- United States

- /

- Construction

- /

- NasdaqGS:ROAD

A Fresh Look at Construction Partners (ROAD) Valuation as Infrastructure Tailwinds and Acquisitions Drive Growth

Reviewed by Simply Wall St

Construction Partners (ROAD) is drawing new attention after recent investor letters pointed to a combination of infrastructure program tailwinds and smart acquisitions. The company’s improving margins and geographic expansion could further bolster its long-term growth outlook.

See our latest analysis for Construction Partners.

Construction Partners has been making strategic moves, such as the recent P&S Paving acquisition to strengthen its Florida presence, all while riding infrastructure tailwinds. Despite recent choppiness, with a one-month share price return of -8.7%, momentum is building with a 39% year-to-date share price return and a long-term total shareholder return of over 500% in five years, rewarding patient investors as growth potential ramps up.

If you’re interested in uncovering what else is gaining traction in the market, now’s the perfect opportunity to broaden your investment search and discover fast growing stocks with high insider ownership

Yet with Construction Partners’ strong run and future growth expectations in focus, the key question remains: is there still value to be found, or have investors already priced in the company’s accelerating momentum?

Most Popular Narrative: Fairly Valued

Construction Partners’ latest fair value narrative closely aligns with the market, as the consensus view is very similar to the last close price. This opens the door for a deeper look at the numbers and the factors driving this carefully balanced outlook.

The company's concentration in high-growth Sunbelt regions, particularly with recent transformative acquisitions like Lone Star in Texas and Durwood Greene in Houston, aligns with continued migration and urbanization trends that will drive outsized growth in contract awards, organic revenue, and market share.

Curious about what really powers this nearly perfect valuation call? The narrative leans into bold long-term growth assumptions and a future profit multiple not often seen for companies outside the tech sector. Can organic expansion and a series of smart deals justify such optimism? Find out which specific forecasts are behind this perfectly balanced price target.

Result: Fair Value of $123.83 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor shortages or a slowdown in public infrastructure funding could quickly challenge these optimistic long-term forecasts.

Find out about the key risks to this Construction Partners narrative.

Another View: Looking at Value Through a Different Lens

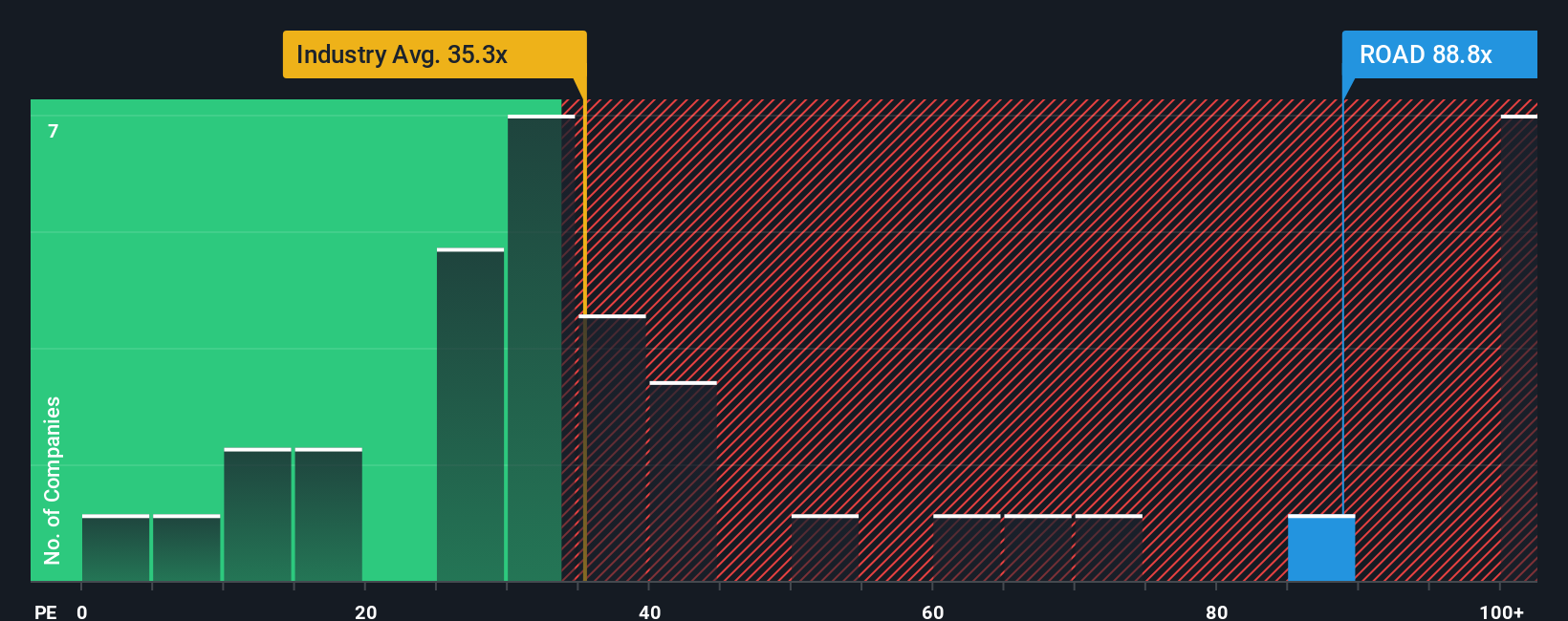

While analyst consensus puts Construction Partners close to fair value based on future growth projections, things look different when you compare the current price-to-earnings ratio to the broader industry. Construction Partners trades at 91.9x earnings, which is well above both the US industry average of 35.3x and the peer average of 23.7x. The so-called fair ratio is 55.8x, suggesting the company is priced for significant future improvement. Such a large gap could be a risk if the expected growth does not materialize. Will the market continue to reward this optimism, or will it eventually expect more reasonable pricing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Construction Partners Narrative

If this analysis doesn't quite fit your perspective, or you’re curious to craft your own take from the latest data, you can explore and build your own view in just a few minutes with our tools. Do it your way.

A great starting point for your Construction Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye on new opportunities. Level up your strategy by finding fresh angles and trends in sectors others might be missing out on.

- Tap into high growth potential by researching these 24 AI penny stocks, which are powering innovation across industries.

- Capture consistent income and stability with these 17 dividend stocks with yields > 3%, uncovering companies with yields above 3%.

- Stay ahead of the curve as digital assets transform markets, with these 79 cryptocurrency and blockchain stocks pushing boundaries in blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROAD

Construction Partners

A civil infrastructure company, constructs and maintains roadways in Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Texas.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives