- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:MRCY

Assessing Mercury Systems (MRCY) Valuation After New Governance-Focused Shareholder Investigation

Reviewed by Simply Wall St

A shareholder rights law firm has launched an investigation into whether Mercury Systems (MRCY) officers and directors breached their fiduciary duties, putting corporate governance and long term shareholder protections under a sharper spotlight.

See our latest analysis for Mercury Systems.

The legal scrutiny arrives after a powerful run, with Mercury Systems delivering a year to date share price return of 68.6 percent and a 1 year total shareholder return of 85.95 percent. This suggests momentum has been strong even as governance questions emerge.

If this governance story has you rethinking your defense exposure, it could be a good moment to scan other opportunities across aerospace and defense stocks for fresh ideas.

Yet with revenues rising, losses lingering, and shares still trading below analyst targets, investors face a key question: Is Mercury Systems undervalued after its rebound, or has the market already priced in the next leg of growth?

Most Popular Narrative: 17% Undervalued

With Mercury Systems last closing at $71.35 against a narrative fair value of $86, the valuation case leans on ambitious, long term growth assumptions.

Investments in R&D and expanded product offerings (including acquisition integration and common processing architectures) are enabling wins in next-generation programs and recurring business, supporting a long-term transition toward a higher-margin, more predictable earnings model.

Curious how modest top line growth, rising margins, and a richer earnings multiple could still justify a premium defense valuation story? Unpack the full narrative to see which future profitability targets and valuation multiples underpin that $86 fair value.

Result: Fair Value of $86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat scenario still hinges on unwinding low margin legacy contracts and sustaining defense budgets, where any stumble could swiftly pressure margins and growth expectations.

Find out about the key risks to this Mercury Systems narrative.

Another Lens on Valuation

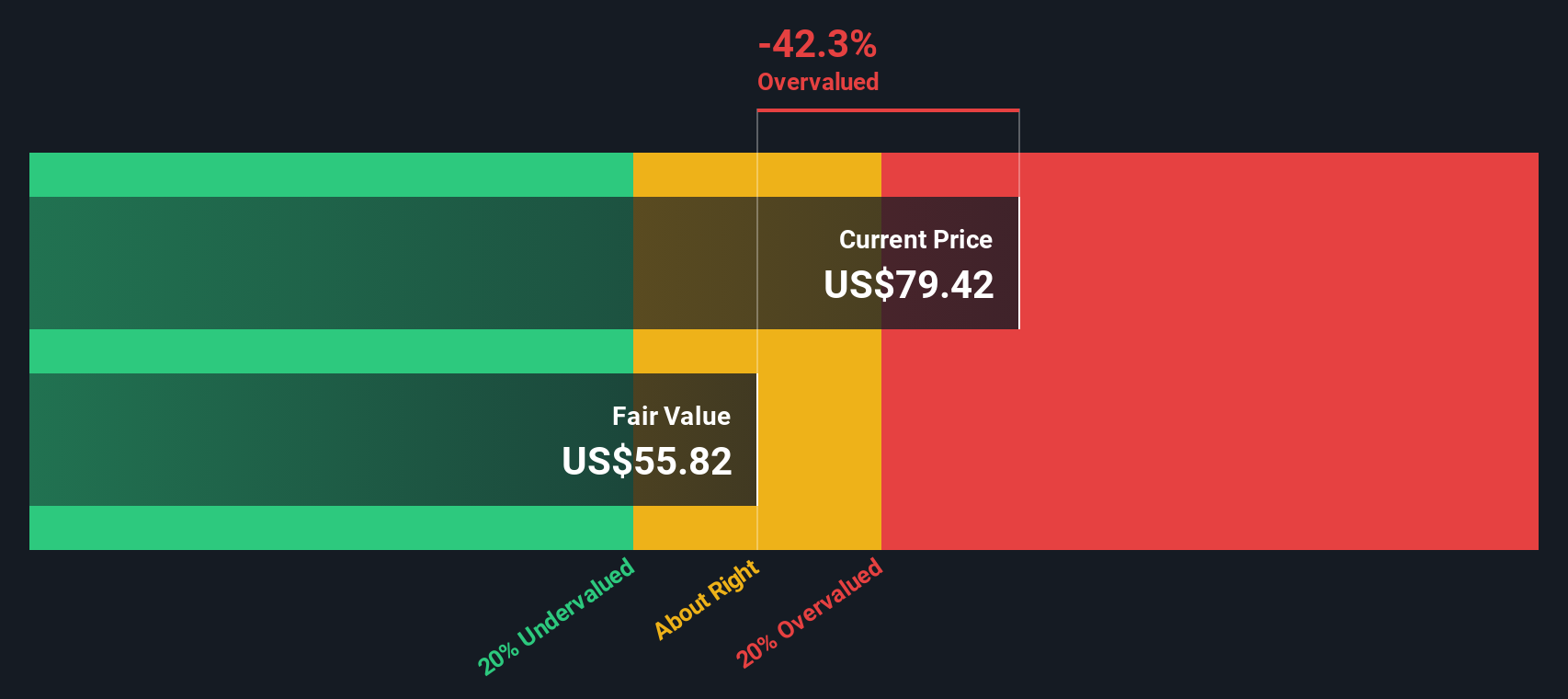

Our SWS DCF model takes a stricter view, suggesting Mercury Systems is overvalued at today’s price, with fair value closer to $44. This stands in sharp contrast to the narrative fair value of $86, raising the question: which future path do you believe?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Mercury Systems Narrative

If you see the story differently, or want to run your own numbers, you can build a personalized narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Mercury Systems.

Looking for more investment ideas?

Do not stop at a single defense stock. Use the Simply Wall St Screener today to uncover focused opportunities and stay ahead while others hesitate on the sidelines.

- Explore potential multi-bagger opportunities early by scanning these 3573 penny stocks with strong financials built on solid financial foundations rather than speculation.

- Focus on the center of intelligent automation by targeting these 26 AI penny stocks that are involved in data driven innovation.

- Seek dependable portfolio income by concentrating on these 14 dividend stocks with yields > 3% that may support long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRCY

Mercury Systems

A technology company, manufactures and sells components, products, modules, and subsystems for defense prime contractors, original equipment manufacturers, government, and commercial aerospace companies.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026