- United States

- /

- Electrical

- /

- NasdaqGS:POWL

Powell Industries, Inc.'s (NASDAQ:POWL) P/E Is Still On The Mark Following 92% Share Price Bounce

The Powell Industries, Inc. (NASDAQ:POWL) share price has done very well over the last month, posting an excellent gain of 92%. The annual gain comes to 268% following the latest surge, making investors sit up and take notice.

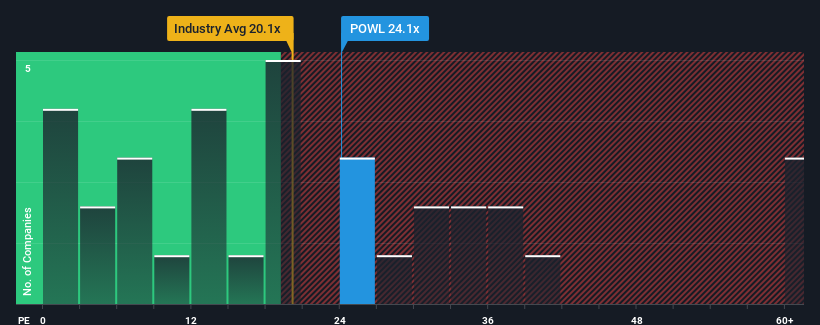

Following the firm bounce in price, Powell Industries may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 24.1x, since almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Powell Industries certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Powell Industries

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Powell Industries' is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered an exceptional 334% gain to the company's bottom line. The latest three year period has also seen an excellent 457% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 17% during the coming year according to the two analysts following the company. With the market only predicted to deliver 13%, the company is positioned for a stronger earnings result.

With this information, we can see why Powell Industries is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Powell Industries' P/E?

Powell Industries shares have received a push in the right direction, but its P/E is elevated too. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Powell Industries maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Powell Industries that you should be aware of.

If you're unsure about the strength of Powell Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:POWL

Powell Industries

Designs, develops, manufactures, sells, and services custom-engineered equipment and systems.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives