- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Plug Power (NASDAQ:PLUG) can Drive Growth with its New Cash Reserves

Sometimes, unprofitable companies with large cash assets, dedicated management and perspective business models can be a very good investment if stockholders are patient and invest small amounts over time.

Plug Power (NASDAQ:PLUG) investors might have had the right idea about the company when investing, and the stock was up 213% in the last year, but the investment was too much and too early for a young company.

When looking at unprofitable companies, there is a qualitative and quantitative aspect to analyze.

- The qualitative aspect is the management team, business model, and risk factors.

- The quantitative aspect is the capacity upon which the company can grow - these include their cash and asset reserves, and future revenue projections based on industry growth and the buying power of clients.

Considering that Plug Power's stock burst some 62% from their January 2021 high, it is prudent to find out if investors had the wrong idea about the company or were a bit early and Plug Power has indeed the capacity to grow.

Let's have a look at the estimated growth rates and the cash capacity of the company to fund that growth.

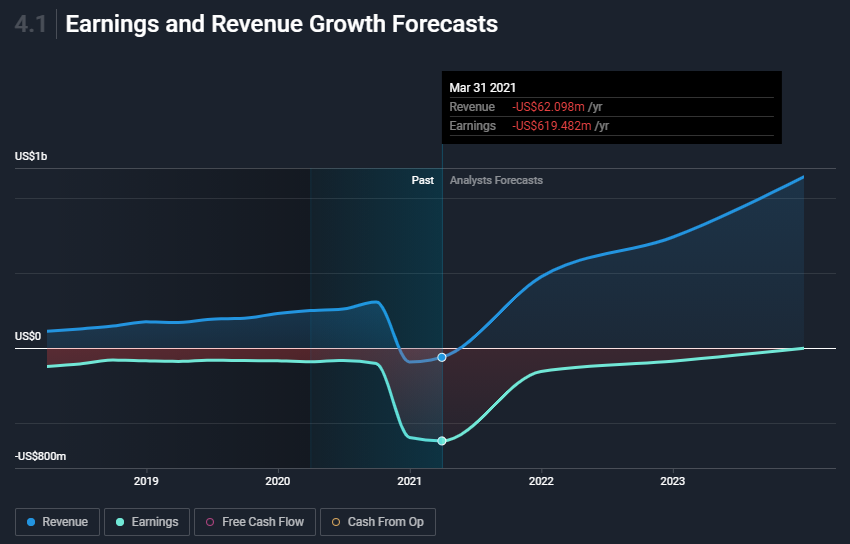

Plug Power (NASDAQ:PLUG) Revenue & Earnings Estimates, July 2021

As we can see from the chart above, analysts are expecting Plug Power to recover from the pandemic by 2022 and drive almost a billion in USD growth by 2024.

Now let's examine the capacity the company has to fund that growth with the equity - or cash currently available.

Note, that companies can also fund projects with debt, but that may increase the risk for the company by imposing a fixed cost which is hard to cover in bad times.

View our latest analysis for Plug Power

When Might Plug Power Run Out Of Money?

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash.

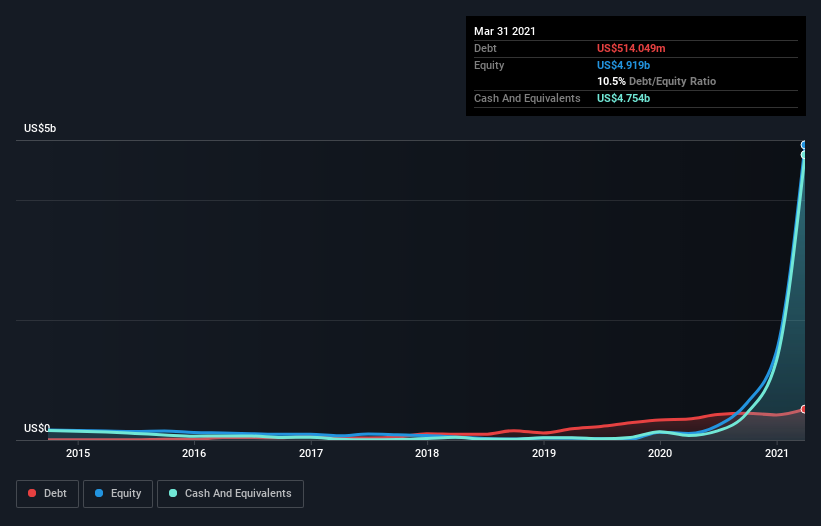

Plug Power has US$4.8b in cash it held at March 2021. Looking at the last year, the company burnt through US$269m.

That means it had a cash runway of very many years as of March 2021.

Importantly, though, analysts think that Plug Power will reach cashflow breakeven in the next few years.

Depicted below, you can see how its cash holdings have changed over time.

It is apparent that Plug Power got massive cash reserves recently, and this gives the company a very solid foundation with which it can fund its projects and growth.

Debt is currently not a problem, but is does seem that management kept debt at levels above cash and equity levels in the past - This may be a result of demanding operating expenditures, but we would be concerned if they start liberally engaging in debt issuance.

How Easily Can Plug Power Raise Cash?

Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalization, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market cap of US$16b, Plug Power's US$269m in cash burn equates to about 1.7% of its market value.

That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

Conclusion

Plug Power has been revitalized by new cash reserves with which they can fund future growth, giving the company a stable foundation.

Considering the recent downfall of the stock price, investors may have the opportunity to enter at a more reasonable price than in early 2021.

One real positive is that analysts are forecasting high growth and that the company will reach breakeven after 2024.

Once we consider the other metrics mentioned in this article together, the overall picture is one we are comfortable with.

There are too many aspects of Plug Power to cover in one brief article, but the key fundamentals for the company can all be found in one place – Plug Power's company page on Simply Wall St. We've also put together a list of key aspects you should look at:

- Historical Track Record: What has Plug Power's performance been like over the past? Go into more detail in the past track record analysis, and take a look at the free visual representations of our analysis for more clarity.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Plug Power's board and the CEO’s background .

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives