- United States

- /

- Machinery

- /

- NasdaqGS:PCAR

PACCAR (PCAR): Is There Value Left After a Period of Sideways Trading?

Reviewed by Kshitija Bhandaru

PACCAR (PCAR) has seen its stock move mostly sideways over the past month, with shares closing at $95.23 most recently. Investors have been watching the company’s steady financials and considering the possible implications for future growth.

See our latest analysis for PACCAR.

PACCAR’s modest moves lately come after a more turbulent stretch, with a one-year total shareholder return of -7.3%. This suggests momentum has faded following earlier gains. Despite a solid three-year total shareholder return of almost 79%, the latest 30-day share price return of -6.8% highlights the market’s recent caution and shifting sentiment around valuation and growth outlook.

If you’re weighing your next opportunity, now could be the perfect time to widen your lens and discover See the full list for free.

With mixed returns and solid fundamentals, the key question now is whether PACCAR’s current valuation leaves room for upside, or if the market has already factored in all the possible future growth. Is there a real buying opportunity?

Most Popular Narrative: 8% Undervalued

With PACCAR’s consensus narrative fair value estimated at $103.50, there is an 8% gap above the latest close of $95.23, fueling debate about the next move. This creates a real tension for investors trying to judge whether the price fully reflects the company’s upcoming opportunities and risks.

Ongoing investments in next-gen clean diesel, alternative powertrains, and connected vehicle services position PACCAR to capture future growth as fleets transition towards more efficient and zero-emission vehicles, supporting long-term top line and margin expansion.

Wondering what bold forecasts are driving the narrative toward this higher value? The secret sauce mixes breakthrough technology and future margin leaps, but the real quantitative assumptions are hidden in the full narrative. This is where the numbers behind the optimism might surprise you.

Result: Fair Value of $103.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff uncertainties and weakness in truck orders could disrupt PACCAR’s growth path. These factors act as key risks to this optimistic narrative.

Find out about the key risks to this PACCAR narrative.

Another View: Fair Value Through a Different Lens

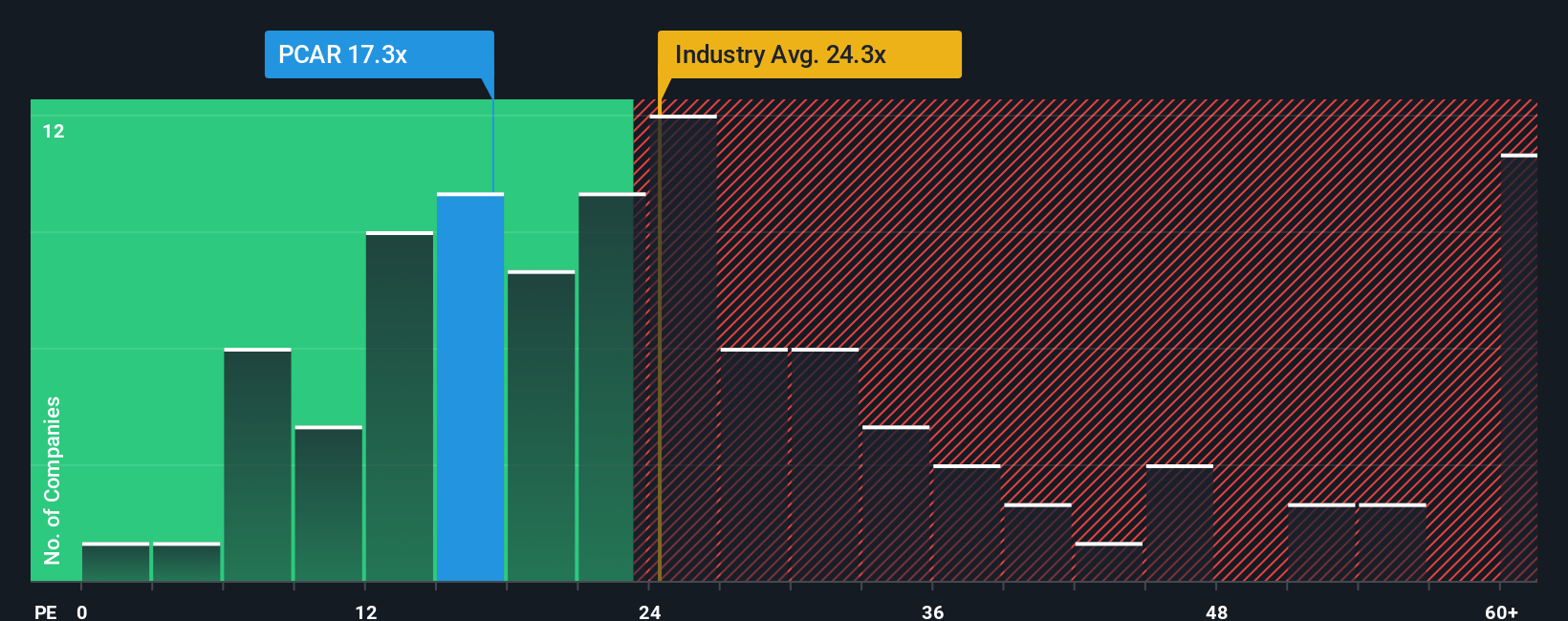

Looking at PACCAR from the perspective of market multiples, its price-to-earnings ratio of 16.3x is noticeably lower than the US Machinery industry average of 23.8x and the peer average of 22.3x. This lower ratio might indicate good value, but it also raises the question: has the market simply priced in slower growth or higher risks?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PACCAR for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PACCAR Narrative

If you think the story could unfold differently or want to follow your own data trail, it takes just a few minutes to create your personal narrative and Do it your way.

A great starting point for your PACCAR research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t just watch from the sidelines while new opportunities pass by. Take bold steps ahead and seize fresh investment potential tailored to your style right now.

- Grow your income and capitalize on yields above 3% when you spot these 18 dividend stocks with yields > 3% consistently delivering attractive dividends and stable returns.

- Catch the next wave of innovation by tapping into these 24 AI penny stocks that are disrupting entire industries with artificial intelligence and smart automation leadership.

- Focus on value and resilience by targeting these 869 undervalued stocks based on cash flows that are trading below their true worth based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCAR

PACCAR

Designs, manufactures, and distributes light, medium, and heavy-duty commercial trucks in the United States, Canada, Europe, Mexico, South America, Australia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026