- United States

- /

- Software

- /

- NasdaqCM:NISN

The Returns At Nisun International Enterprise Development Group (NASDAQ:NISN) Provide Us With Signs Of What's To Come

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Although, when we looked at Nisun International Enterprise Development Group (NASDAQ:NISN), it didn't seem to tick all of these boxes.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Nisun International Enterprise Development Group, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.10 = US$6.6m ÷ (US$125m - US$62m) (Based on the trailing twelve months to June 2020).

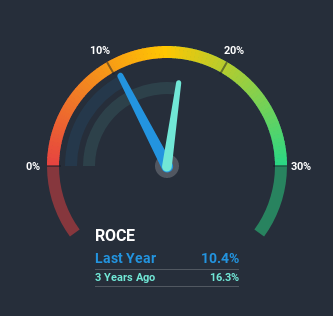

Therefore, Nisun International Enterprise Development Group has an ROCE of 10%. By itself that's a normal return on capital and it's in line with the industry's average returns of 9.6%.

View our latest analysis for Nisun International Enterprise Development Group

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Nisun International Enterprise Development Group's past further, check out this free graph of past earnings, revenue and cash flow.

What Does the ROCE Trend For Nisun International Enterprise Development Group Tell Us?

Unfortunately, the trend isn't great with ROCE falling from 32% five years ago, while capital employed has grown 327%. However, some of the increase in capital employed could be attributed to the recent capital raising that's been completed prior to their latest reporting period, so keep that in mind when looking at the ROCE decrease. The funds raised likely haven't been put to work yet so it's worth watching what happens in the future with Nisun International Enterprise Development Group's earnings and if they change as a result from the capital raise.

On a separate but related note, it's important to know that Nisun International Enterprise Development Group has a current liabilities to total assets ratio of 50%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

In Conclusion...

Even though returns on capital have fallen in the short term, we find it promising that revenue and capital employed have both increased for Nisun International Enterprise Development Group. And long term investors must be optimistic going forward because the stock has returned a huge 949% to shareholders in the last three years. So should these growth trends continue, we'd be optimistic on the stock going forward.

One final note, you should learn about the 3 warning signs we've spotted with Nisun International Enterprise Development Group (including 1 which is significant) .

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

When trading Nisun International Enterprise Development Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nisun International Enterprise Development Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:NISN

Nisun International Enterprise Development Group

An investment holding company, provides technology-driven integrated financing solutions and supply chain services in China.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.