- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Rocket Lab Shares Soar 513% as Investors React to New Launch Contracts in 2025

Reviewed by Bailey Pemberton

If you have been keeping an eye on Rocket Lab lately, you are not alone. The stock’s recent trajectory has been nothing short of remarkable, with gains that have left many investors wondering what comes next. Over just the last week, the share price rose 3.1%, and the surge over the past month was a staggering 37.8%. Step back even further, and those numbers become jaw-dropping. Rocket Lab’s shares are up 165.5% year-to-date and an incredible 513.0% over the last year. If you have been holding since early days, the three-year total return clocks in at an almost unbelievable 1463.0%.

Much of this momentum can be traced to growing interest in the commercial space sector, as well as Rocket Lab’s steady drumbeat of successful launches and satellite deployments. Investors clearly see potential, and that excitement has pushed the company’s valuation multiples higher, with risk perceptions shifting as the space industry matures and competition evolves. But with explosive gains like these, many readers are rightly asking if Rocket Lab is actually undervalued, or if the share price has already rocketed ahead of fundamentals.

Here is a quick reality check: on a quantitative basis, Rocket Lab currently scores a 0 out of 6 on our value screening, meaning it does not pass any of the key checks for being fundamentally undervalued. So what does that actually mean for the stock’s prospects? In the next section, I will walk you through the standard valuation checks and why they matter, but if you really want to know how to value a company like Rocket Lab, you will not want to miss the final section of this article for an even deeper insight.

Rocket Lab scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Rocket Lab Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and then discounting those projections back to today's dollars. Essentially, it asks what all the estimated future profits are worth right now, given the time value of money.

For Rocket Lab, analysts estimate that the company generated free cash flow of negative $208.5 Million over the last twelve months. Looking forward, cash flows are projected to improve, rising to $58.6 Million by 2027. Projections for the next ten years suggest that Rocket Lab could eventually generate up to $417.8 Million in free cash flow by 2035. It is important to note that only the next five years are based on direct analyst estimates. Figures beyond that are extrapolated from those trends.

Based on these projections, the DCF model calculates Rocket Lab's estimated intrinsic value at $11.88 per share. With the current stock price significantly above this level, the DCF valuation implies the stock is trading roughly 457.7% above its fair value. This makes it appear sharply overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rocket Lab may be overvalued by 457.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Rocket Lab Price vs Book

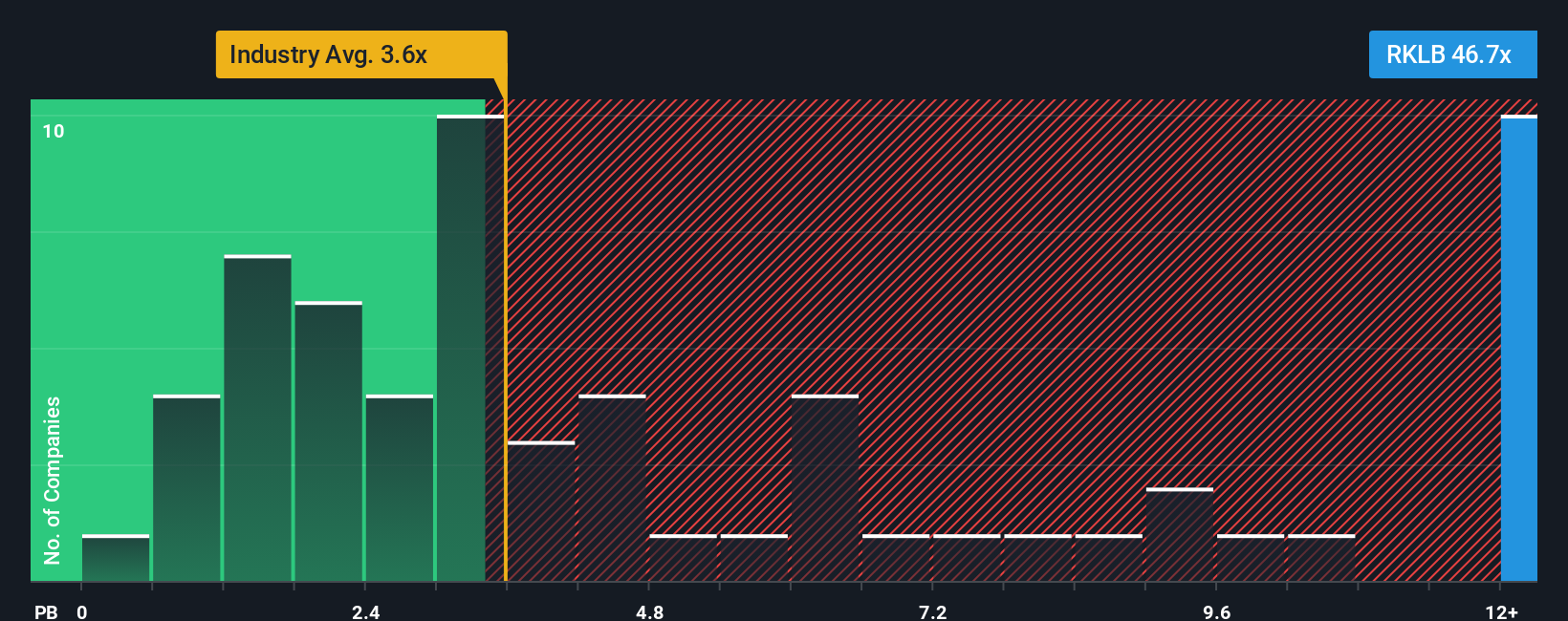

The price-to-book (PB) ratio is a commonly used valuation tool, particularly for companies that may not yet be profitable but have substantial tangible assets, such as those in the aerospace and defense sector. For firms like Rocket Lab, where earnings are still negative but investments in equipment and infrastructure are significant, the PB ratio allows investors to measure how much they are paying compared to the company's book value.

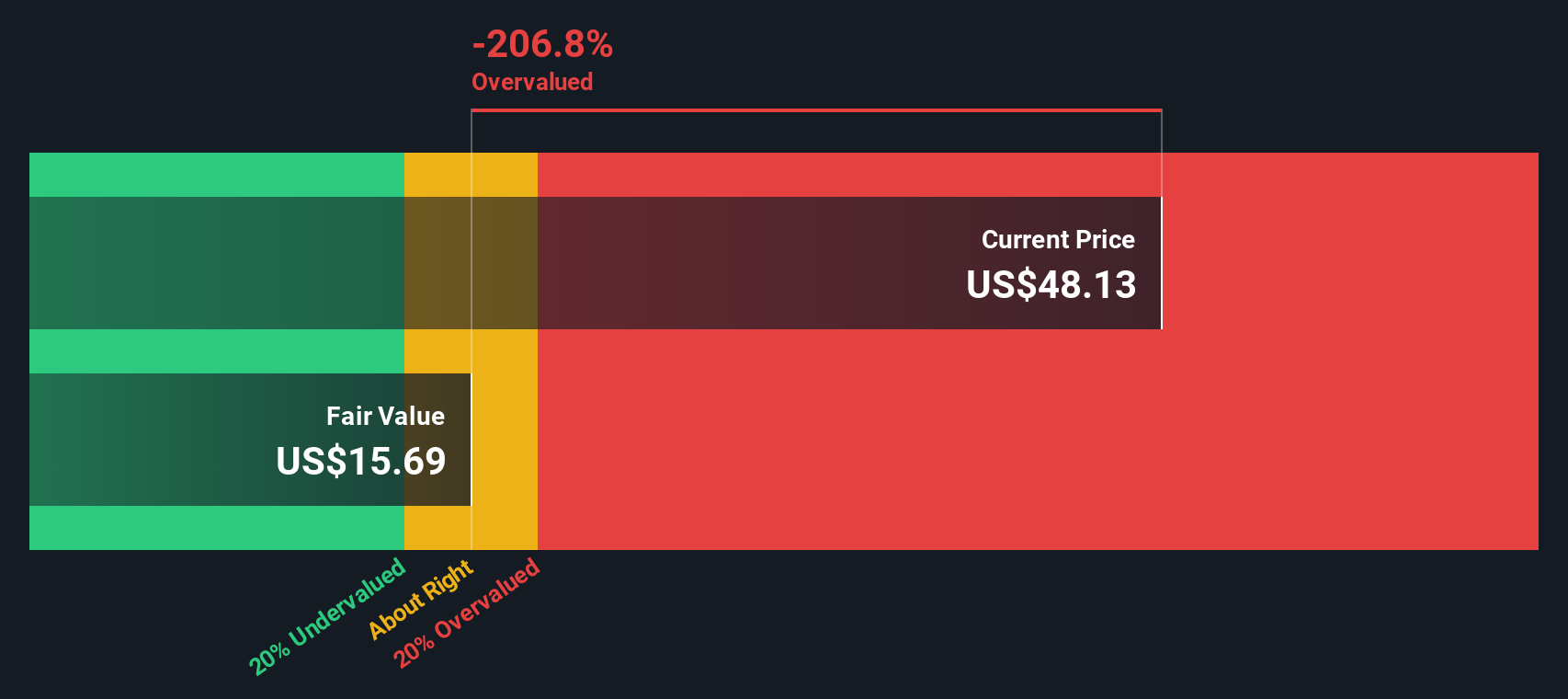

Typically, a company with higher expected growth and lower risk might command a PB ratio above the industry average. In contrast, higher risk or slower growth would justify a lower multiple. At present, Rocket Lab trades at a PB ratio of 46.58x, which is significantly above both the aerospace and defense industry average of 3.38x and the peer group average of 10.27x.

Simply Wall St's "Fair Ratio" takes this a step further by tailoring the expected PB multiple to Rocket Lab's specific profile. This includes considering its market cap, business risks, profit margins, and sector growth trends, instead of relying solely on broad industry averages. This approach provides a more precise view of what investors might reasonably pay for the stock at this time.

Comparing Rocket Lab's actual PB ratio to the Fair Ratio reveals a substantial gap, indicating the shares are currently priced well above what would be considered justified by its underlying assets and prospects.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rocket Lab Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story or perspective you create about a company, outlining your view on its growth, risks, and future performance. You then connect this perspective to a set of financial forecasts and a resulting fair value.

Narratives bridge the gap between "the numbers" and "the story," letting you see how your expectations for Rocket Lab’s revenue, margins, or market position translate directly into a fair value and a reason to buy, sell, or hold. On Simply Wall St’s Community page, millions of investors are already sharing and following Narratives, making them a simple and accessible way to test ideas against current market prices.

What makes Narratives powerful is that they update automatically as fresh news, earnings, or industry insights are published, so your decision making is always anchored in the latest information. For example, some investors see Rocket Lab’s fair value at $20.00 based on cautious growth assumptions, while others believe it could be as high as $60.00 with stronger revenue acceleration. This means everyone can find a Narrative that matches their conviction and risk appetite.

Do you think there's more to the story for Rocket Lab? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives