- United States

- /

- Machinery

- /

- NasdaqCM:MVST

July 2025's Promising Penny Stocks To Monitor

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, but it is up 15% over the past year with earnings forecasted to grow by 15% annually. Penny stocks may be a throwback term, but they still offer intriguing opportunities for growth at lower price points. By focusing on smaller or newer companies with strong balance sheets and solid fundamentals, investors can uncover hidden gems that might deliver impressive returns without many of the typical risks associated with this segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.68 | $607.59M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.62 | $266.61M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.9527 | $160.22M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.50 | $254.62M | ✅ 3 ⚠️ 0 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $98.4M | ✅ 3 ⚠️ 2 View Analysis > |

| Safe Bulkers (SB) | $4.12 | $421.52M | ✅ 2 ⚠️ 3 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.845 | $6.14M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.47 | $100.19M | ✅ 3 ⚠️ 2 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.88 | $44.85M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 419 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Microvast Holdings (MVST)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Microvast Holdings, Inc. specializes in battery technologies for electric vehicles and energy storage solutions, with a market cap of approximately $1.09 billion.

Operations: Microvast Holdings generates revenue primarily from its Batteries / Battery Systems segment, which accounts for $414.94 million.

Market Cap: $1.09B

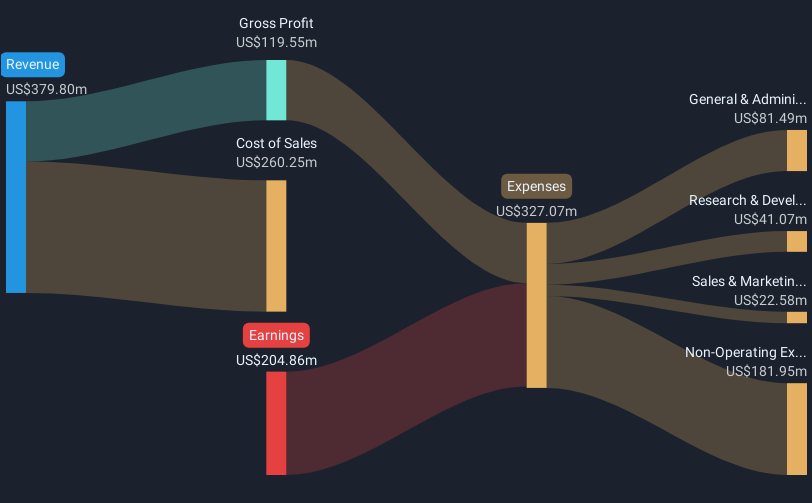

Microvast Holdings, Inc. has recently been added to multiple Russell indexes, indicating increased visibility among investors. Despite a volatile share price, the company reported US$116.49 million in first-quarter sales for 2025 and turned profitable with a net income of US$61.79 million compared to a loss last year. However, it remains unprofitable over the long term with losses increasing at 0.6% annually over five years and maintains high debt levels relative to equity at 41.2%. With strong revenue growth projections between US$450 million and US$475 million for 2025, Microvast's financial position is bolstered by short-term assets exceeding liabilities but faces challenges in sustaining cash runway if free cash flow continues decreasing.

- Jump into the full analysis health report here for a deeper understanding of Microvast Holdings.

- Examine Microvast Holdings' earnings growth report to understand how analysts expect it to perform.

Caribou Biosciences (CRBU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Caribou Biosciences, Inc. is a clinical-stage biopharmaceutical company focused on developing genome-edited allogeneic cell therapies for hematologic malignancies and autoimmune diseases, with a market cap of approximately $190.66 million.

Operations: Caribou Biosciences generates revenue primarily from its development of a pipeline of allogeneic CAR-T and CAR-NK cell therapies, totaling $9.92 million.

Market Cap: $190.66M

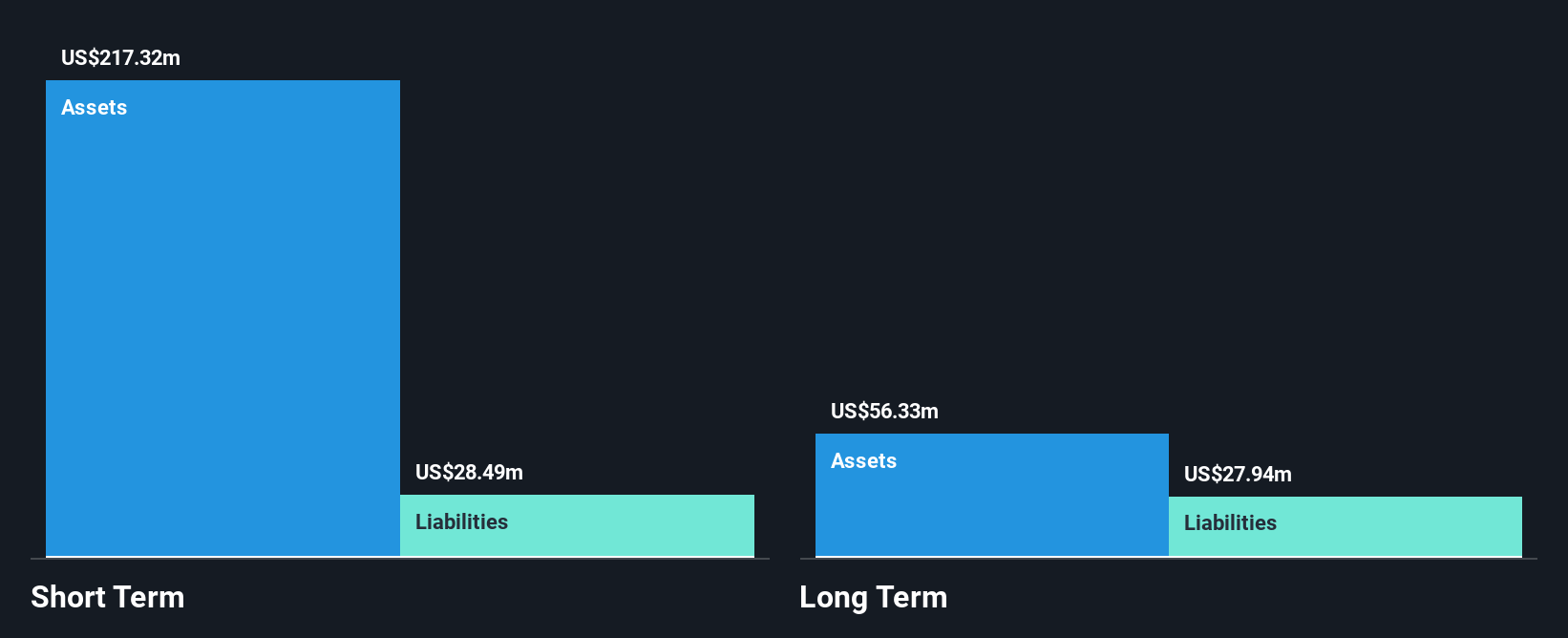

Caribou Biosciences, Inc., with a market cap of approximately US$190.66 million, is navigating the complexities of being a clinical-stage biopharmaceutical entity. Despite generating US$9.92 million in revenue from its CAR-T and CAR-NK therapies pipeline, the company remains unprofitable with increasing losses over five years at 27.5% annually. Caribou's short-term assets of US$217.3 million comfortably cover both short- and long-term liabilities, providing some financial stability amid high volatility and recent strategic moves like a proposed reverse stock split and equity offerings totaling up to US$400 million to extend its cash runway into late 2027.

- Take a closer look at Caribou Biosciences' potential here in our financial health report.

- Learn about Caribou Biosciences' future growth trajectory here.

Perfect (PERF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perfect Corp. is an artificial intelligence software as a service company that offers AI- and AR-powered solutions for the beauty, fashion, and skincare industries globally, with a market cap of $254.62 million.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $61.93 million.

Market Cap: $254.62M

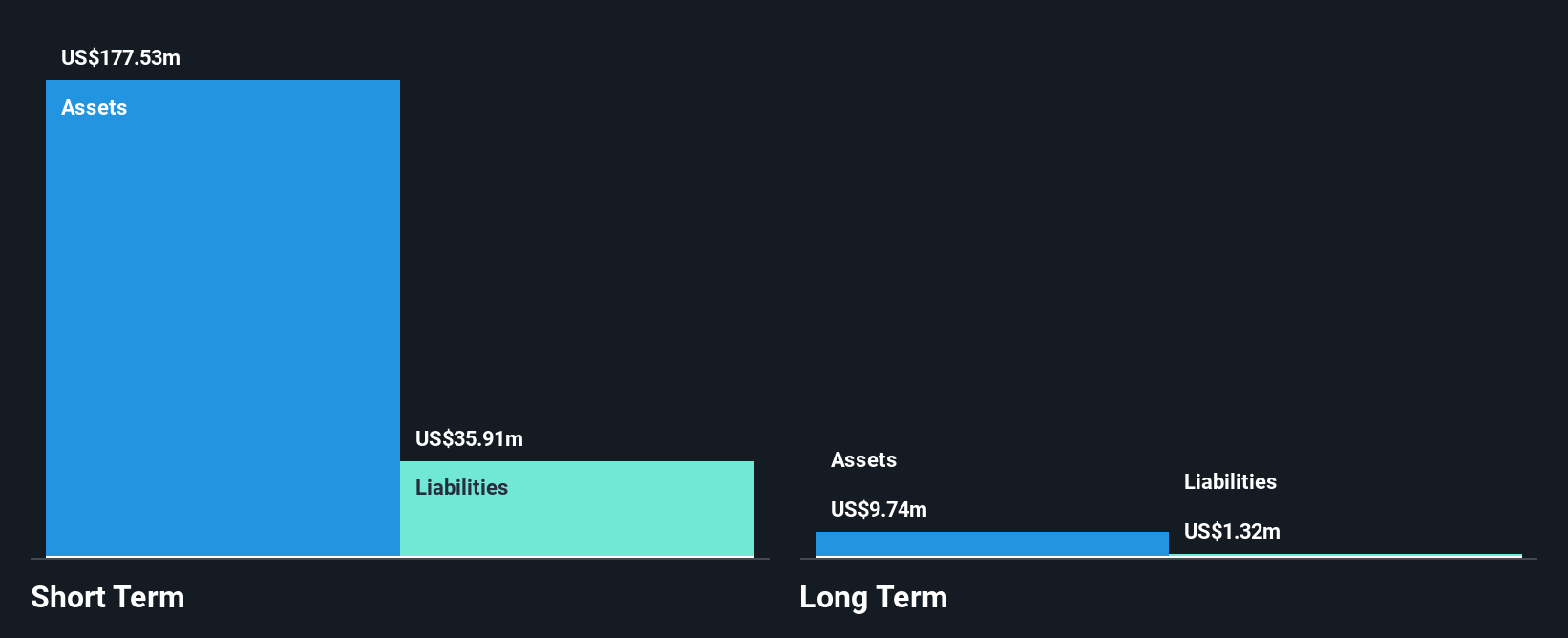

Perfect Corp., with a market cap of US$254.62 million, is leveraging its AI and AR technology to enhance the beauty and fashion industries. The company, debt-free with short-term assets of US$177.5 million exceeding liabilities, has shown stable weekly volatility at 7%. Recent collaborations with NVIDIA have boosted its offerings in virtual try-ons and AI-driven recommendations, addressing online shopping challenges like high return rates. Earnings grew by 24.9% over the past year, surpassing industry growth rates, while forecasted earnings growth stands at 22.15% annually. Despite a low Return on Equity of 4.5%, Perfect's innovations position it well for future opportunities in digital retail experiences.

- Click here and access our complete financial health analysis report to understand the dynamics of Perfect.

- Understand Perfect's earnings outlook by examining our growth report.

Where To Now?

- Unlock more gems! Our US Penny Stocks screener has unearthed 416 more companies for you to explore.Click here to unveil our expertly curated list of 419 US Penny Stocks.

- Ready For A Different Approach? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MVST

Microvast Holdings

Provides battery technologies for electric vehicles and energy storage solutions.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives