- United States

- /

- Electrical

- /

- NasdaqGS:NXT

Is It Too Late To Consider Nextpower After Its 119% 2025 Share Price Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Nextpower is still worth chasing after its big run up, or if it might be smarter to wait for a better entry point, this breakdown is for you.

- The stock has cooled off recently, slipping about 3.8% over the last week and 14.4% over the past month, but it is still up 119.2% year to date and 121.3% over the last year.

- Those swings have come as investors react to a string of upbeat industry updates around grid modernisation and renewable infrastructure build outs, along with heightened interest in companies positioned to benefit from long term electrification trends. In addition, policy support for clean energy projects has kept sentiment elevated, even as shorter term market jitters have introduced more volatility.

- Right now, Nextpower scores a 4/6 valuation check, suggesting it looks undervalued on several key metrics. In a moment we will walk through those methods, then finish with a more holistic way of thinking about what the market might really be pricing in.

Approach 1: Nextpower Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in dollar terms. For Nextpower, the 2 Stage Free Cash Flow to Equity model starts from its last twelve months Free Cash Flow of about $620.8 million and then layers on analyst forecasts and longer term extrapolations.

Analysts expect Free Cash Flow to climb to around $476.1 million in 2026 and $612.0 million in 2027, with Simply Wall St extending those projections out so that by 2035 Free Cash Flow is estimated at roughly $1.26 billion. Rolling all of those discounted cash flows together produces an estimated intrinsic value of $101.48 per share.

Compared with the current market price, that implies Nextpower is trading at roughly a 14.7% discount to its DCF based value. On this cash flow view, the shares appear attractively priced relative to the model’s estimate of intrinsic value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nextpower is undervalued by 14.7%. Track this in your watchlist or portfolio, or discover 935 more undervalued stocks based on cash flows.

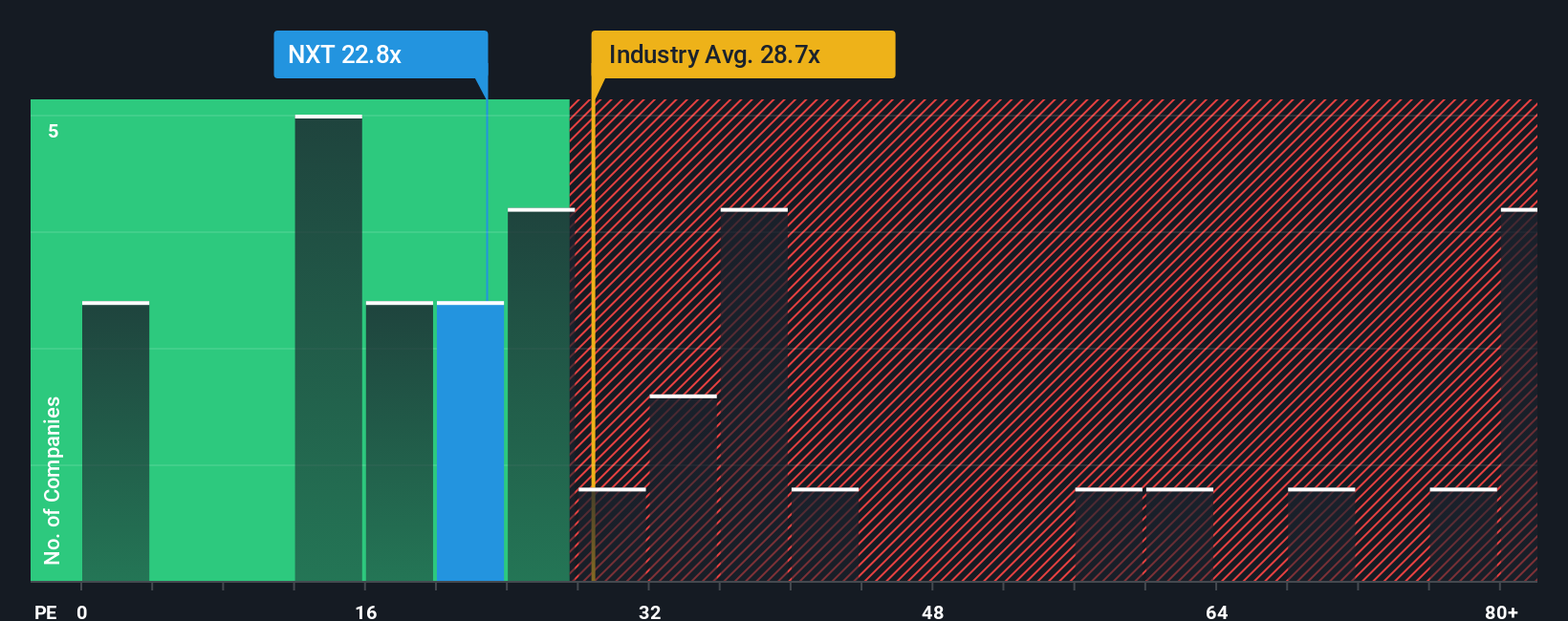

Approach 2: Nextpower Price vs Earnings

For a profitable business like Nextpower, the Price to Earnings, or PE, ratio is a useful yardstick because it directly links what investors are paying for the stock to the earnings the company is generating today. In general, faster growing, lower risk companies tend to justify a higher PE, while slower growth or higher uncertainty usually call for a lower, more cautious multiple.

Nextpower currently trades on a PE of about 22.3x. That sits well below both the wider Electrical industry average of roughly 30.7x and the peer group average near 37.2x, which on a simple comparison might make the stock look cheap. However, Simply Wall St also calculates a proprietary Fair Ratio of around 30.8x for Nextpower, reflecting what investors might reasonably pay given its earnings growth outlook, margins, industry positioning, market cap and risk profile. This Fair Ratio is more informative than a plain peer or sector comparison because it adjusts for the specific strengths and risks of the company rather than assuming one size fits all.

Set against that 30.8x Fair Ratio, Nextpower’s current 22.3x PE suggests the shares are trading at a meaningful discount.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nextpower Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page that lets you attach a clear story, your assumptions about future revenue, earnings and margins, and a resulting fair value to companies like Nextpower. This allows you to see how the company’s story connects to a financial forecast and then to a fair value that you can compare with today’s price to decide whether to buy, hold or sell. The Narrative automatically updates when new news or earnings arrive and different investors can express very different perspectives. For example, someone may think Nextpower deserves a fair value near $38 because growth and margins could disappoint, while someone else may believe the business merits closer to $97 based on stronger demand, policy support and premium profitability.

Do you think there's more to the story for Nextpower? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nextpower might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXT

Nextpower

Provides solar tracker technologies and solutions for utility-scale and distributed generation solar applications in the United States and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026