- United States

- /

- Electrical

- /

- NasdaqCM:POLA

The Polar Power (NASDAQ:POLA) Share Price Has Gained 104%, So Why Not Pay It Some Attention?

Unfortunately, investing is risky - companies can and do go bankrupt. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! Take, for example Polar Power, Inc. (NASDAQ:POLA). Its share price is already up an impressive 104% in the last twelve months. Shareholders are also celebrating an even better 176% rise, over the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. Unfortunately the longer term returns are not so good, with the stock falling 13% in the last three years.

See our latest analysis for Polar Power

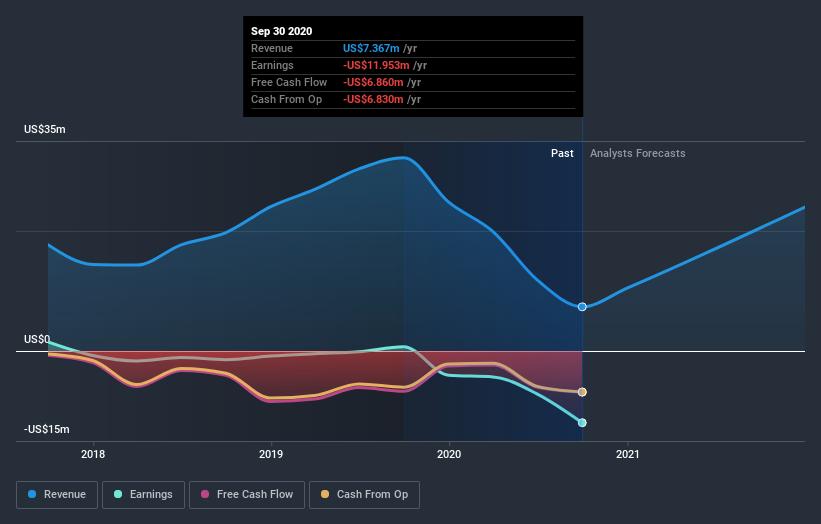

Polar Power isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Polar Power saw its revenue shrink by 77%. So we would not have expected the share price to rise 104%. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. It's quite likely the revenue fall was already priced in, anyway.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Polar Power will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that Polar Power shareholders have gained 104% (in total) over the last year. What is absolutely clear is that is far preferable to the dismal 4% average annual loss suffered over the last three years. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Polar Power is showing 5 warning signs in our investment analysis , and 2 of those make us uncomfortable...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Polar Power or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqCM:POLA

Polar Power

Designs, manufactures, and sells direct current (DC) power generators, renewable energy, and cooling systems in the United States and internationally.

Mediocre balance sheet low.

Market Insights

Community Narratives