- United States

- /

- Machinery

- /

- NasdaqGM:PDYN

Palladyne AI (NasdaqGM:PDYN) Faces 14% Weekly Drop As New Tariffs Shake Market

Reviewed by Simply Wall St

Palladyne AI (NasdaqGM:PDYN) experienced a 14% decline in its share price over the week, coinciding with a broader market downturn driven by new tariff announcements. As major indexes like the Nasdaq entered bear market territory, Palladyne AI's tech-heavy market presence did not shield it from the heavy selling pressure that affected many tech stocks. The negative market sentiment, marked by a 9% drop in the S&P 500 and ongoing concerns about a looming recession, weighed heavily on investor confidence across sectors, including emerging AI companies like Palladyne AI.

Despite the recent 14% decline, Palladyne AI has delivered an exceptional total shareholder return of 128.05% over the last year. In contrast to the US market and the broader Machinery industry, which experienced declines of 3.3% and 16.2% respectively, Palladyne AI's total return highlights its resilience and growth potential.

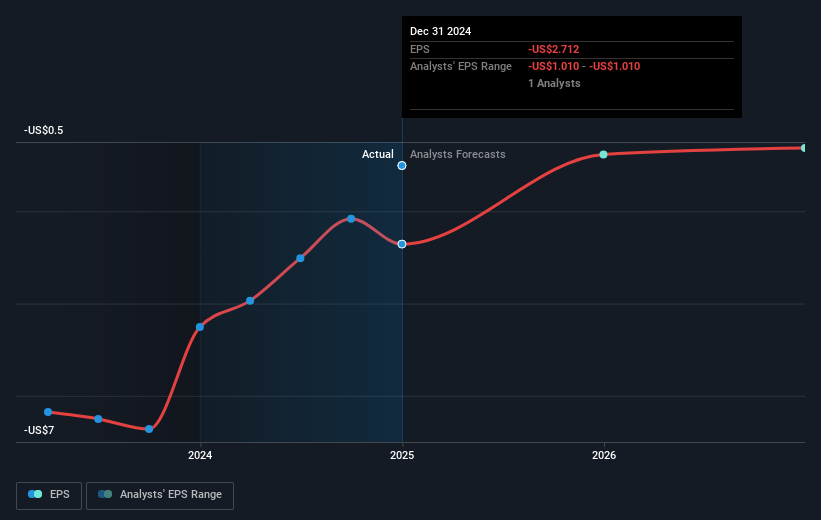

Key developments during this period include the announcement of a successful collaboration with Teal drones and an expanded partnership with Red Cat Holdings, enhancing the visibility and reach of Palladyne's AI software. Additionally, earnings reports from February 2025 showed notable improvements in net loss and sales figures, offering a more promising financial outlook. These advancements, coupled with a new contract with the Air Force Research Laboratory, likely bolstered investor confidence in Palladyne's technology and future prospects. Nonetheless, the company experienced substantial shareholder dilution with follow-on equity offerings totaling US$24 million, which presented challenges but may also have provided necessary capital for growth initiatives.

Learn about Palladyne AI's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Palladyne AI, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PDYN

Palladyne AI

A software company, focuses on delivering software that enhances the utility and functionality of third-party stationary and mobile robotic systems in the United States.

Moderate with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives