- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Why Plug Power (PLUG) Is Up 5.6% After Expanding Global Partnerships and Securing Major Orders

Reviewed by Simply Wall St

- In recent days, Plug Power extended its contract with logistics firm Uline through 2030 and formed a partnership with Brazil-based GH2 Global to deploy hydrogen-powered logistics infrastructure in the country, while analysts at Roth/MKM reiterated their positive outlook due to strong production activity and significant orders at the company’s Vista facility.

- These developments highlight Plug Power's efforts to expand globally and improve operational flexibility, even as it continues to face challenges with sustained profitability.

- We'll explore how Plug Power's focus on large-scale overseas partnerships could reshape the company's outlook for long-term growth.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Plug Power Investment Narrative Recap

To be a shareholder in Plug Power, you need confidence in the global hydrogen industry maturing and Plug’s ability to transition large-scale projects from pipeline to steady revenue while improving profitability. While recent contracts and expansions confirm business momentum, these developments do not significantly address Plug Power’s core short-term challenge: reaching sustainable positive margins and controlling ongoing cash burn, which remains the most pressing risk.

Among the recent announcements, Plug Power’s new multi-year hydrogen supply agreement with a major U.S. industrial gas company stands out. Securing a long-term, cost-controlled source of hydrogen is essential, as reliable supply and reduced input costs directly support Plug Power’s goal of restoring gross margin and bringing operational cash flow closer to breakeven.

Yet, despite headline wins, investors should be aware that persistent negative gross margins continue to pose a challenge for the business...

Read the full narrative on Plug Power (it's free!)

Plug Power's narrative projects $1.2 billion revenue and $124.7 million earnings by 2028. This requires 22.2% yearly revenue growth and a $2.1 billion increase in earnings from -$2.0 billion today.

Uncover how Plug Power's forecasts yield a $1.97 fair value, a 30% upside to its current price.

Exploring Other Perspectives

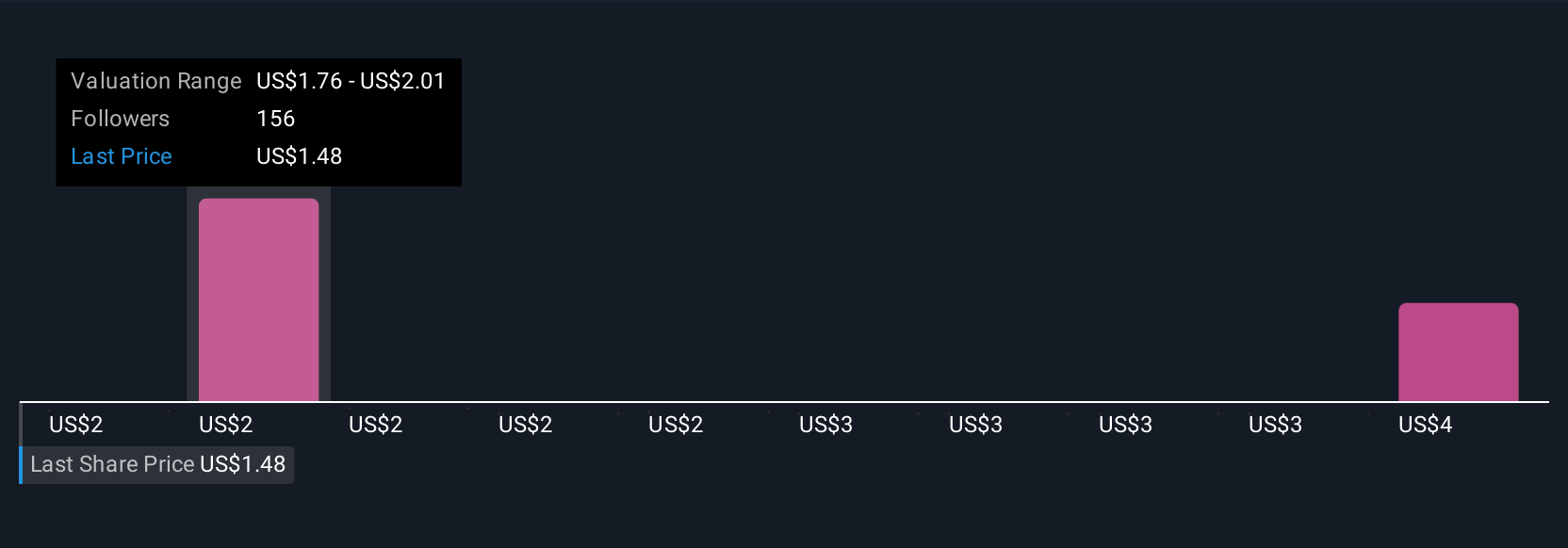

Seventeen Simply Wall St Community fair value estimates for Plug Power range from US$1.49 to US$3.96 per share, showing a spectrum of opinion. With the company’s ongoing struggle to achieve sustainable profitability, these differences reflect how many ways investors interpret risk and reward in this story.

Explore 17 other fair value estimates on Plug Power - why the stock might be worth over 2x more than the current price!

Build Your Own Plug Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Plug Power research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Plug Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Plug Power's overall financial health at a glance.

No Opportunity In Plug Power?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives