- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Plug Power Inc.'s (NASDAQ:PLUG) Stock Retreats 27% But Revenues Haven't Escaped The Attention Of Investors

Plug Power Inc. (NASDAQ:PLUG) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 72% share price decline.

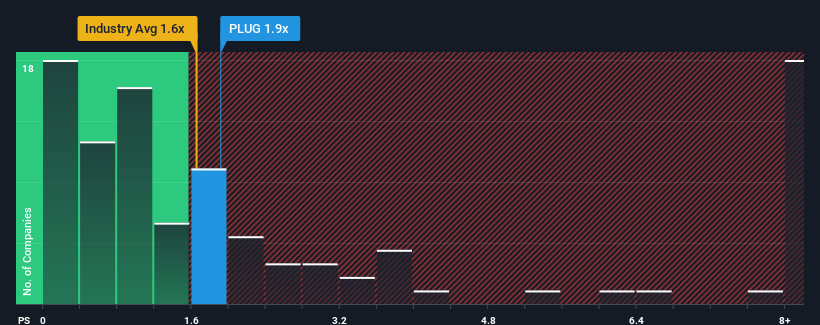

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Plug Power's P/S ratio of 1.9x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in the United States is also close to 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Plug Power

How Plug Power Has Been Performing

Plug Power could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Plug Power.Is There Some Revenue Growth Forecasted For Plug Power?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Plug Power's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 27%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 32% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 35% per year, which is not materially different.

In light of this, it's understandable that Plug Power's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Plug Power's P/S Mean For Investors?

Following Plug Power's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Plug Power's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Electrical industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Plug Power that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PLUG

Plug Power

Develops hydrogen and fuel cell product solutions in North America, Europe, Asia, and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives