- United States

- /

- Machinery

- /

- NasdaqCM:RR

Will Richtech Robotics (RR) Rebuild Investor Trust Amid Fresh Scrutiny of Its Key Partnerships?

Reviewed by Sasha Jovanovic

- In recent days, Richtech Robotics Inc. filed a shelf registration to potentially offer various securities, including Class B common stock, preferred stock, debt securities, and more, following a critical short-seller report by Capybara Research alleging fraudulent activity and questioning its reported Walmart partnership.

- The intersection of capital-raising moves and public fraud allegations has placed Richtech Robotics' credibility and business prospects under significant scrutiny from investors and market observers.

- We'll explore how accusations surrounding Richtech’s Walmart partnership are shaping its current investment narrative and market perception.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Richtech Robotics' Investment Narrative?

To be a shareholder in Richtech Robotics right now, you'd need confidence in both the company’s vision for rapid robotics adoption and its ability to rebuild trust after the latest controversy. The long-term story rests on fast revenue growth, expansion into new robotics markets, and execution of high-profile partnerships. But the recent shelf registration, hot on the heels of fraud allegations and doubts about the scope of the Walmart partnership, injects fresh uncertainty into what had been a momentum-driven narrative. Investor focus is shifting from revenue acceleration and overseas deals to near-term credibility, capital needs, and transparency. This change could see the market less responsive to future commercial wins and more sensitive to any news addressing the underlying allegations or leadership’s answers to them. The main risk right now is erosion of trust at the precise moment further capital raises are on the table, making execution and communication absolutely pivotal.

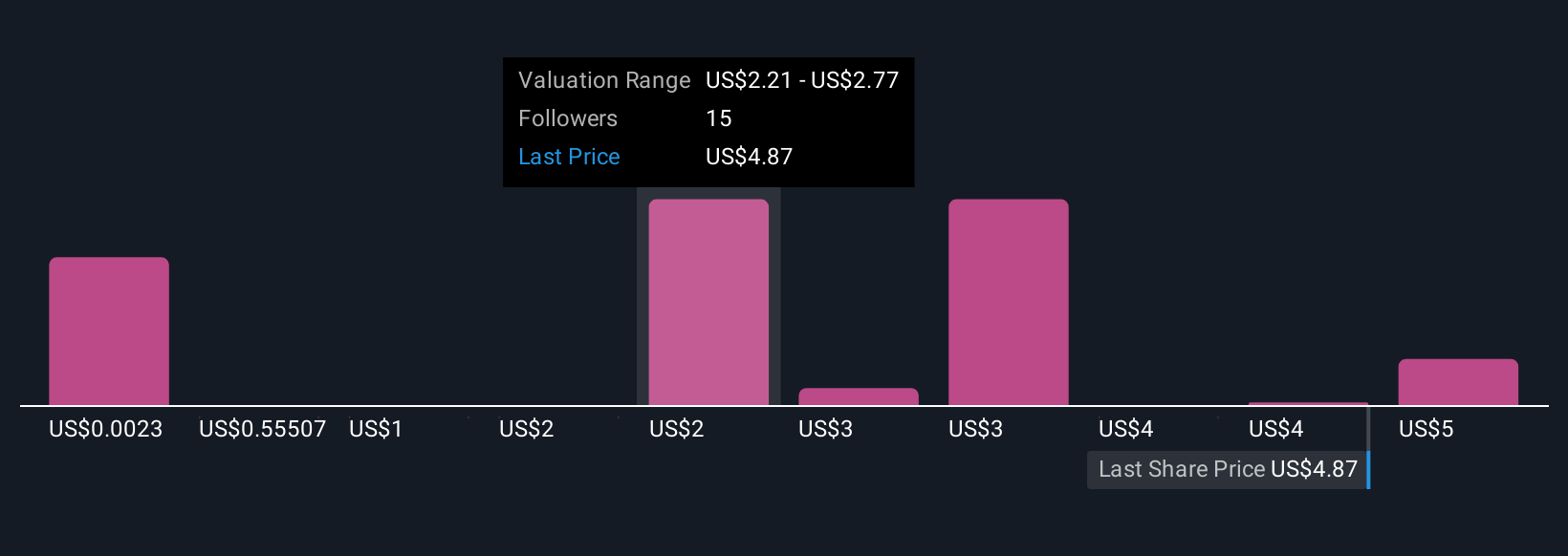

Yet without clarity around those allegations, dilution risk is something every investor should keep in mind. Richtech Robotics' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 27 other fair value estimates on Richtech Robotics - why the stock might be worth less than half the current price!

Build Your Own Richtech Robotics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Richtech Robotics research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Richtech Robotics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Richtech Robotics' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RR

Richtech Robotics

Develops, manufactures, deploys, and sells robotic solutions for automation in the service industry in the United States.

Flawless balance sheet with medium-low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026