- United States

- /

- Electrical

- /

- NasdaqGS:NXT

Nextracker (NXT): Evaluating Valuation as Earnings Growth and Origami Solar Acquisition Drive Investor Interest

Reviewed by Kshitija Bhandaru

Nextracker (NXT) is drawing fresh attention as investors look ahead to its upcoming earnings report, with expectations for meaningful year-over-year revenue growth. Curiosity is also building around its acquisition of Origami Solar, which could strengthen its technology suite.

See our latest analysis for Nextracker.

Nextracker’s share price has kept investors guessing lately, with small but positive moves since the start of the year, even as news like its Origami Solar acquisition stirs the sector. While its 1-year total shareholder return stands at just 1.2%, momentum could build if expected revenue growth materializes and recent tech investments pay off.

If sector shake-ups have your attention, it could be the moment to broaden your scope and discover See the full list for free.

With analysts divided and new technology bets in play, the key question is whether Nextracker’s rapid revenue growth is already reflected in its price or if there is still room for investors to benefit from a buying opportunity.

Most Popular Narrative: 8.6% Overvalued

With Nextracker trading at $79.36 and the most popular valuation narrative pegging fair value at $73.08, the company appears to be priced a step above consensus. Such a gap suggests investors are either looking past today’s metrics or expecting additional surprises ahead.

Nextracker's global expansion of R&D facilities in the U.S., Brazil, and India, along with the partnership with UC Berkeley for solar technology research, is expected to reinforce its commitment to innovation and position the company as a leader in solar technology. This could have an impact on long-term revenue and growth.

Curious how this ambitious growth story stacks up against gritty reality? The fair value hinges on predictions that would shock most skeptics. Find out what bold revenue and margin bets drive this optimistic price tag. Are they plausible or wishful thinking? The full narrative reveals the critical assumptions that could change how you value Nextracker.

Result: Fair Value of $73.08 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting policies on solar tariffs and reliance on the U.S. market could quickly undercut current growth expectations and challenge Nextracker’s positive outlook.

Find out about the key risks to this Nextracker narrative.

Another View: Are Multiples Telling a Different Story?

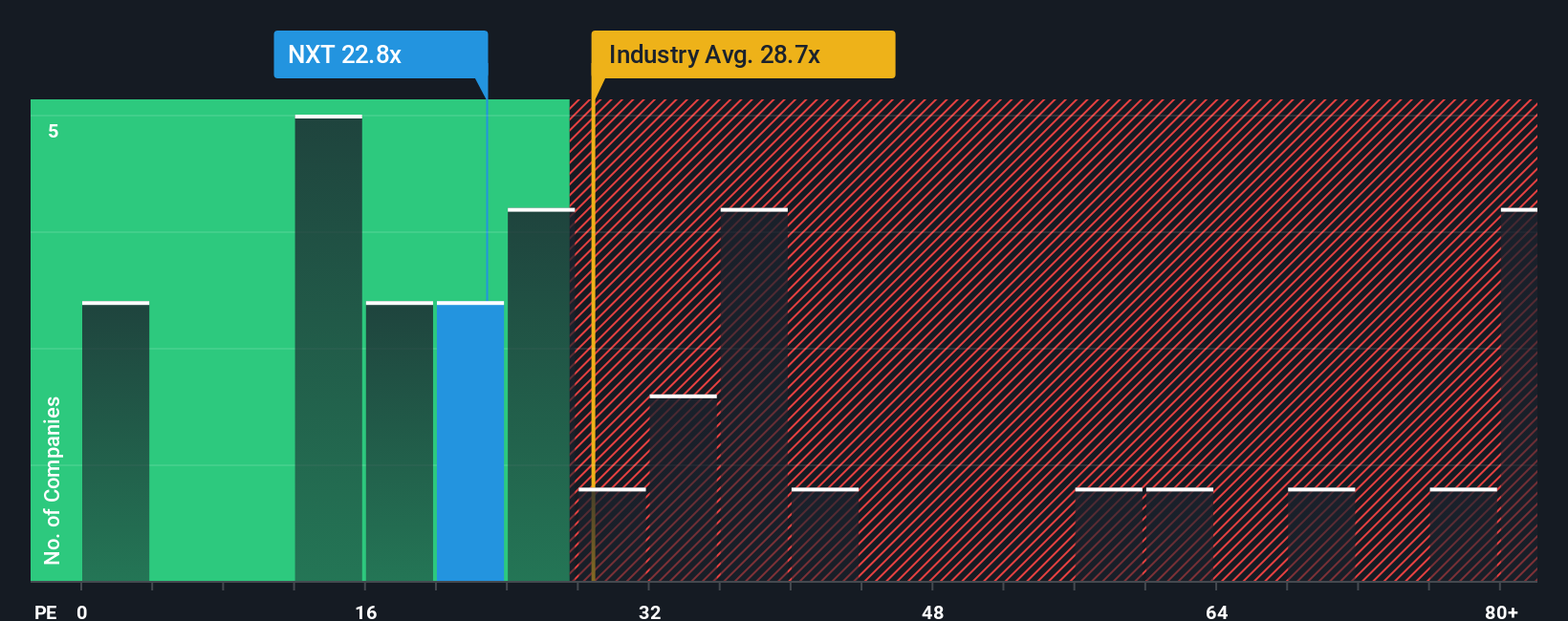

Looking at Nextracker's valuation through earnings ratios adds a new angle. Its price-to-earnings ratio is 21.6x, which is well below both the industry average (29.4x) and the peer average (38.9x). The fair ratio is even higher at 33.1x. On paper, this suggests the market might be underrating Nextracker's potential or simply being cautious about future risks. Could broader investor sentiment shift to close that gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nextracker Narrative

If these perspectives don't fit your view or you want to dive into your own research, it only takes a few minutes to shape your own story: Do it your way

A great starting point for your Nextracker research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at just one company? Explore fresh growth, innovation, and reliable returns by considering these hand-picked opportunities you could be missing:

- Supercharge your portfolio with these 24 AI penny stocks. These companies are redefining industry standards using artificial intelligence and automation for tomorrow’s breakthroughs.

- Maximize your cash flow by targeting these 19 dividend stocks with yields > 3% that offer yields above 3% from stable businesses committed to rewarding shareholders.

- Get ahead of market trends with these 26 quantum computing stocks. These companies are leading advancements in quantum computing, transforming everything from security to scientific research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nextracker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXT

Nextracker

Provides solar tracker technologies and solutions for utility-scale and distributed generation solar applications in the United States and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives