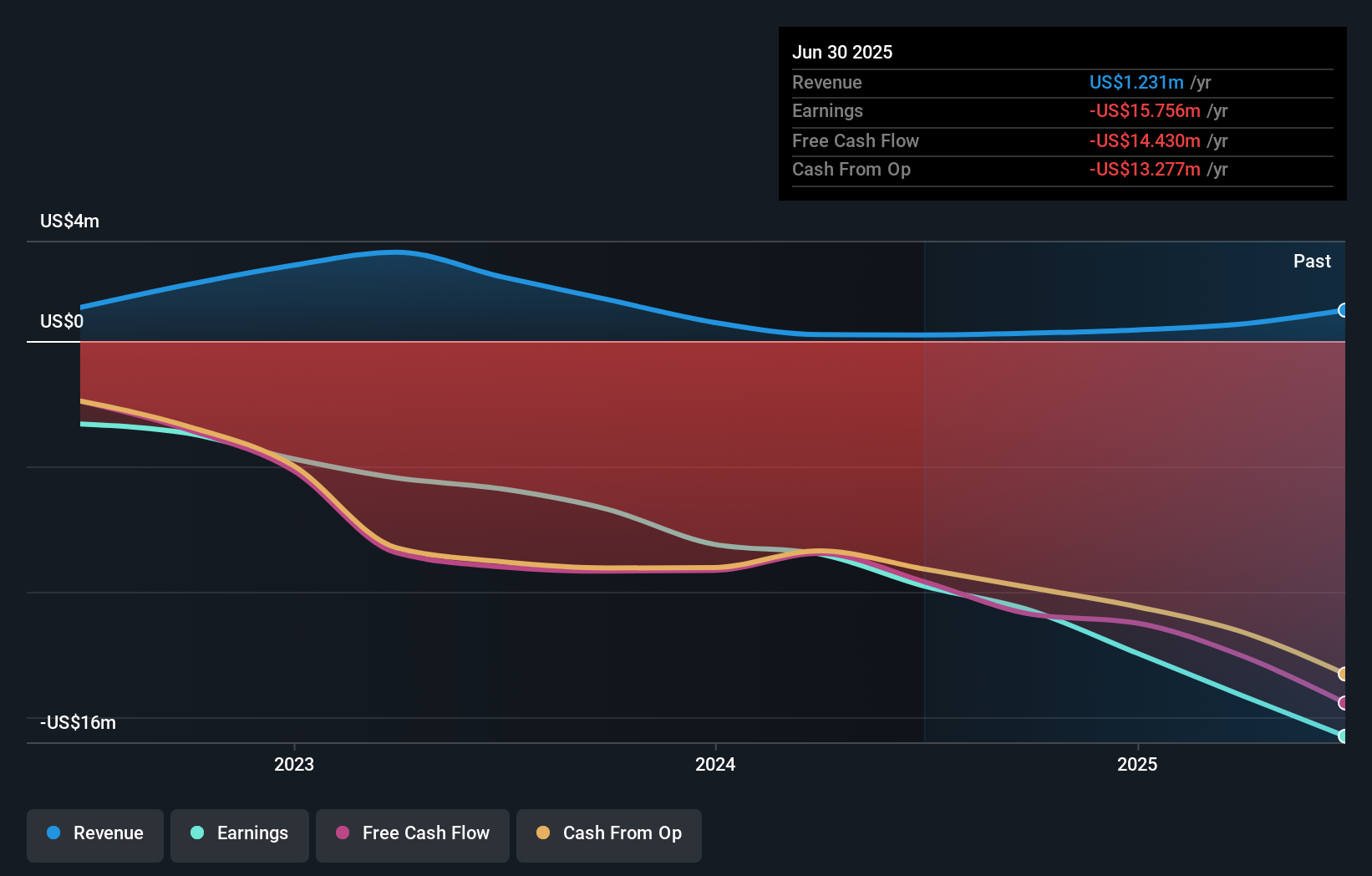

To have conviction in 374Water, shareholders need to believe in the company’s potential to transform waste management through its supercritical water oxidation (SCWO) technology, especially as regulatory pressure to address PFAS and hazardous waste grows. The recent appointment of Stephen J. Jones as Interim CEO may have a material impact here, his track record in scaling environmental services brings relevant expertise for accelerating commercialization and expanding Waste Destruction Services (WDS), which is central to 374Water’s immediate growth strategy. However, the company still faces significant hurdles: it remains unprofitable, has limited revenue, and has experienced persistent losses with a short cash runway. Jones’s leadership could help tackle execution risk and technological rollouts, but delays in key deployments like the OC San project and a volatile share price highlight ongoing challenges. This leadership change directly addresses previous concerns over management experience, potentially improving capital allocation and operational pace, though the fundamental risks around revenue generation and cash position remain central. On the other hand, recurring net losses and short cash runway are risks investors should have on their radar.

The valuation report we've compiled suggests that 374Water's current price could be inflated.Exploring Other Perspectives

Explore 2 other fair value estimates on 374Water - why the stock might be worth less than half the current price!

Build Your Own 374Water Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 374Water research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free 374Water research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 374Water's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 374Water might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SCWO

374Water

Provides a technology that transforms wet wastes into recoverable resources in the United States.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives