- United States

- /

- Machinery

- /

- NasdaqCM:MVST

A Fresh Look at Microvast Holdings (MVST) Valuation After Surprising Earnings and Solid-State Battery Advances

Reviewed by Simply Wall St

If you have been tracking Microvast Holdings (MVST), you will have noticed a fresh wave of headlines this week as the company reported earnings and revenue numbers that exceeded expectations. After struggling with losses in recent quarters, Microvast is now emphasizing its push into solid-state battery technology, which is designed for faster charging and longer life. The company is also ramping up production capacity in China. The news has quickly grabbed investor attention, raising questions about what comes next for the company and whether it signals a true shift in financial health.

Taking a step back, Microvast’s shares have climbed 15% over the past year, even after some choppy months recently. Despite short-term swings, the company’s global expansion and improved fundamentals have led to renewed optimism and higher trading volumes. Compared to its volatile multi-year performance, this year’s upward momentum stands out against a backdrop of more stable earnings and ambitious growth goals.

So, with shares on the move and Microvast chasing bigger ambitions, is now the time for investors to consider a stake, or is the market already pricing in the future growth story?

Most Popular Narrative: 48.7% Undervalued

According to the most widely followed narrative, Microvast Holdings is seen as significantly undervalued compared to its potential, with analysts anticipating much stronger financial performance and market expansion in coming years.

Continued investments in advanced battery technologies, such as all-solid-state and silicon-based cells, position Microvast to meet growing demand for high-performance, safer, and versatile battery solutions across sectors like EVs, energy storage, robotics, and aerospace. This supports a higher-margin product mix and top-line revenue growth. Strategic capacity expansion, including the new 2 GWh line at the Huzhou facility scheduled for Q4 2025, enables Microvast to capture accelerating order flow from the global electrification push. This directly supports volume growth and operating leverage, which is likely to enhance future revenue and gross margins.

What is the secret behind this bold undervaluation call? The narrative is built on a path of aggressive growth projections and impressive profit targets, rolling out over the next few years. But what financial assumptions are fueling this optimism, and could they turn the stock’s fortunes? Uncover the details that might reshape how you look at Microvast’s future.

Result: Fair Value of $5.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as execution delays in new battery technologies and ongoing exposure to geopolitical tensions could challenge the bullish outlook.

Find out about the key risks to this Microvast Holdings narrative.Another View: Looking at Market Comparisons

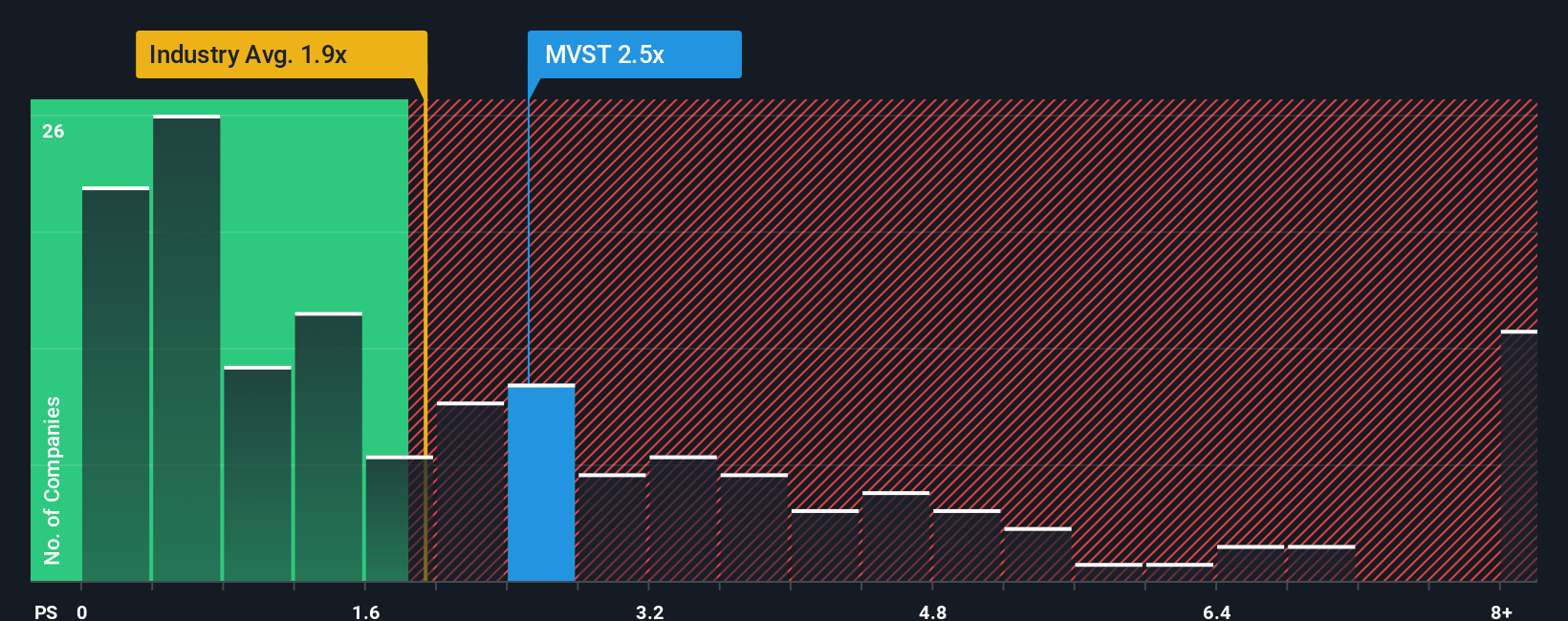

On the flip side, when compared to others in its industry using a common valuation approach, Microvast trades at a higher level than average. This challenges the idea of it being undervalued. Could the excitement be overdone?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Microvast Holdings to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Microvast Holdings Narrative

If you see things differently or would rather dig into the numbers yourself, you can put together your own Microvast narrative in just a few minutes. Do it your way

A great starting point for your Microvast Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for Your Next Smart Investment?

Stay ahead of the market by tapping into investment strategies you might be overlooking. Make your portfolio work harder with these fresh growth opportunities:

- Unlock growth potential by evaluating penny stocks with strong financials using penny stocks with strong financials and spot emerging leaders before they make headlines.

- Boost your returns by tracking undervalued stocks based on cash flows with undervalued stocks based on cash flows. This can give you a head start on market moves others miss.

- Ride the rise of health innovation by screening for healthcare AI stocks through healthcare AI stocks. Discover companies redefining tomorrow’s medicine.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MVST

Microvast Holdings

Provides battery technologies for electric vehicles and energy storage solutions.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives