- United States

- /

- Electrical

- /

- NYSEAM:OPTT

Did Business Growth Power Ocean Power Technologies' (NASDAQ:OPTT) Share Price Gain of 261%?

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. Take, for example Ocean Power Technologies, Inc. (NASDAQ:OPTT). Its share price is already up an impressive 261% in the last twelve months. Also pleasing for shareholders was the 41% gain in the last three months. In contrast, the longer term returns are negative, since the share price is 86% lower than it was three years ago.

See our latest analysis for Ocean Power Technologies

Because Ocean Power Technologies made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last twelve months, Ocean Power Technologies' revenue grew by 79%. That's a head and shoulders above most loss-making companies. Meanwhile, the market has paid attention, sending the share price soaring 261% in response. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

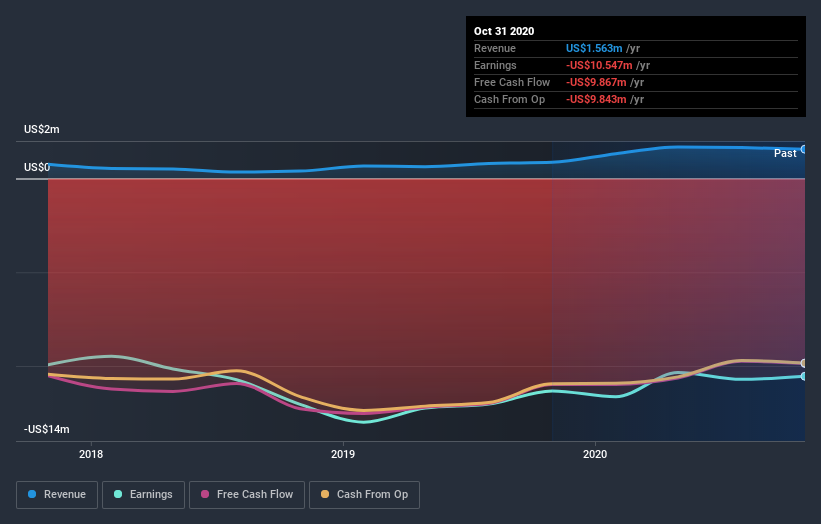

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Ocean Power Technologies' financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Ocean Power Technologies shareholders have received a total shareholder return of 261% over the last year. That certainly beats the loss of about 14% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for Ocean Power Technologies (1 is potentially serious!) that you should be aware of before investing here.

But note: Ocean Power Technologies may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Ocean Power Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSEAM:OPTT

Ocean Power Technologies

Develops and commercializes proprietary power platforms that generate electricity by harnessing the renewable energy of ocean waves in North America, South America, Europe, Australia, and Asia.

Moderate with adequate balance sheet.

Market Insights

Community Narratives