- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Is The Rocket Lab Rally Still Justified After Its Recent Surge In 2025?

Reviewed by Bailey Pemberton

- If you are wondering whether Rocket Lab’s huge run up is already priced in or if there is still meaningful upside on the launch pad, this article will walk through what the numbers actually say about the stock’s value.

- The share price has been on a wild ride, down 15.1% over the last week but still up 26.1% in a month, 116.2% year to date and an eye catching 132.4% over the past year, with a staggering 1346.6% gain over three years and 423.9% over five.

- These moves have come as investors focus on Rocket Lab’s role in the growing small satellite launch market and its push into spacecraft manufacturing and satellite services. These are areas that could materially expand its revenue base over time. At the same time, increased competition in launch, regulatory scrutiny around space activities and the capital intensity of scaling up have all added to the debate about how aggressively the market should be valuing that future.

- Despite all that excitement, Rocket Lab currently scores just 0 out of 6 on our valuation checks, which might surprise anyone looking only at the share price chart. Next, we will break down what different valuation methods are telling us about Rocket Lab today and hint at an even more insightful way to think about valuation that we will come back to at the end of this article.

Rocket Lab scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Rocket Lab Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting those back to today’s value in $.

Rocket Lab is currently burning cash, with last twelve month free cash flow of about $220.3 Million outflow. Analysts and model assumptions see that turning around sharply, with free cash flow projected to reach roughly $1.34 Billion by 2035, based on a mix of explicit analyst forecasts through 2029 and then growth extrapolated thereafter.

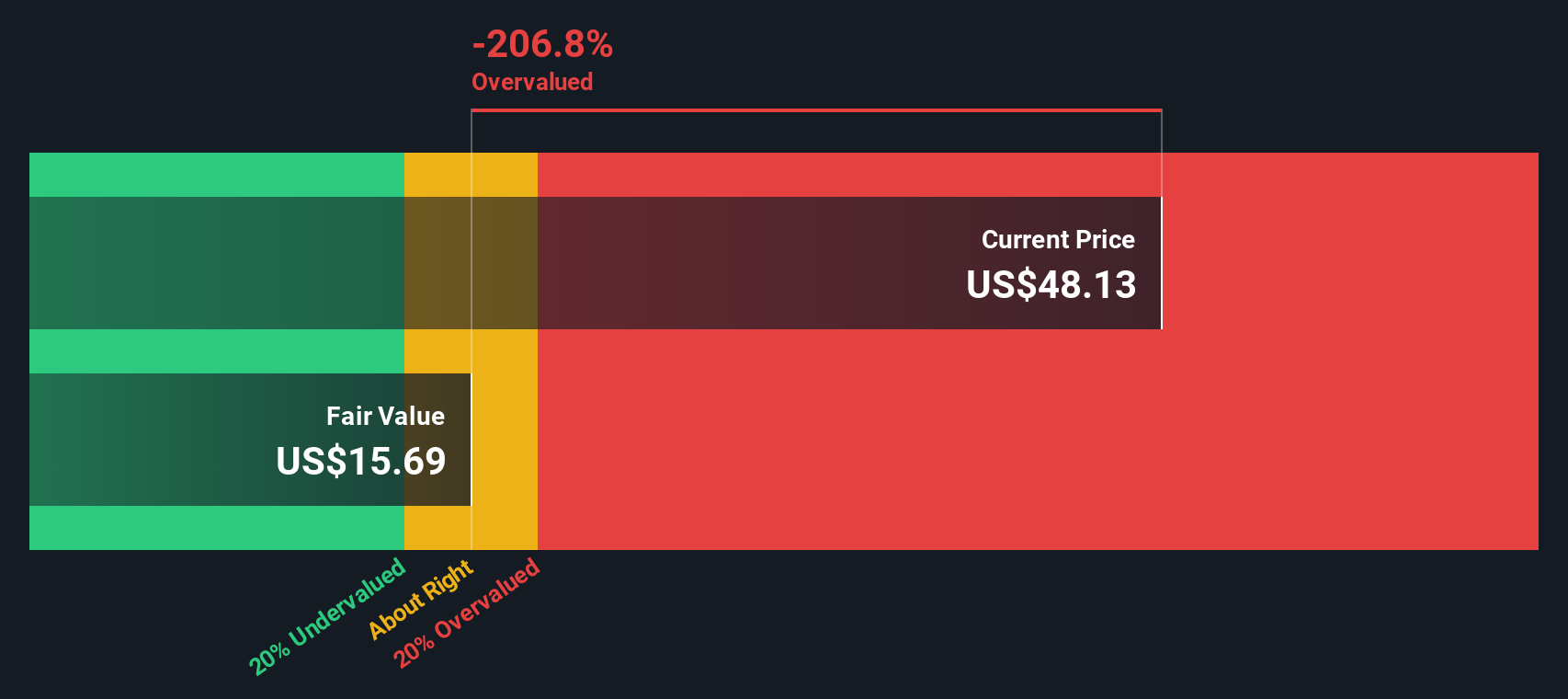

Using a 2 Stage Free Cash Flow to Equity approach, these projected cash flows are discounted back to today, giving an estimated intrinsic value of about $37.90 per share. Compared with the current market price, the DCF suggests the stock is currently trading at a premium of roughly 42.4%.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rocket Lab may be overvalued by 42.4%. Discover 911 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Rocket Lab Price vs Book

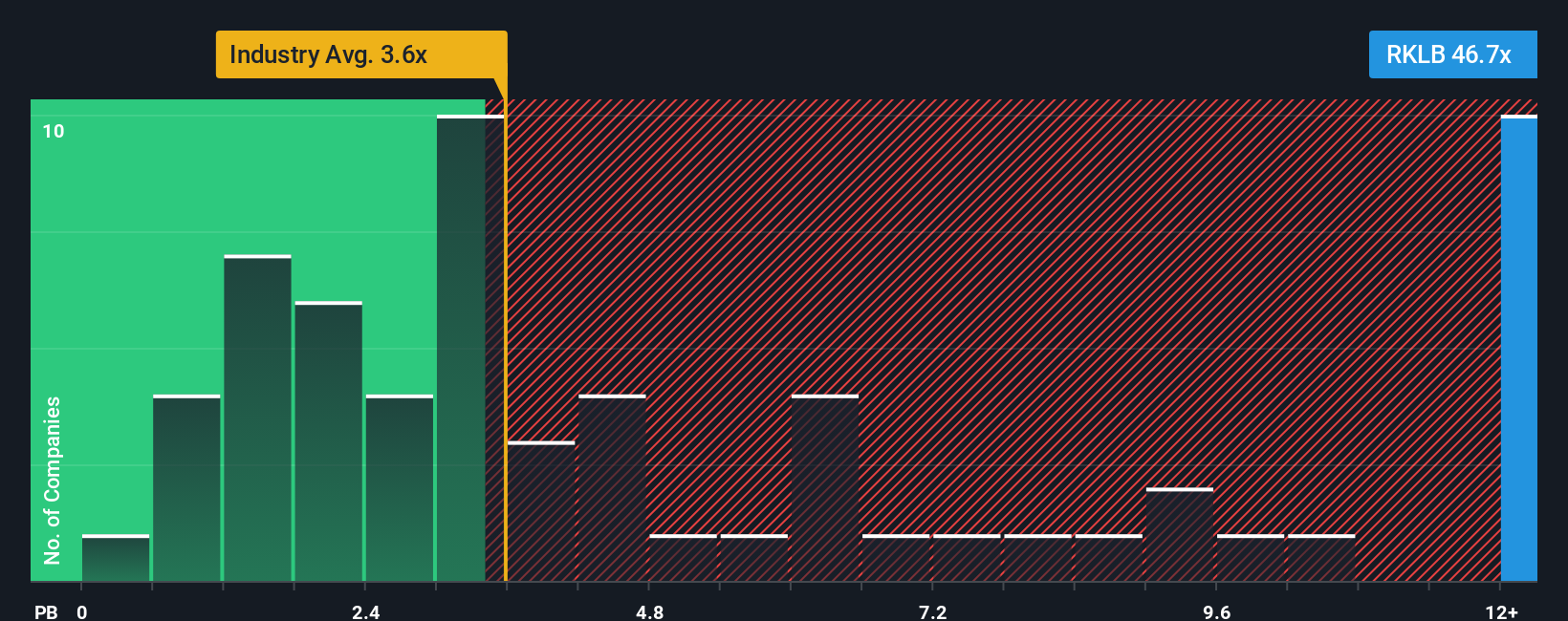

For companies that are still building toward consistent profitability, the price to book, or P/B, ratio is often a better yardstick than earnings based metrics. It compares what investors are paying for each dollar of net assets, which can be useful when profits are volatile or negative but the underlying asset base is growing.

In general, faster growth and lower perceived risk justify a higher P/B multiple, while slower growth or higher risk argue for a lower one. Rocket Lab currently trades at about 22.50x book value, which is far richer than the Aerospace and Defense industry average of roughly 3.53x and also above the peer group average of around 8.77x.

Simply Wall St’s Fair Ratio is a proprietary estimate of what Rocket Lab’s P/B multiple should be, after accounting for its growth outlook, profitability profile, risk factors, industry positioning and market cap. This makes it more informative than a simple comparison with industry or peers, which can overlook important differences in quality and risk. In this case, Rocket Lab’s actual 22.50x P/B sits well above its Fair Ratio estimate, indicating the shares look expensive even after adjusting for their growth story.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rocket Lab Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple but powerful way to connect your view of Rocket Lab’s story with concrete forecasts for revenue, earnings and margins, and then a fair value you can compare to today’s price.

On Simply Wall St’s Community page, Narratives let you describe the story you believe, translate that into numbers like future growth rates, profitability and discount rates, and instantly see the Fair Value those assumptions imply, so you can decide whether Rocket Lab looks like a buy, a hold or a sell at its current market price.

Because Narratives on the platform are dynamic, they automatically update when new information arrives, such as fresh earnings results, contract wins or launch news. This helps you keep your investment thesis current rather than static.

For example, one Rocket Lab Narrative envisions a very optimistic path with fair value near $98 per share built on explosive backbone space economy growth and strong margins. A more cautious Narrative anchors closer to about $66 per share based on moderate growth and profitability. Seeing these side by side makes it clearer which story you agree with and how much upside or downside you are really taking on.

Do you think there's more to the story for Rocket Lab? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)