- United States

- /

- Electrical

- /

- NasdaqCM:OESX

Investors Don't See Light At End Of Orion Energy Systems, Inc.'s (NASDAQ:OESX) Tunnel And Push Stock Down 33%

Orion Energy Systems, Inc. (NASDAQ:OESX) shares have retraced a considerable 33% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 37% in that time.

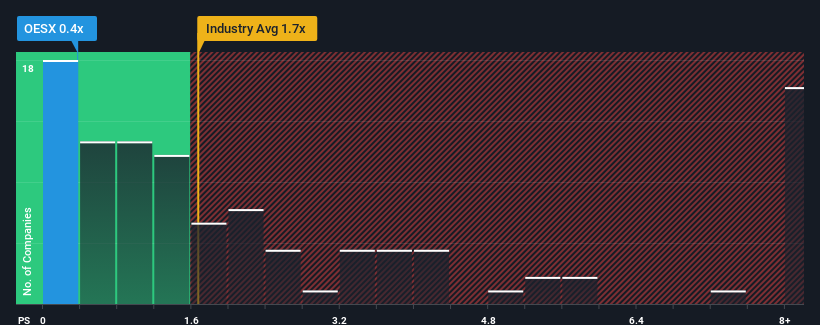

Since its price has dipped substantially, Orion Energy Systems' price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Electrical industry in the United States, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Orion Energy Systems

How Orion Energy Systems Has Been Performing

With revenue growth that's inferior to most other companies of late, Orion Energy Systems has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Orion Energy Systems will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Orion Energy Systems' is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 17% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 22% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 16% per annum over the next three years. With the industry predicted to deliver 45% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Orion Energy Systems' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Orion Energy Systems' P/S?

The southerly movements of Orion Energy Systems' shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Orion Energy Systems' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Orion Energy Systems you should know about.

If you're unsure about the strength of Orion Energy Systems' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OESX

Orion Energy Systems

Researches, designs, develops, manufactures, markets, sells, installs, and implements energy management systems for commercial office and retail, area lighting, industrial applications, and government in North America and Germany.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives