- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Plug Power (NASDAQ:PLUG) Has Enough Time to Deliver on the Growth Plan

After a sluggish earnings result, Plug Power's ( NASDAQ: PLUG ) weakness was short-lived as it rallied 8% in the next session. The price action is now getting very bullish, as the stock looks to recapture the critical level at US$50.

While analysts remain optimistic, the company is not without the critics who point out that some business segments are very dependent on Amazon and Walmart.

See our latest analysis for Plug Power

Third-quarter 2021 results

- Revenue: US$143.9m (up 34% from 3Q 2020)

- Net loss: US$106.7m (loss widened 64% from 3Q 2020)

Although revenues improved, the company reported a mediocre third-quarter result with increased losses and weaker control over costs.

Over the last 3 years, on average, earnings per share have fallen by 62% per year, but its share price has increased by 187% per year, which means it is well ahead of earnings.

Despite these results, some analysts stay optimistic as Morgan Stanley's Stephen Byrd maintains an Overweight rating with a US$43 price target. In comparison, Raymond James' Joseph Spak sees it as Outperform with a price target of US$48.

However, their positivity falls short compared to Amit Dayal of H.C. Wainwright, who set a US$78 target pointing out that Q3 loss was expected. It is worth noting that his price target is sitting above the all-time high at US$73.18.

Meanwhile, Plug Power signed a definitive agreement to acquire Frames Group, a Dutch company with a rich history in turnkey systems integration for the energy sector. The acquisition is valued at €115M. Hopefully, this move will diversify the income streams as, for example, their material handling business depends on Amazon to a tune of 80%.

Examining the Cash Burn

Since the company is not yet profitable, shareholders might wonder whether they should be concerned by its cash burn rate.We will consider its annual negative free cash flow, henceforth referring to it as the "cash burn."

Calculating the Cash Runway

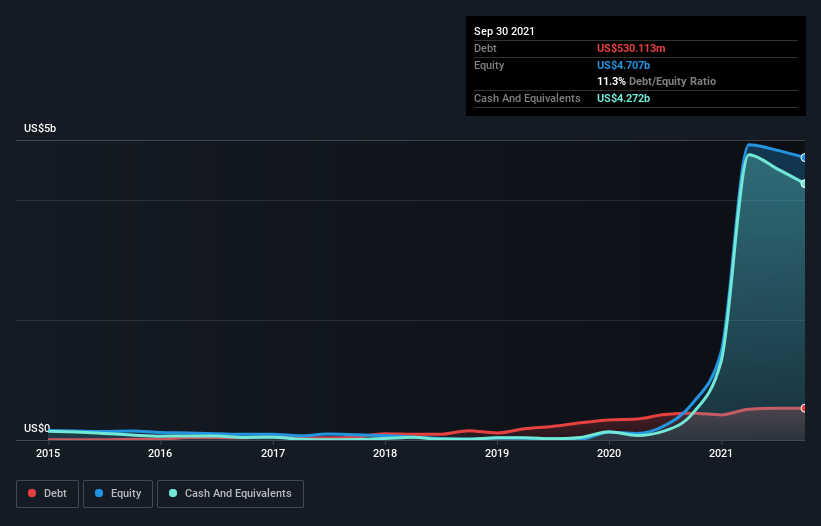

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current cash burn rate.Plug Power is relatively light in debt at US$530m - compared to the US$4.3b in cash it held in September 2021.In the last year, its cash burn was US$480m.Therefore, from September 2021, it had 8.9 years of cash runway.

While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about.

Growth and Future Cash Raising

Plug Power ramped up its cash burn very hard and fast in the last year, by 153%, signifying heavy investment in the business. If that's not bad enough, it saw operating revenue decrease by a whopping 90% over the last year, suggesting the company is going through some sort of dangerous transition. Yet, the last year was in its own category when it comes to turbulence and changes.

Considering these two factors together makes us nervous about the direction the company seems to be heading. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years .

While Plug Power seems to be in a reasonably good position, it's still worth considering how easily it could raise more cash, even to fuel faster growth.Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business.

Plug Power has a market capitalization of US$25b and burnt through US$480m last year, which is 1.9% of the company's market value.So it could almost certainly just borrow a little to fund another year's growth, or else quickly raise the cash by issuing a few shares.

How Risky Is Plug Power's Cash Burn Situation?

Even though its falling revenue makes us a little nervous, we are compelled to mention that we thought Plug Power's cash runway was relatively promising. The hydrogen cell market is estimated to grow at a 26.2% compounded annual growth rate in the 2020s, driving the optimism behind Plug Power as a well-positioned thematic investment opportunity. We are not worried about its cash burn with relatively low debt, especially with enough cash to fuel several years of operations.

While we're the kind of investors who are always a bit concerned about the risks involved with cash-burning companies, the metrics we have discussed in this article leave us relatively comfortable about Plug Power's situation. Taking an in-depth view of risks, we've identified 2 warning signs for Plug Power that you should be aware of before investing.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you're looking to trade Plug Power, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives