- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Rocket Lab USA (NasdaqCM:RKLB) Prepares For Sixth Mission With iQPS Satellite Launch

Reviewed by Simply Wall St

Rocket Lab USA (NasdaqCM:RKLB) announced its upcoming mission "The Sea God Sees," set for May 2025, alongside securing hypersonic test agreements under MACH-TB 2.0. Amid a broader market experiencing a 2% decline, Rocket Lab's share price rose sharply by 37% last month. This significant movement could be attributed to the company's recent announcements, showcasing its strategic initiatives that align with the growing aerospace sector, countering broader declines. As the Dow Jones slipped following an extended winning streak and tariff-related concerns, Rocket Lab's steady rise highlights investor confidence in its future launches and contracts.

Rocket Lab USA's recent announcement regarding its upcoming mission "The Sea God Sees" and new hypersonic test agreements could potentially enhance its strategic focus on end-to-end space services, as underscored by the initiatives outlined in the company's narrative. The increase in rocket launch capabilities and an emphasis on new products like the Flatellite may pave the way for expanded market opportunities and revenue growth. With the share price rising 37% last month, these developments likely bolstered investor confidence despite broader market declines, showcasing the investor optimism aligned with the company's growth prospects.

Over the past year, Rocket Lab's total shareholder return, including both share price and dividends, reached a very large figure of 453.69%. This impressive performance over the longer term contrasts with its 1-year performance relative to the US Aerospace & Defense industry, which saw a return of 20.3%. Rocket Lab's current share price of US$22.4 exhibits a 9.0% discount to the consensus analyst price target of US$24.60, indicating that analysts expect some room for upward movement.

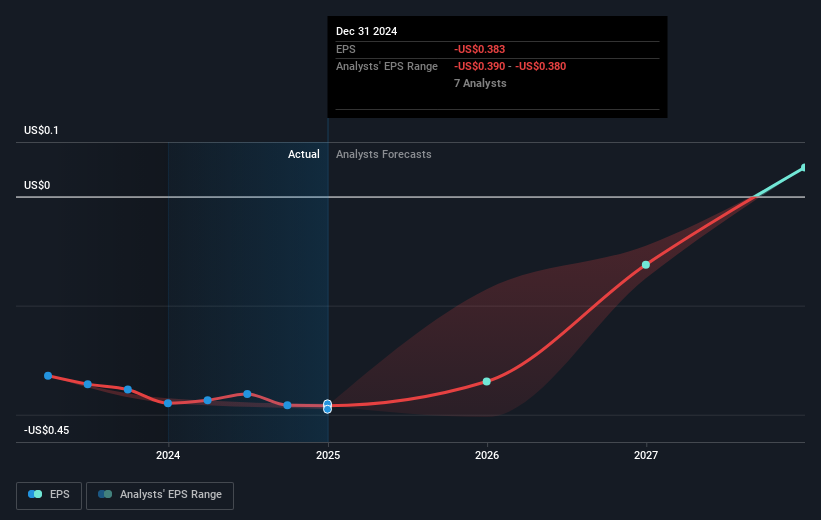

In terms of revenue and earnings forecasts, the latest developments may contribute to accelerating revenue projections and improving margin forecasts. The anticipated growth in Neutron launches and other innovations could lead to greater revenue predictability and earnings enhancement, aligning with analyst expectations for significant revenue and margin improvements over the coming years. With these projections, the share price movement towards the price target may reflect continued investor confidence in Rocket Lab's growth trajectory.

Learn about Rocket Lab USA's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab USA

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives