- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Is Rocket Lab’s Recent 110% Climb Justified After NASA Launch Milestone?

Reviewed by Bailey Pemberton

If you are trying to figure out what to do with Rocket Lab stock, you are definitely not alone. The company has been cruising to new heights, and its stock price movements over the past year have commanded real attention among growth-minded investors. Just take a look at the numbers: shares soared 467.2% in the last 12 months and have rocketed up a staggering 1035.7% over the past three years. Even in the last week alone, Rocket Lab saw a 12.5% lift, while its year-to-date gain stands at 110.2%. These leaps have been powered in part by growing commercial and government interest in reusable space launch technology, benefiting from the broader space industry’s excitement and investments.

Of course, impressive price growth often sparks one burning question: is the stock still trading at a reasonable valuation? Rocket Lab’s current value score stands at 0 out of 6, meaning it does not pass any of the main undervaluation tests analysts use. This might give anyone pause, especially as we break down what those valuation checks actually mean for the company and for investors wondering if there is room left to climb.

Next, we will walk through the most common approaches analysts use to assess whether Rocket Lab is cheap or expensive right now, and why that traditional math might not tell the whole story. There is another, even sharper way to look at valuation, which we will discuss at the end.

Rocket Lab scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Rocket Lab Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and then discounting these estimates back to a present value. The technique provides a grounded way to assess Rocket Lab by looking beyond current profits and focusing on its potential to generate cash over the coming years.

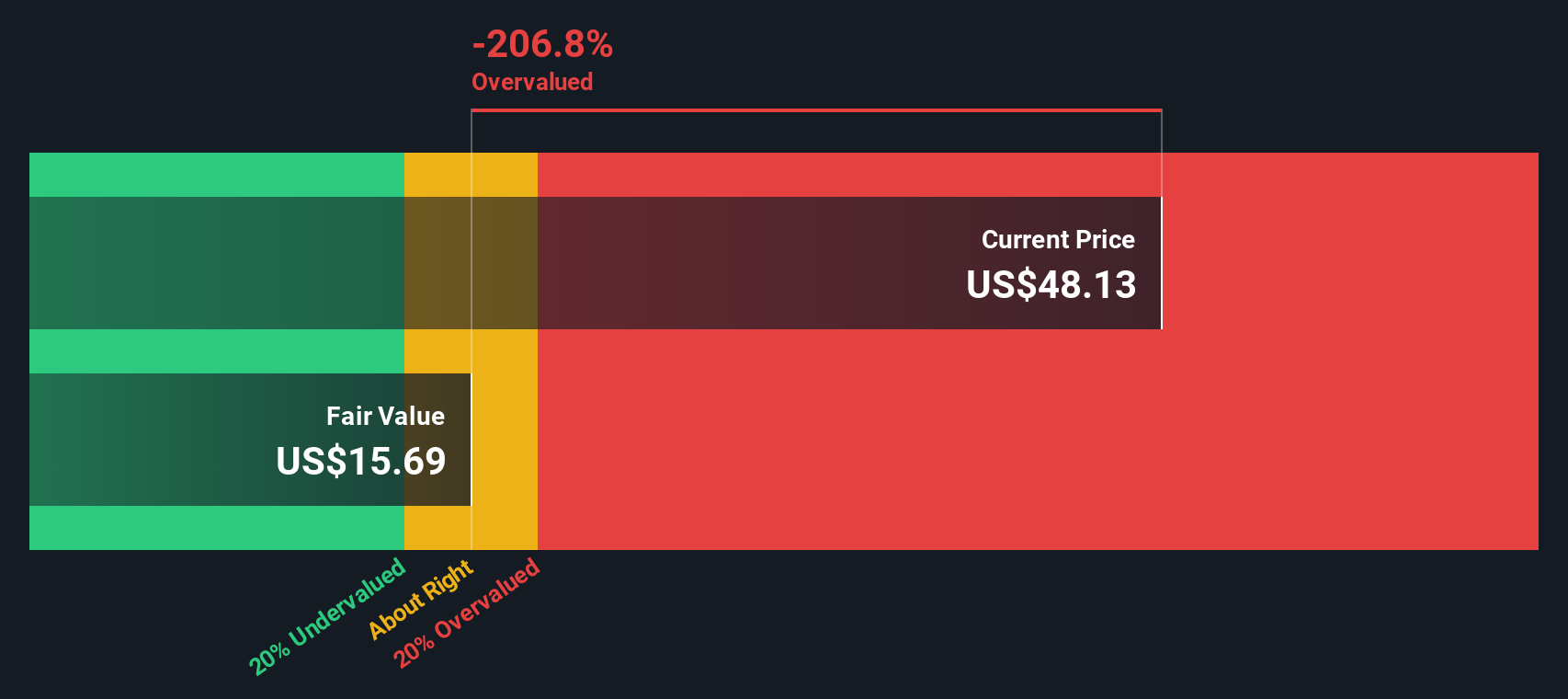

According to recent DCF analysis, Rocket Lab's current free cash flow sits at -$208.5 Million. While still negative today, projections show a rapid turnaround, with analysts forecasting positive and quickly growing free cash flows over the next decade. For example, by 2027, free cash flow is expected to reach $72.1 Million, and simple extrapolation puts 2035’s estimate at about $525 Million.

Given these cash flow projections, the DCF estimates Rocket Lab’s fair value at $15.04 per share. However, compared to its current share price, this implies that Rocket Lab is trading at a 249.0% premium. In other words, the stock appears extremely overvalued based on this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rocket Lab may be overvalued by 249.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Rocket Lab Price vs Book

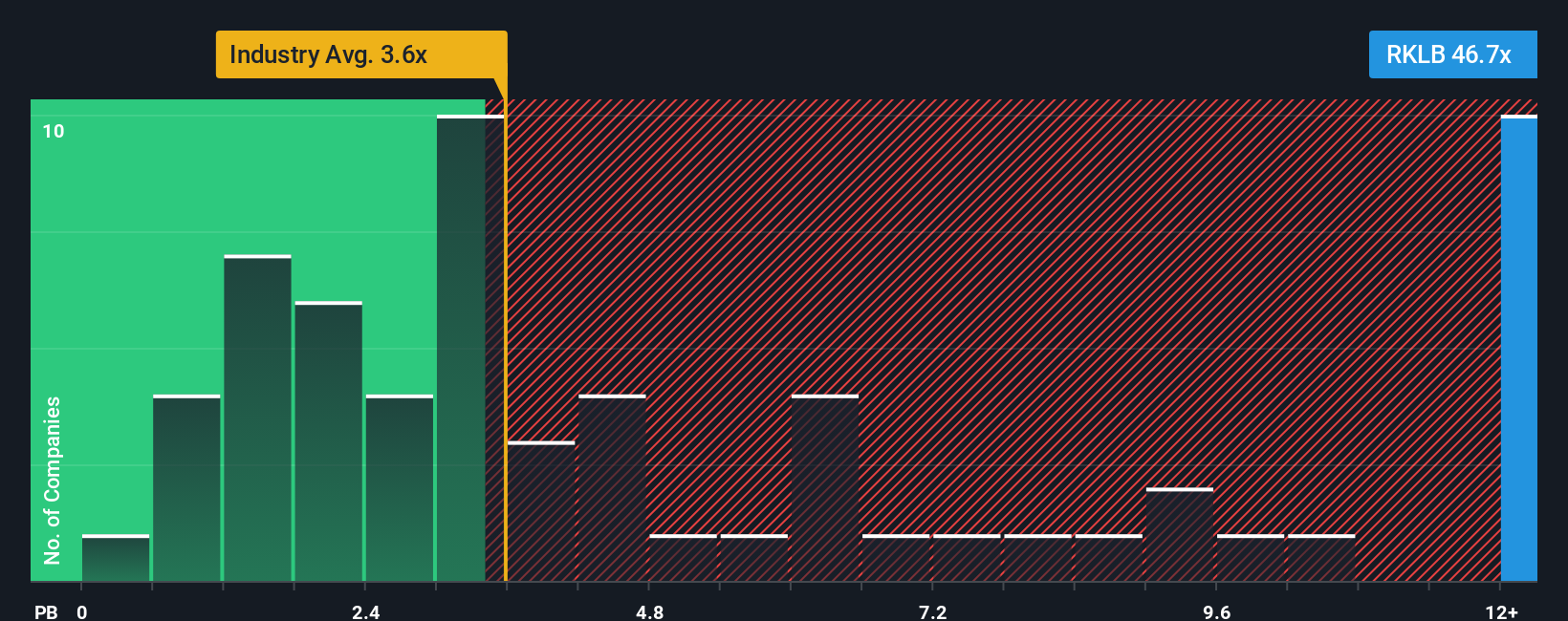

For companies that are not yet profitable, the price-to-book (P/B) ratio is often a more suitable way to measure value compared to other metrics like price-to-earnings. This is because early-stage growth companies such as Rocket Lab typically reinvest heavily, which results in limited or negative earnings for now. The P/B ratio allows us to compare the market price to the company’s net asset value, which can give a sense of whether investors are paying a fair price for the company’s tangible assets and equity.

Growth expectations and risk also play a crucial role in interpreting any valuation multiple. If investors expect rapid growth or see the company as relatively low risk, they are usually willing to pay a higher P/B ratio. Conversely, higher risk or slower expected growth brings that “fair” benchmark down. Rocket Lab’s current P/B ratio is a staggering 36.88x compared to the peer group average of 9.13x, and the broader Aerospace & Defense industry average of 3.57x. These numbers make Rocket Lab look richly priced even among other high-flying space companies.

Simply Wall St’s proprietary “Fair Ratio” model fine-tunes the analysis by factoring in not just industry and market size, but also Rocket Lab’s individual growth, profitability, and risk metrics. This approach is more insightful than simple peer or industry comparisons, since every company’s outlook and fundamentals differ. While the peer average P/B ratio provides context, the Fair Ratio better captures what a reasonable investor would pay for these specific risks and opportunities.

With Rocket Lab’s current P/B ratio so much higher than any benchmark, and no evidence the Fair Ratio comes close to 36.88x, the stock appears significantly overvalued on this measure.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rocket Lab Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your own story and perspective on a company. It connects what you believe about Rocket Lab’s business and future to a tailored financial forecast, resulting in your unique fair value estimate.

Narratives help you move beyond static numbers by linking the bigger picture, such as new rockets, market risks, or rapid sector shifts, to real, actionable forecasts and valuation estimates. On Simply Wall St’s Community page, you can easily build your own Narrative or browse those from millions of other investors. This tool is accessible and practical whether you’re a beginner or a seasoned pro.

With Narratives, you can quickly see whether your fair value is above or below today’s price, giving you a clear signal for when to buy or sell. Your Narrative will automatically update as new news or earnings reports are released.

For Rocket Lab, for example, one investor’s bullish Narrative might forecast $6 billion in revenue by 2035 and assign a fair value near $60 per share, while a more cautious investor could see slower growth and a fair value closer to $20. This shows how your decisions start with your own informed story.

Do you think there's more to the story for Rocket Lab? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives