- United States

- /

- Machinery

- /

- NasdaqGS:NDSN

Nordson (NDSN) Valuation in Focus After Growth Moves, Acquisitions, and Dividend Hike

Reviewed by Kshitija Bhandaru

Nordson (NDSN) is getting a boost after announcing a 5% dividend hike in August. This increase is fueled by growth in its Advanced Technology Solutions business and a string of strategic acquisitions that are broadening its market reach.

See our latest analysis for Nordson.

Nordson’s recent wave of acquisitions and its advanced technology push are starting to show up in the numbers, with the share price climbing 14.3% year-to-date. However, while investors have seen encouraging short-term share price gains, the one-year total shareholder return is still slightly negative. This suggests that longer-term momentum is only just turning the corner.

If you’re watching for where fresh growth stories could emerge next, this is a great time to discover fast growing stocks with high insider ownership.

With Nordson’s share price rising, but still trailing its analyst price target by nearly 10%, the question remains: is there hidden value yet to be unlocked, or has the market already priced in all the future growth?

Most Popular Narrative: 8.6% Undervalued

Compared to the last close at $234.32, the most widely referenced narrative puts Nordson’s fair value 8.6% higher, setting an optimistic tone for what could lie ahead. This viewpoint is grounded in expectations for strong earnings growth and higher profit margins, suggesting the next few years might reshape the company’s valuation.

The analysts have a consensus price target of $256.3 for Nordson based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $285.0, and the most bearish reporting a price target of just $224.0.

What’s driving this favorable outlook? This fair value reflects ambitious assumptions around margin expansion and aggressive earnings growth, all balancing on one expected future multiple. Want to know what surprising calculations back these numbers? Click through to uncover the key forecasts propelling this narrative.

Result: Fair Value of $256.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower-than-expected recoveries in key product lines or integration challenges from acquisitions could quickly change Nordson’s earnings outlook and valuation case.

Find out about the key risks to this Nordson narrative.

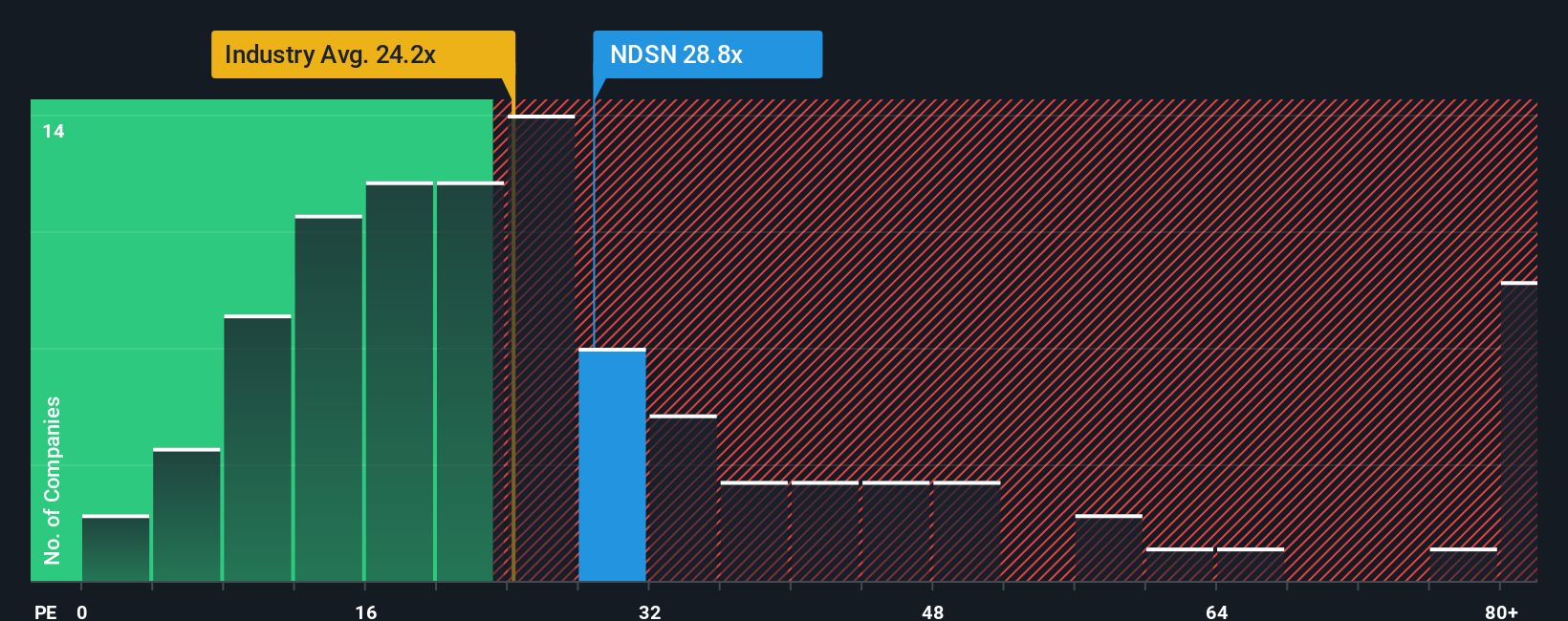

Another View: Multiples Send a Cautious Signal

While the consensus analyst price target suggests Nordson is undervalued, a quick look at its price-to-earnings ratio paints a more cautious picture. At 28.9x, the company trades noticeably above both the industry average of 24.1x and its fair ratio of 24.5x. This gap highlights a valuation risk if the market’s excitement fades or expectations do not materialize.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nordson Narrative

If these perspectives don’t align with your view, or you’d like to dig into the numbers yourself, you can shape your own analysis in just a few minutes with Do it your way.

A great starting point for your Nordson research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye on fresh opportunities. Expand your reach beyond Nordson by checking out hand-picked stocks primed for tomorrow’s growth and returns.

- Supercharge your income potential with high-yield picks by reviewing these 19 dividend stocks with yields > 3%.

- Unlock long-term value by comparing these 891 undervalued stocks based on cash flows, which are currently trading at attractive prices.

- Get ahead of tech innovation by backing these 26 quantum computing stocks, which are pushing the limits in advanced computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDSN

Nordson

Nordson Corporation engineers, manufactures, and markets products and systems to dispense, apply, and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives