- United States

- /

- Machinery

- /

- NasdaqGS:PCAR

How Investors May Respond To PACCAR (PCAR) On Trump's 25% Tariff for Imported Heavy-Duty Trucks

Reviewed by Sasha Jovanovic

- In late September 2025, President Donald Trump announced a 25% tariff on imported heavy-duty trucks, a move intended to protect U.S. manufacturers like PACCAR's Peterbilt and Kenworth brands from foreign competition.

- This new tariff is expected to enhance the competitive position of domestic truck makers, potentially allowing PACCAR to increase its market share and capture higher pricing power.

- We'll now explore how this significant shift in trade policy could influence PACCAR's growth projections and industry standing.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

PACCAR Investment Narrative Recap

Owning PACCAR shares means believing in the resilience and growth potential of U.S. truck manufacturing, with ongoing investments in clean diesel and digital fleet services set against highly cyclical industry demand. The recent 25% tariff on imported heavy-duty trucks may lift PACCAR’s competitive advantage domestically, but short-term earnings pressure from softer orders and weakening revenue growth remains a primary risk that may outweigh potential tariff benefits for now. Amid this uncertainty, the company’s continued commitment to regular dividends, including the recent $0.33 per share announcement, stands out as a sign of financial stability and focus on ongoing shareholder returns, an important factor when catalysts like regulatory-driven pre-buy cycles or policy changes create volatility. However, investors should remember that if market normalization is further delayed or truck order weakness deepens, then…

Read the full narrative on PACCAR (it's free!)

PACCAR's narrative projects $32.1 billion revenue and $4.2 billion earnings by 2028. This requires 1.1% yearly revenue growth and a $1.1 billion earnings increase from $3.1 billion today.

Uncover how PACCAR's forecasts yield a $103.50 fair value, a 3% upside to its current price.

Exploring Other Perspectives

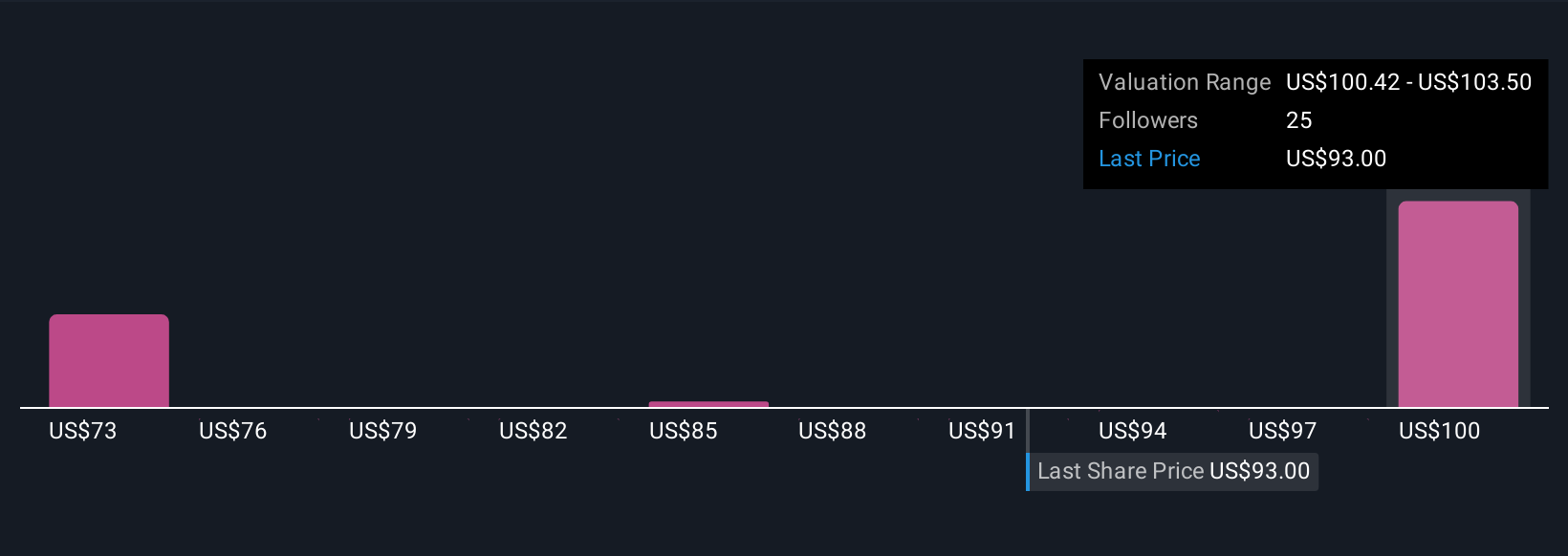

Four fair value estimates from the Simply Wall St Community range from US$73.99 to US$103.50, showing wide differences in growth expectations and potential. This diversity reflects real uncertainty, especially as risks around continued soft truck demand and economic headwinds could critically influence PACCAR’s revenue and profit outlook, so be sure to explore multiple perspectives before making up your mind.

Explore 4 other fair value estimates on PACCAR - why the stock might be worth 26% less than the current price!

Build Your Own PACCAR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PACCAR research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PACCAR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PACCAR's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 31 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCAR

PACCAR

Designs, manufactures, and distributes light, medium, and heavy-duty commercial trucks in the United States, Canada, Europe, Mexico, South America, Australia, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives