- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Rocket Lab USA (NasdaqCM:RKLB) Joins Hypersonic Test Flight Under MACH-TB 2.0 Program

Reviewed by Simply Wall St

Rocket Lab USA (NasdaqCM:RKLB) recently secured selection for a hypersonic test flight under the MACH-TB 2.0 program and participation in multi-billion dollar government contracts, potentially enhancing its recognition in the aerospace sector. Despite a general downturn due to weak GDP data overshadowing broader markets, Rocket Lab's shares rose by 20% last month, suggesting that the positive momentum from its strategic contracts may have added weight to the prevailing market trends, marked by a 5.2% rise. Moreover, their launch of innovative technologies like STARRAY and Frontier radios further underscores their expanding capabilities.

Every company has risks, and we've spotted 2 risks for Rocket Lab USA you should know about.

The recent selection of Rocket Lab USA for the MACH-TB 2.0 program and participation in multi-billion dollar government contracts presents notable opportunities for revenue growth and expansion in the aerospace sector. These developments may further enhance the company’s prospects as it positions itself to capture a significant portion of future market demand for space services and technologies. With its strategic focus on end-to-end space services and the anticipated increase in launch cadence, Rocket Lab is aiming to boost its earnings potential and market presence.

Rocket Lab's stock performance last year was remarkably strong, with a total return of over 495%, reflecting substantial investor confidence in its growth potential. In comparison, over the past year, Rocket Lab outpaced the US Aerospace & Defense industry, which saw a 19.3% return, and the broader US market with a 9.9% return. This robust performance highlights the market’s favorable outlook on Rocket Lab's future prospects.

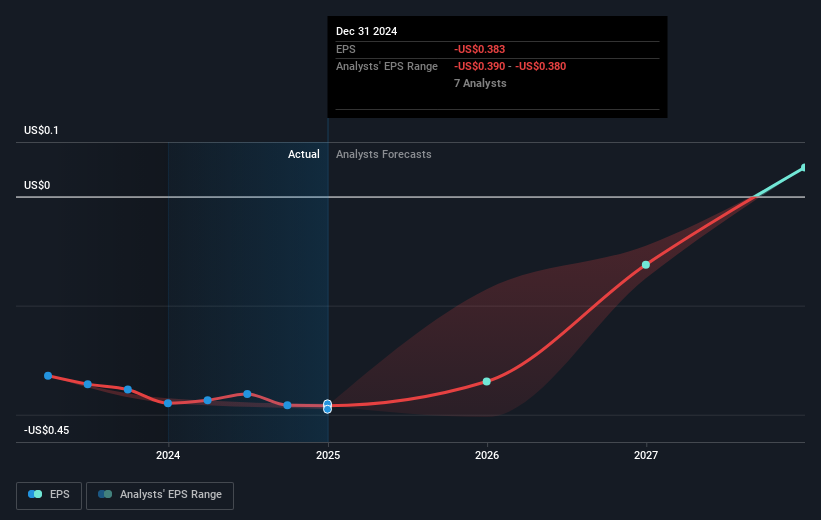

The potential uptick in upcoming revenues and earnings forecasts linked to these contracts could significantly impact Rocket Lab's financial outlook. Analysts expect the company’s revenue to grow by 41.1% annually over the next three years, with a forecasted shift to profitability. This anticipated growth supports the consensus analyst price target of US$24.32. Given the current share price of US$19.04, this represents an upside potential of 21.7%, aligning with the attractive valuation seen by analysts. However, the need to meet aggressive targets and mitigate execution risks remains crucial for Rocket Lab’s sustained growth trajectory.

Learn about Rocket Lab USA's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Rocket Lab USA, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab USA

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives