- United States

- /

- Machinery

- /

- NasdaqCM:MVST

Microvast Holdings (NasdaqCM:MVST) Shares Surge 74% Over Last Quarter

Reviewed by Simply Wall St

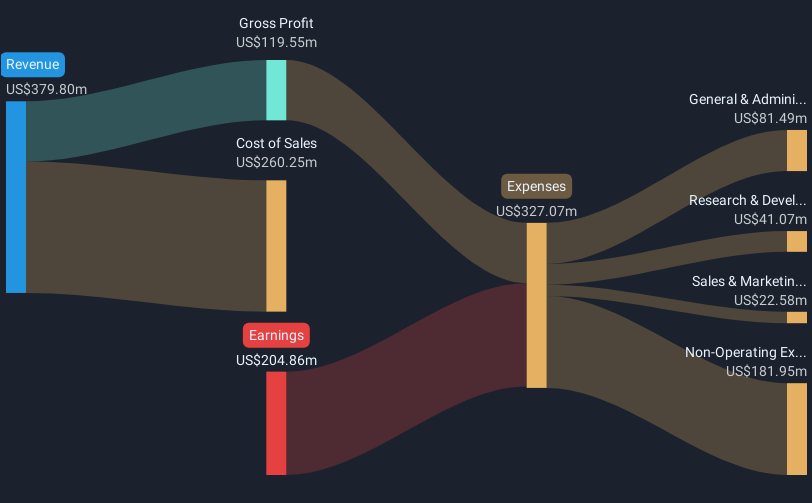

Microvast Holdings (NasdaqCM:MVST) has experienced a notable period of growth, with its addition to various Russell Indexes being a key development. Over the last quarter, the company's stock price surged 74%, aligning with these key inclusions which likely enhanced its market visibility and attracted institutional interest. Additionally, strong Q1 earnings, where net income notably transformed from a loss to a gain, further bolstered investor confidence. These positive developments significantly contributed to the share price increase, counteracting the overall flat market despite an annual market upswing of 13% and forecasted 15% annual earnings growth.

Microvast Holdings has 2 risks (and 1 which is significant) we think you should know about.

The recent inclusion of Microvast Holdings in various Russell Indexes has considerably boosted its market visibility and potentially piqued institutional interest. This development aligns with the company's long-term shareholder returns, a very large increase over the past year. Compared to the US Machinery industry's 16.8% rise in the past year, Microvast's performance stands out. Despite market growth, the company's share price still trades below the consensus analyst price target of US$4.0, indicating room for further progress depending on the future realization of current forecasts.

Looking ahead, the enhancements in revenue and earnings projections hold significance due to the company's focus on innovation and expansion efforts like the Huzhou Phase 3.2 project. Analysts anticipate an annual revenue growth rate of 18.1% over the next three years, alongside an improvement in profit margins. However, challenges such as liquidity constraints and increased competition might impact these forecasts. Thus, while the recent developments have positively influenced the outlook, stakeholders need to consider these risks when assessing the company's potential to achieve the anticipated earnings growth, which is essential for meeting the analyst price targets.

Understand Microvast Holdings' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MVST

Microvast Holdings

Provides battery technologies for electric vehicles and energy storage solutions.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives