- United States

- /

- Machinery

- /

- NasdaqCM:MVST

A Look at Microvast Holdings (MVST) Valuation Following $125M Equity Offering

Reviewed by Kshitija Bhandaru

Microvast Holdings (MVST) just filed for a $125 million follow-on equity offering. This brings fresh capital into play and introduces potential dilution for existing shareholders. These moves often grab investor attention due to their direct impact on value.

See our latest analysis for Microvast Holdings.

Microvast Holdings has had a busy stretch, recently unveiling next-generation battery products at a major industry event and joining the S&P Global BMI Index. However, most eyes have been on its $125 million follow-on equity raise, which likely contributed to shifting investor sentiment. While 1-year total shareholder return stands at a robust 18.6%, stock momentum has been steady rather than explosive. This suggests the market is weighing growth ambitions against capital needs.

If you want to see what else is energizing the sector, you might enjoy exploring See the full list for free.

With shares rallying nearly 90% year-to-date and the price now just 20% below analyst targets, the big question is whether Microvast is undervalued, or if the market already anticipates future growth from here.

Most Popular Narrative: 17% Undervalued

With the most widely followed fair value estimate at $5.50, Microvast’s share price recently closed at $4.56, suggesting meaningful upside if projections prove correct. The narrative behind this valuation leans heavily on disruptive technology, capacity expansion, and the global demand for advanced battery solutions.

Continued investments in advanced battery technologies, such as all-solid-state and silicon-based cells, position Microvast to meet growing demand for high-performance, safer, and versatile battery solutions across sectors like EVs, energy storage, robotics, and aerospace. This supports a higher-margin product mix and top-line revenue growth. Strategic capacity expansion, including the new 2 GWh line at the Huzhou facility scheduled for Q4 2025, enables Microvast to capture accelerating order flow from the global electrification push. This directly supports volume growth and operating leverage, which is likely to enhance future revenue and gross margins.

Want to know what powers this bold narrative? The secret: sky-high revenue growth forecasts and margin optimism, all built on a technology playbook that could set new records. Which financial leaps do analysts expect, and how aggressive are the forecasts? Unlock the narrative to see exactly what numbers build the case for Microvast’s estimated upside.

Result: Fair Value of $5.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, real risks remain, such as geopolitical headwinds and reliance on next-generation battery commercialization. These factors could sharply alter Microvast’s growth story ahead.

Find out about the key risks to this Microvast Holdings narrative.

Another View: Sales Ratio Tells a Different Story

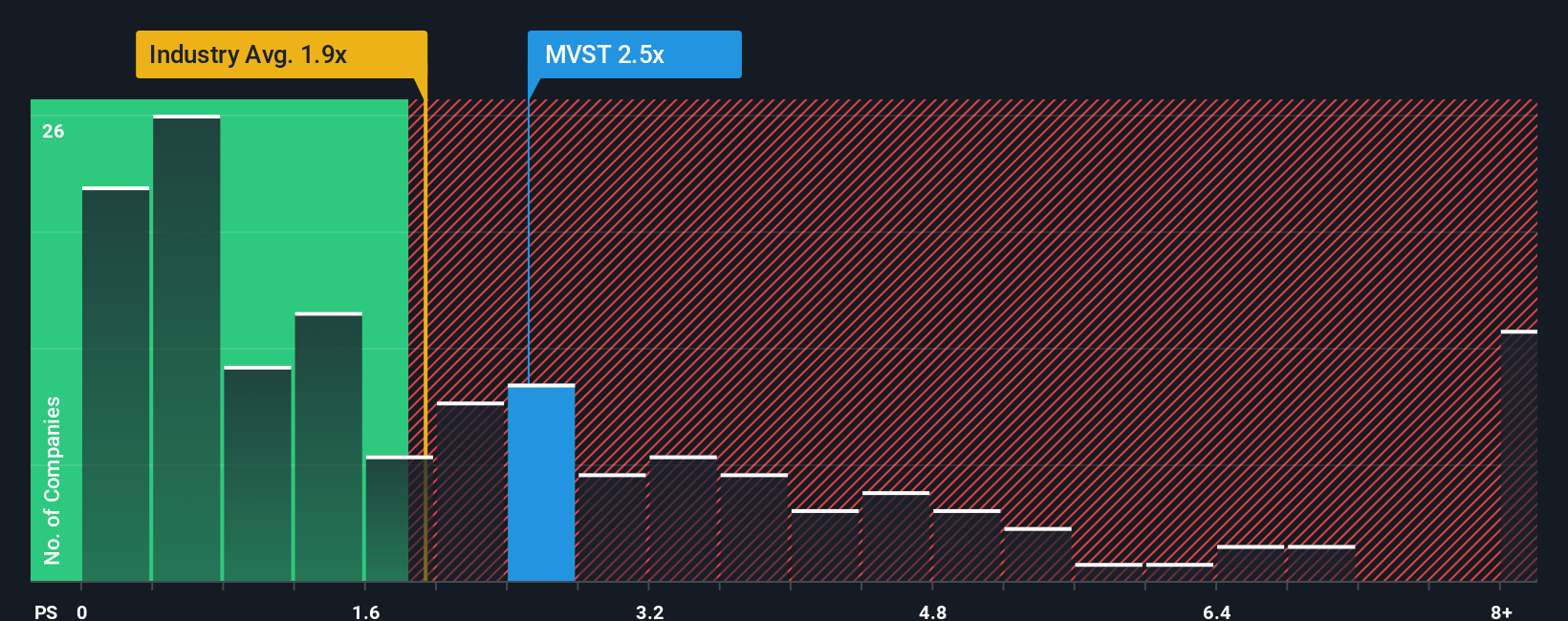

Looking at Microvast through its sales ratio offers a more cautious perspective. The company trades at 3.5 times sales, which is well above the peer average of 0.7 and the US Machinery industry's 1.9. While the market is clearly pricing in strong growth, this premium leaves little room for error if expectations aren't met. Is the optimism justified, or are investors overlooking risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Microvast Holdings Narrative

If you see the story differently, or simply want to dig deeper into the numbers yourself, you can craft your own stock narrative in just minutes using Do it your way.

A great starting point for your Microvast Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that real opportunities often hide beyond the headlines. Don’t miss your chance to discover where the next breakout winners could be hiding.

- Unlock high growth potential and strong financials by checking out these 3561 penny stocks with strong financials creating buzz in dynamic markets.

- Get ahead of innovation by tapping into the brightest opportunities among these 24 AI penny stocks transforming industries with artificial intelligence.

- Secure reliable income streams by searching through these 19 dividend stocks with yields > 3% with yields above 3%, an approach that may help build a resilient portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MVST

Microvast Holdings

Provides battery technologies for electric vehicles and energy storage solutions.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives