- United States

- /

- Electrical

- /

- NasdaqGS:POWL

Discovering Limbach Holdings And 2 Other Hidden Small Caps with Strong Potential

Reviewed by Simply Wall St

The market has been flat in the last week but is up 20% over the past year, with earnings forecast to grow by 15% annually. In this environment, identifying small-cap stocks with strong potential can be a key strategy for investors seeking growth opportunities; Limbach Holdings and two other hidden gems exemplify such prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| First Ottawa Bancshares | 85.49% | 7.25% | 25.81% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Limbach Holdings (NasdaqCM:LMB)

Simply Wall St Value Rating: ★★★★★★

Overview: Limbach Holdings, Inc. operates as a building systems solution company in the United States with a market cap of $726.78 million.

Operations: Limbach generates revenue primarily from Owner Direct Relationships ($301.47 million) and General Contractor Relationships ($210.20 million).

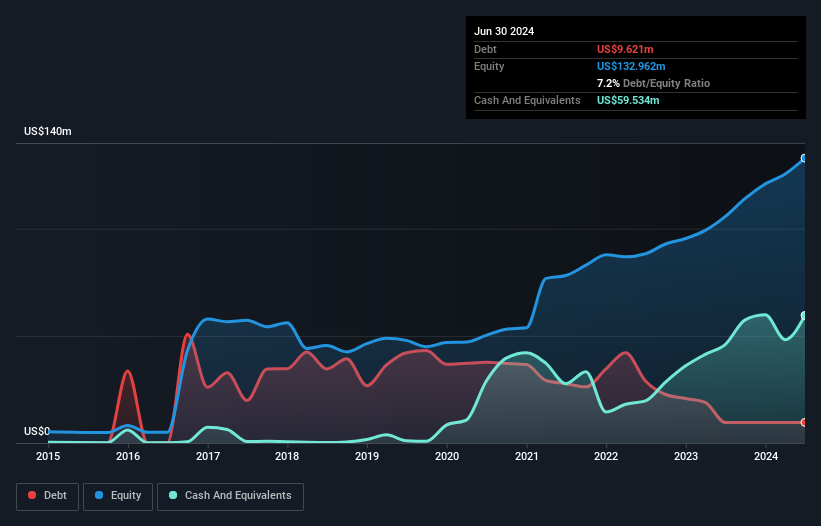

Limbach Holdings has shown impressive earnings growth of 64.9% over the past year, outpacing the Construction industry's 23.5%. The company reported second-quarter sales of US$122.24 million and net income of US$5.96 million, with diluted EPS rising from US$0.46 to US$0.50 year-over-year. Over five years, Limbach's debt-to-equity ratio dropped from 88% to 7.2%, highlighting effective debt management while trading at a significant discount to its estimated fair value by 45%.

Omega Flex (NasdaqGM:OFLX)

Simply Wall St Value Rating: ★★★★★★

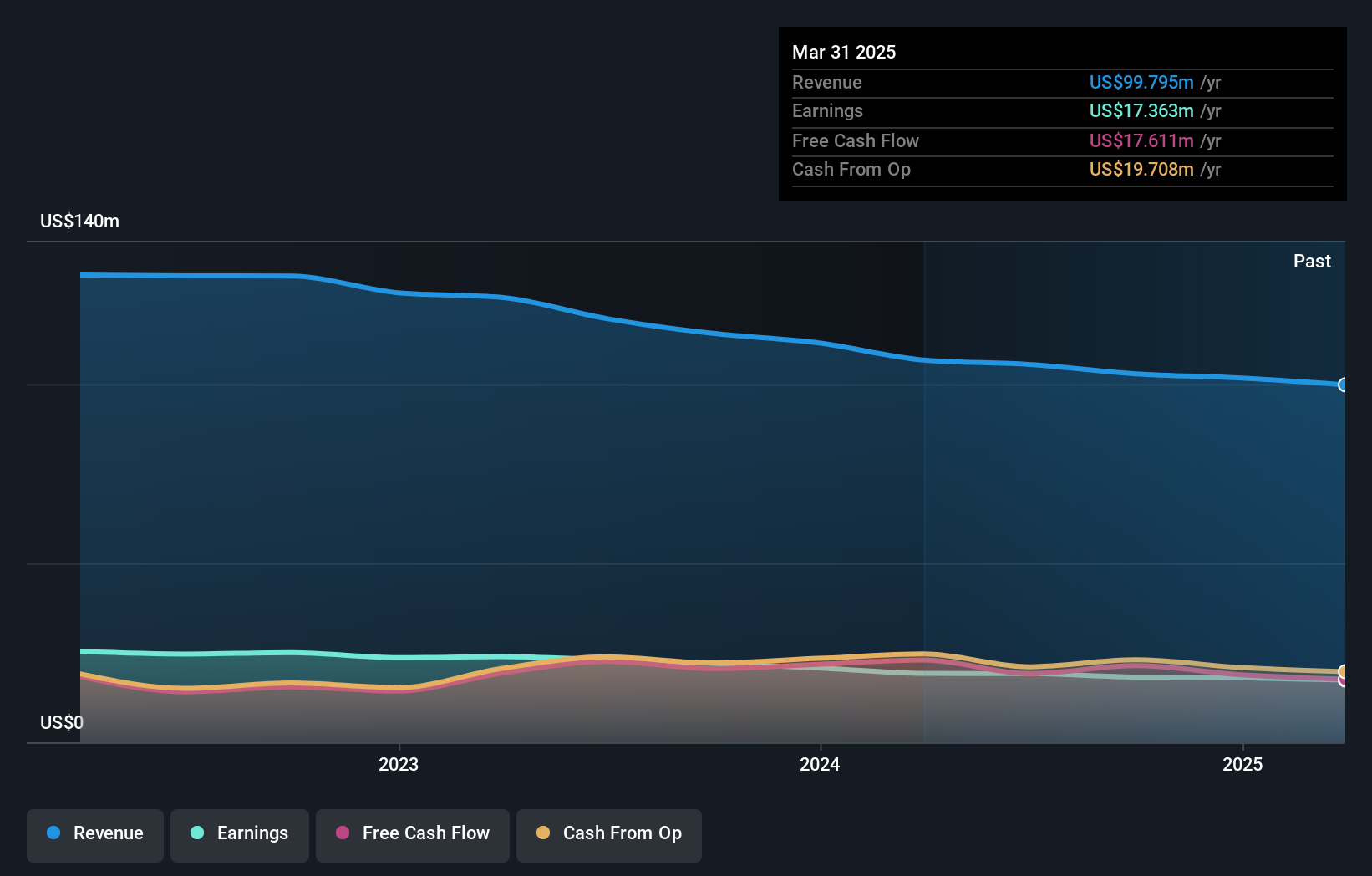

Overview: Omega Flex, Inc., along with its subsidiaries, manufactures and sells flexible metal hoses and accessories in North America and internationally, with a market cap of $473.22 million.

Operations: Omega Flex, Inc. generates $105.48 million in revenue from the manufacture and sale of flexible metal hoses and accessories. The company's market cap stands at $473.22 million.

Omega Flex, a niche player in the flexible metal hose industry, has demonstrated consistent financial strength with no debt over the past five years and positive free cash flow. Despite reporting sales of US$24.62 million for Q2 2024, down from US$25.84 million last year, net income remained relatively stable at US$4.5 million. The company declared a quarterly dividend of $0.34 per share and reelected key board members during its recent AGM in June 2024.

- Click to explore a detailed breakdown of our findings in Omega Flex's health report.

Assess Omega Flex's past performance with our detailed historical performance reports.

Powell Industries (NasdaqGS:POWL)

Simply Wall St Value Rating: ★★★★★★

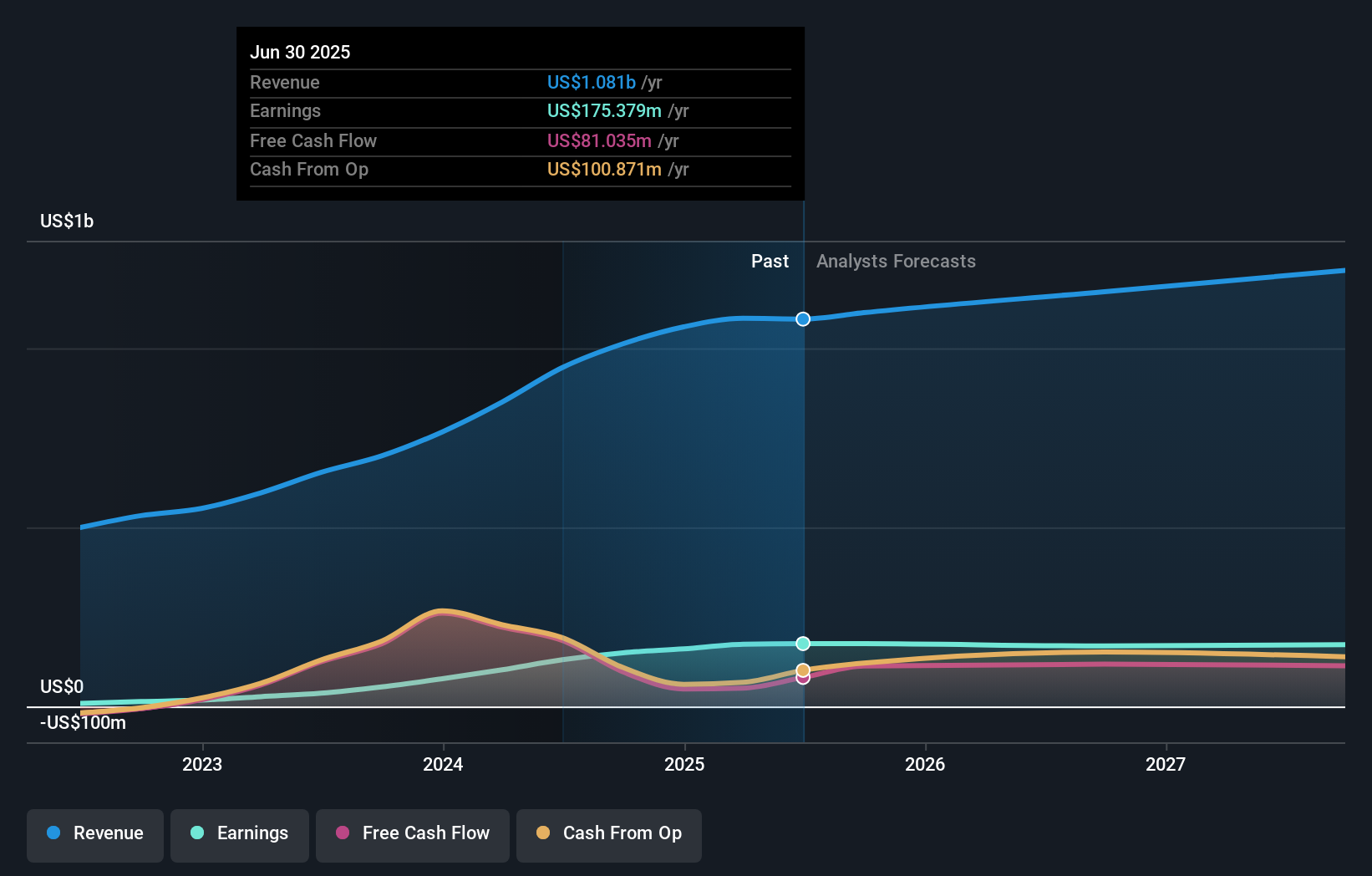

Overview: Powell Industries, Inc., along with its subsidiaries, designs, develops, manufactures, sells, and services custom-engineered equipment and systems; the company has a market cap of approximately $1.86 billion.

Operations: Powell Industries generates revenue primarily from its Electric Equipment segment, which reported $945.93 million in sales. The company has a market cap of approximately $1.86 billion.

Powell Industries, a nimble player in the electrical industry, has seen its earnings soar by 253.6% over the past year, significantly outpacing the industry's 2.1% growth. The company reported third-quarter sales of US$288.17 million and net income of US$46.22 million, reflecting robust performance compared to last year's figures of US$192.37 million and US$18.45 million respectively. Despite recent volatility in share price and significant insider selling over the past three months, Powell's debt-free status and forecasted annual earnings growth rate of 7.87% suggest promising future prospects for investors looking at value opportunities within this sector.

Make It Happen

- Get an in-depth perspective on all 211 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Powell Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POWL

Powell Industries

Designs, develops, manufactures, sells, and services custom-engineered equipment and systems.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives