- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Rocket Lab (RKLB): Assessing Valuation After Record Q3, New Government Missions and Growing Backlog

Reviewed by Simply Wall St

Rocket Lab (RKLB) just followed up a record Q3 with fresh momentum, stacking new government missions, including its upcoming JAXA Raise and Shine launch, on top of a swelling billion dollar plus backlog.

See our latest analysis for Rocket Lab.

Those contract wins and record results are feeding straight into sentiment, with a 7 day share price return of 27.7 percent and a year to date share price return above 100 percent, signalling powerful, still building momentum despite recent volatility around the Neutron delay.

If Rocket Lab’s trajectory has you thinking bigger about space and defense exposure, this could be a good moment to scout other aerospace and defense stocks that fit your strategy.

With analysts lifting targets into the mid 60s and the stock already more than doubling this year, the real question now is simple: is Rocket Lab still flying under the radar, or is the market already banking on years of growth ahead?

Most Popular Narrative: 21.5% Undervalued

With Rocket Lab closing at $51.56 against a narrative fair value near the mid 60s, the story leans bullish on long term cash generation potential.

Escalating demand for real time data, earth observation, and global connectivity is driving increasing recurring revenue opportunities through satellite constellation launches and manufacturing. Rocket Lab's high Electron launch cadence and in house satellite production (including potential for future proprietary constellations) are enabling the company to capitalize on these industry tailwinds, supporting multi year revenue growth and backlog expansion.

Want to see how these tailwinds translate into hard numbers? The narrative leans on aggressive revenue ramps, margin expansion, and a punchy future earnings multiple.

Result: Fair Value of $65.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained Neutron delays or continued heavy R&D spend without matching contract wins could stretch cash, pressure margins, and quickly puncture today’s optimism.

Find out about the key risks to this Rocket Lab narrative.

Another Angle on Valuation

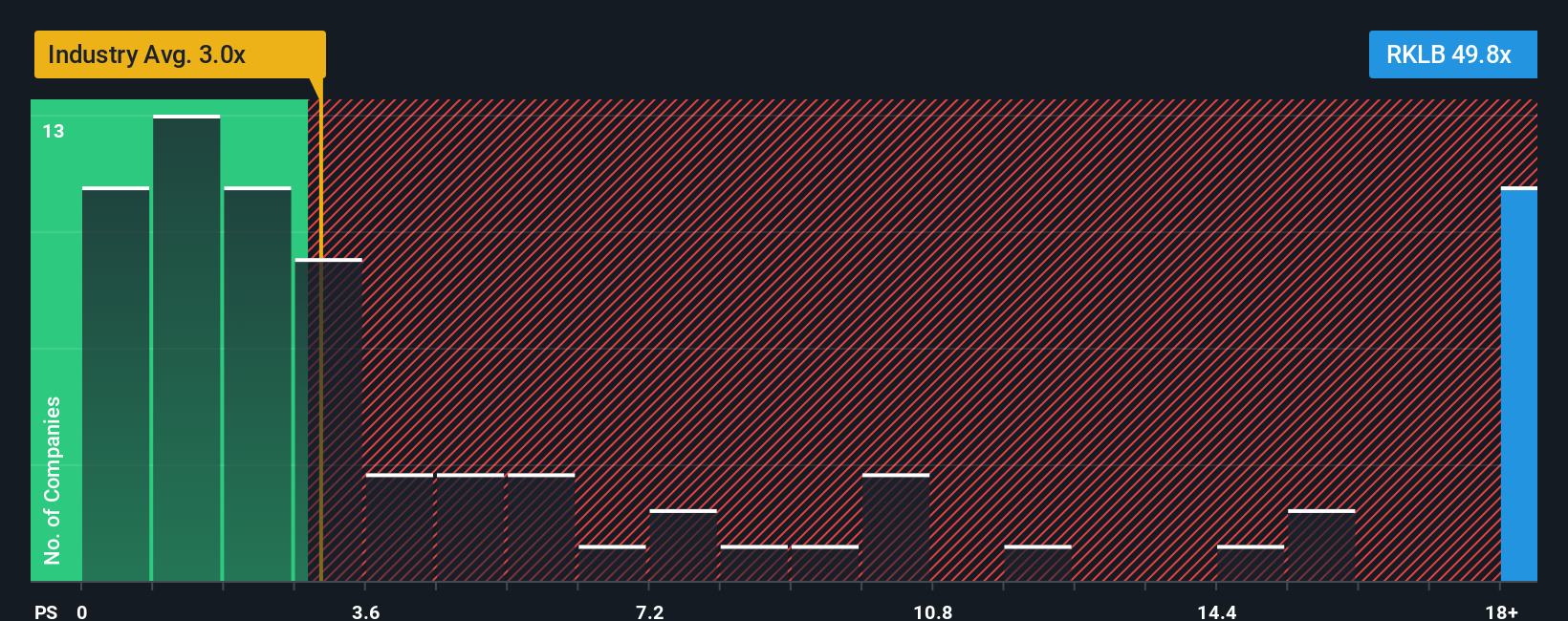

That bullish narrative fair value near $65 sits awkwardly beside the current price to sales ratio of roughly 49.7 times. Our fair ratio points closer to 7.2 times, and the US Aerospace and Defense industry averages about 3 times, suggesting sentiment may be running far ahead of fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rocket Lab Narrative

If this view does not quite match your own or you would rather lean on your own homework, you can quickly build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Rocket Lab research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Rocket Lab might be your launchpad, but you will miss bigger opportunities if you stop here. Let Simply Wall St's powerful screener surface your next move.

- Target reliable income by scanning these 15 dividend stocks with yields > 3% that balance attractive yields with solid fundamentals and long term payout potential.

- Capture structural growth by reviewing these 27 AI penny stocks positioned at the heart of machine learning, automation, and data driven innovation.

- Capitalize on market mispricings by assessing these 909 undervalued stocks based on cash flows where current prices may still trail long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026