- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Rocket Lab (RKLB) Valuation in Focus After Launching $750 Million Equity Offering

Reviewed by Kshitija Bhandaru

Rocket Lab (NasdaqCM:RKLB) is in the spotlight after unveiling a fresh $750 million at-the-market stock offering, partnering with several major investment banks to gradually sell shares as needed. This sizable equity move has triggered concern among investors about potential dilution, putting downward pressure on the stock. With the company raising capital at this scale, shareholders are watching closely to see how this influx of funding will fuel Rocket Lab’s ambitious growth plans and whether the price hit is a short-term setback or a sign of shifting risk.

This equity offering is the standout event, but it comes amid a busy period for Rocket Lab. The company has made strategic investments in expanding its U.S. semiconductor production, supported by government awards, and has completed key acquisitions to broaden its technology portfolio. Despite recent volatility, Rocket Lab’s stock is up more than 91% year-to-date and has soared over 45% over the past three months, hinting at building momentum before this offering. Now, with market sentiment seemingly recalibrating after the announcement, the question is whether this pause reflects only the expected dilution or something deeper regarding long-term prospects.

So is the market offering investors a discounted entry into Rocket Lab’s next phase, or is all that future growth already priced in?

Most Popular Narrative: 50.7% Overvalued

According to KiwiInvest, the current narrative views Rocket Lab as significantly overvalued based on expected growth and future market opportunities.

The global 'space economy' is forecasted to be worth approximately $1.8 trillion by 2035. Roughly $800 billion is estimated to be made up of "backbone" business, such as satellites and rockets, along with the services or software required to enable them, such as internet and positioning technologies. The remaining $1 trillion is estimated to come from businesses that operate on top of that backbone. For example, super-accurate position tracking enables faster package delivery or even autonomous drone delivery.

Ever wonder what financial rocket fuel propels Rocket Lab’s high price tag? The narrative spotlights aggressive long-term expansion, but the core fair value calculation still depends on a few bold growth targets and margin estimates. Are you ready to see which numbers could launch or ground Rocket Lab’s valuation?

Result: Fair Value of $31.72 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent cash burn and potential delays with the Neutron rocket could challenge Rocket Lab's aggressive growth targets and put pressure on its valuation outlook.

Find out about the key risks to this Rocket Lab narrative.Another View: Testing Rocket Lab’s Value With a Different Lens

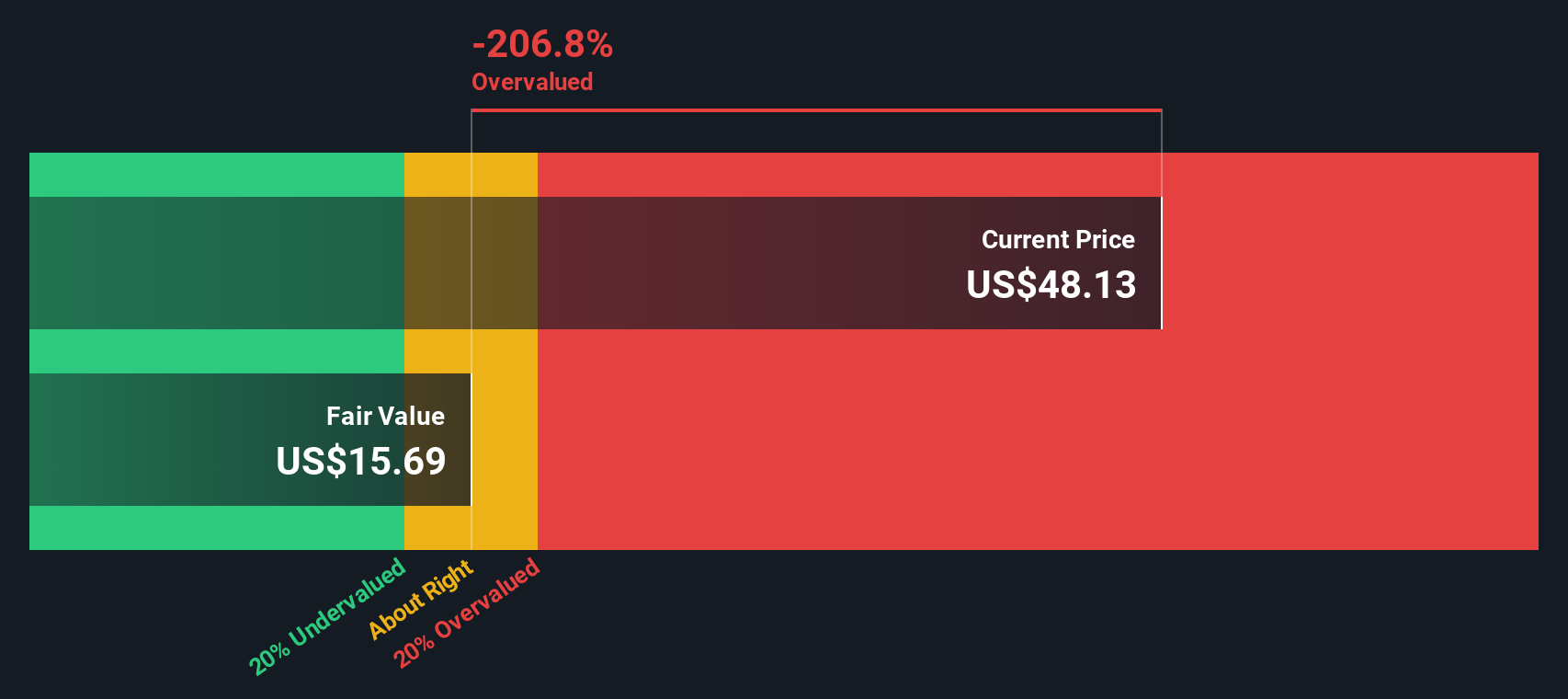

Our SWS DCF model also indicates Rocket Lab is trading at a premium to its fair value, which echoes the earlier concerns. Still, valuation models are only as good as their inputs. Could there be more to the story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rocket Lab for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rocket Lab Narrative

If you think the analysis above doesn't match your expectations or want to put your own numbers to the test, crafting a personalized narrative takes just a few minutes: Do it your way.

A great starting point for your Rocket Lab research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take your portfolio to the next level by pinpointing unique stocks primed for growth. These handpicked themes can uncover the edge you have been searching for. Don’t let smart investing opportunities pass you by.

- Tap into future healthcare breakthroughs now by using healthcare AI stocks to spot companies at the crossroads of technology and medicine.

- Amplify your income with steady cash flow. Start with dividend stocks with yields > 3% and focus on investments delivering robust yields above 3%.

- Ride the momentum in artificial intelligence by selecting AI penny stocks for exposure to high-potential innovators leading the AI evolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives