- United States

- /

- Electrical

- /

- NasdaqCM:NNE

What NANO Nuclear Energy (NNE)'s Feasibility Study With BaRupOn Could Mean for 1 GW Texas Opportunity

Reviewed by Sasha Jovanovic

- On November 24, 2025, NANO Nuclear Energy announced it signed a Feasibility Study Agreement with BaRupOn LLC to assess supplying multiple KRONOS MMR units, potentially delivering 1 GW of nuclear energy, to the planned LAMP power and innovation hub in Liberty, Texas.

- This agreement highlights growing interest in advanced nuclear microreactors for supporting high-performance computing and other energy-intensive sectors facing rising electricity demand.

- We'll explore how the BaRupOn partnership and potential 1 GW deployment opportunity could reshape NANO Nuclear's investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is NANO Nuclear Energy's Investment Narrative?

To own NANO Nuclear Energy, you have to believe that advanced microreactor technology will secure a meaningful foothold in powering next-wave industrial demand, from AI data centers to clean energy hubs. The company’s new feasibility study with BaRupOn in Texas places NANO at the heart of a rapidly growing market for high-density power, potentially shifting short-term catalysts closer to revenue generation if the project advances beyond early assessment. However, this agreement, while exciting, does not immediately resolve core risks: NANO is still pre-revenue, carries steep losses, and faces complex regulatory and commercialization hurdles. While recent funding rounds have extended its cash runway, the immediate impact of this BaRupOn news is more directional than material, an important signal for the story, but unlikely to shift the near-term financial outlook significantly unless further contracts or regulatory milestones are reached sooner than expected. On the other hand, rising costs and unproven commercialization still cast a shadow over the path to profitability.

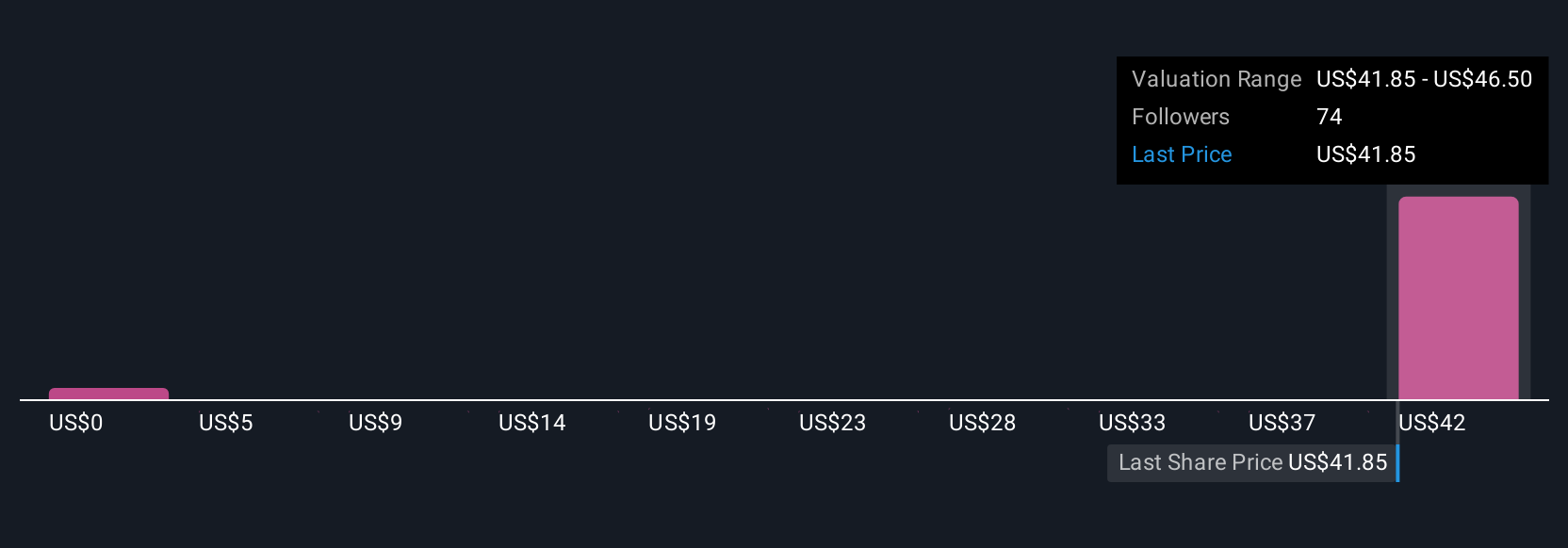

According our valuation report, there's an indication that NANO Nuclear Energy's share price might be on the expensive side.Exploring Other Perspectives

Explore 16 other fair value estimates on NANO Nuclear Energy - why the stock might be worth less than half the current price!

Build Your Own NANO Nuclear Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NANO Nuclear Energy research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free NANO Nuclear Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NANO Nuclear Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NANO Nuclear Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NNE

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026