- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Rocket Lab (NasdaqCM:RKLB) Soars 99% In Last Quarter

Reviewed by Simply Wall St

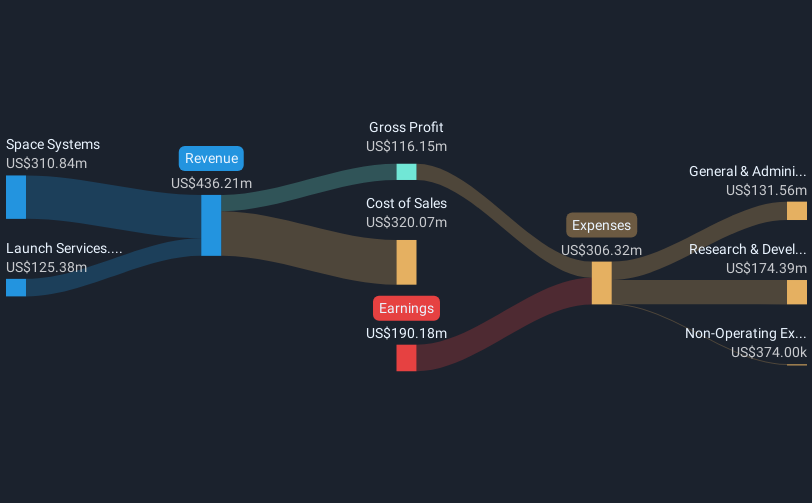

Rocket Lab (NasdaqCM:RKLB) has experienced a significant 99% increase in its share price over the last quarter. The recent addition to multiple Russell indexes, including the Russell 1000 and Midcap Growth benchmarks, highlights the company's rising prominence. This profile elevation coincides with Rocket Lab's successful launch activities, including its 67th and 68th Electron rockets, and a new contract with the European Space Agency. While the S&P 500 and Nasdaq are at all-time highs, Rocket Lab's performance could be seen as aligning with this momentum, enhanced by strong operational and contractual developments in the space sector.

You should learn about the 2 risks we've spotted with Rocket Lab.

Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

The recent developments, including Rocket Lab's successful rocket launches and addition to the Russell indexes, could positively influence its narrative by bolstering investor confidence and enhancing visibility within the space sector. These achievements align with the company's goal to expand its market presence, potentially supporting revenue and earnings forecasts as they show operational strength and capability.

Over a longer three-year period, the company's shares have delivered a very large total return of 803.29%, showcasing strong performance beyond the recent quarterly gains. This return surpasses the broader one-year return of 38.5% for the US Aerospace & Defense industry, highlighting Rocket Lab's ability to outpace its sector peers in the past year.

The news of successful launches and new contracts might impact revenue and earnings positively, as they reflect Rocket Lab's capacity to secure and execute significant contracts, crucial for its revenue trajectory. The increased Electron launch cadence and the potential Neutron development could further drive long-term growth, leveraging the demand for medium-class launches and large satellite constellations.

Rocket Lab's current share price of US$22.4 remains below the consensus analyst price target of US$24.6, indicating a 9% potential upside. This suggests that while the recent achievements have bolstered the company's profile, its valuation still offers room for growth relative to analyst expectations. Investors may view this gap as an opportunity, provided the company continues to meet its operational and financial targets.

Learn about Rocket Lab's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives