- United States

- /

- Electrical

- /

- NasdaqGS:LYTS

Shareholders Will Probably Hold Off On Increasing LSI Industries Inc.'s (NASDAQ:LYTS) CEO Compensation For The Time Being

CEO James Clark has done a decent job of delivering relatively good performance at LSI Industries Inc. (NASDAQ:LYTS) recently. As shareholders go into the upcoming AGM on 02 November 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for LSI Industries

Comparing LSI Industries Inc.'s CEO Compensation With the industry

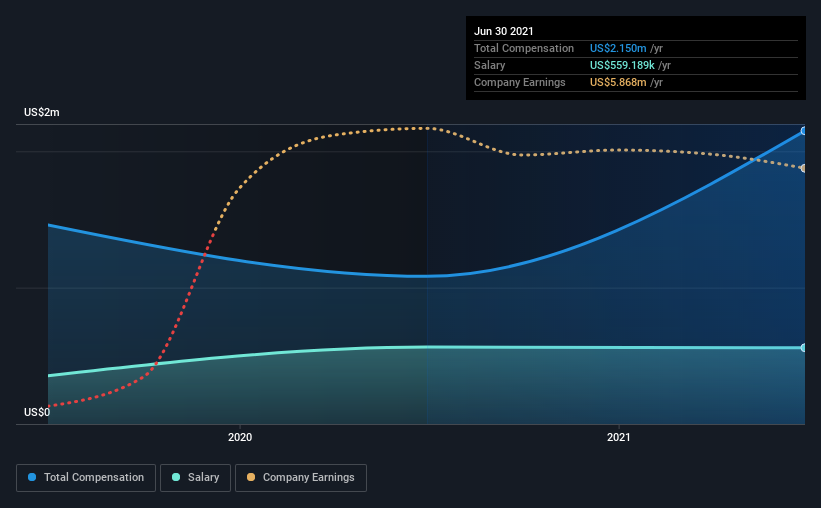

At the time of writing, our data shows that LSI Industries Inc. has a market capitalization of US$208m, and reported total annual CEO compensation of US$2.2m for the year to June 2021. Notably, that's an increase of 99% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$559k.

In comparison with other companies in the industry with market capitalizations ranging from US$100m to US$400m, the reported median CEO total compensation was US$702k. Hence, we can conclude that James Clark is remunerated higher than the industry median. What's more, James Clark holds US$551k worth of shares in the company in their own name.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | US$559k | US$564k | 26% |

| Other | US$1.6m | US$518k | 74% |

| Total Compensation | US$2.2m | US$1.1m | 100% |

On an industry level, roughly 27% of total compensation represents salary and 73% is other remuneration. There isn't a significant difference between LSI Industries and the broader market, in terms of salary allocation in the overall compensation package. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

LSI Industries Inc.'s Growth

Over the past three years, LSI Industries Inc. has seen its earnings per share (EPS) grow by 93% per year. In the last year, its revenue is up 3.3%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has LSI Industries Inc. Been A Good Investment?

Most shareholders would probably be pleased with LSI Industries Inc. for providing a total return of 102% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 4 warning signs for LSI Industries that investors should think about before committing capital to this stock.

Switching gears from LSI Industries, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:LYTS

LSI Industries

Manufactures and distributes commercial lighting, graphics, and display solutions across strategic vertical markets.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives