- United States

- /

- Machinery

- /

- NasdaqGS:NNBR

Take Care Before Jumping Onto NN, Inc. (NASDAQ:NNBR) Even Though It's 26% Cheaper

NN, Inc. (NASDAQ:NNBR) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 53% share price decline.

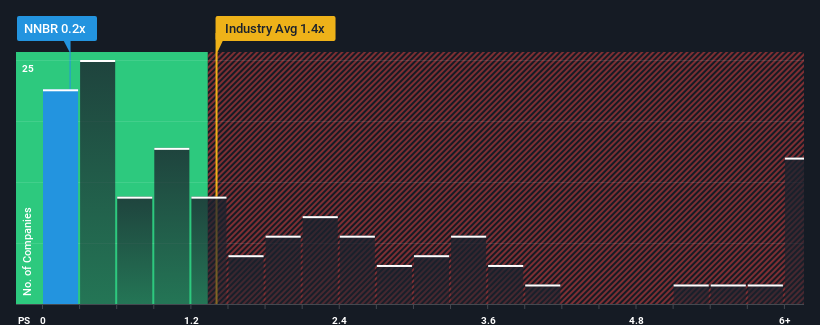

Following the heavy fall in price, it would be understandable if you think NN is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in the United States' Machinery industry have P/S ratios above 1.4x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for NN

What Does NN's Recent Performance Look Like?

NN has been struggling lately as its revenue has declined faster than most other companies. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think NN's future stacks up against the industry? In that case, our free report is a great place to start .Is There Any Revenue Growth Forecasted For NN?

The only time you'd be truly comfortable seeing a P/S as low as NN's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 5.1% decrease to the company's top line. As a result, revenue from three years ago have also fallen 2.8% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 2.8% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 3.6% per year, which is not materially different.

With this information, we find it odd that NN is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From NN's P/S?

NN's recently weak share price has pulled its P/S back below other Machinery companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for NN remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

It is also worth noting that we have found 1 warning sign for NN that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if NN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NNBR

NN

Designs, manufactures, and sells high-precision components and assemblies for various end markets in the United States, China, Brazil, Mexico, Germany, Poland, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026