- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Intuitive Machines (LUNR) Lands US Air Force Contract Extension for Lunar Nuclear Power Technology

Reviewed by Sasha Jovanovic

- On October 30, 2025, Intuitive Machines announced it received an US$8.2 million contract extension from the U.S. Air Force Research Laboratory to accelerate the development of compact nuclear power systems for spacecraft and lunar infrastructure.

- This contract signals growing confidence in Intuitive Machines' Stirling technology, which could support longer lunar missions by overcoming solar power limitations in extreme environments.

- We'll explore how this major government contract extension may strengthen Intuitive Machines' revenue streams and prospects for space-based nuclear power advancements.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Intuitive Machines Investment Narrative Recap

Investors in Intuitive Machines need to believe that government and commercial demand for lunar and deep space infrastructure will accelerate, creating a scalable market for advanced technologies like nuclear power systems. The recent US$8.2 million Air Force contract extension may help diversify near-term revenue and raise the company's technology profile, but does not fundamentally address the company’s largest short-term risk: its dependence on large, milestone-based contracts that can be unpredictable in timing and scope.

Among recent announcements, the US$9.8 million contract to advance the Orbital Transfer Vehicle highlights continued momentum in winning funded projects related to space infrastructure. While these contracts build the order book and showcase client interest, the financial impact depends heavily on successful execution and conversion to profitable revenue, echoing the central risks facing Intuitive Machines at this stage.

Yet, unlike hype around government contracts, investors should be aware of the continued reliance on a small pool of major awards that...

Read the full narrative on Intuitive Machines (it's free!)

Intuitive Machines' narrative projects $502.2 million revenue and $41.2 million earnings by 2028. This requires 30.5% yearly revenue growth and a $283 million increase in earnings from the current level of -$241.8 million.

Uncover how Intuitive Machines' forecasts yield a $15.43 fair value, a 65% upside to its current price.

Exploring Other Perspectives

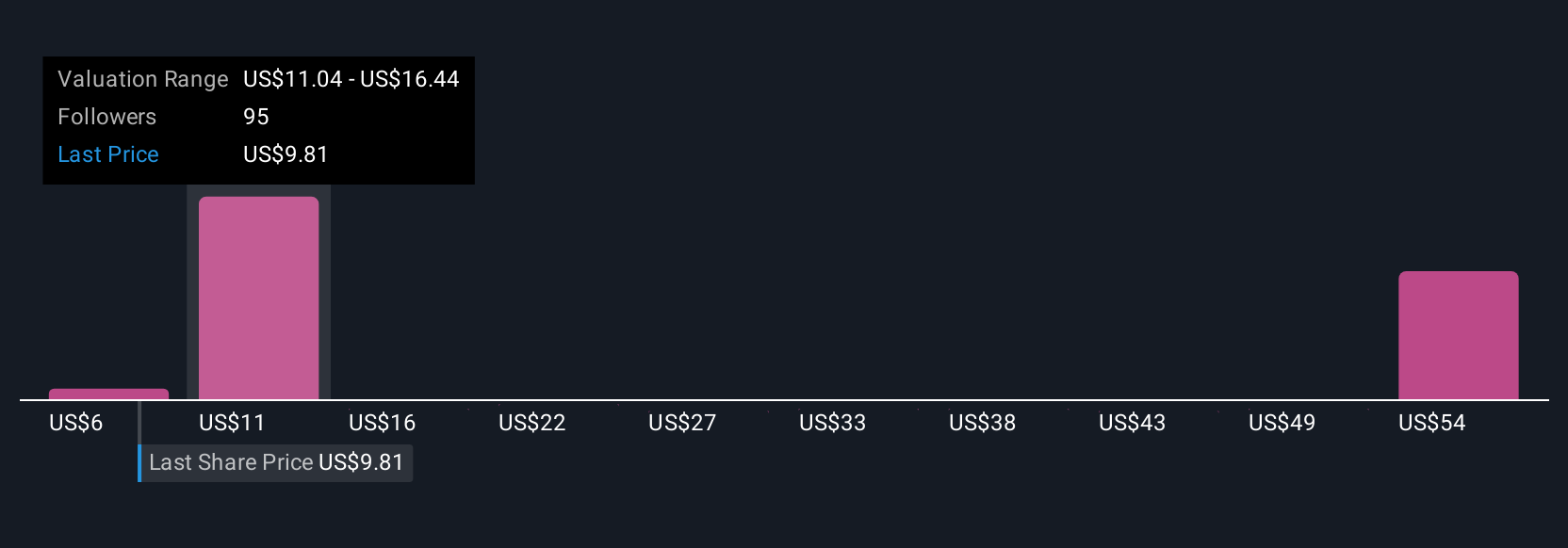

Twenty-eight Simply Wall St Community fair value estimates for Intuitive Machines span from US$5.69 to US$63.59 per share. While investor views differ, ongoing dependence on large government contracts can trigger significant revenue swings if project timelines shift, so consider multiple scenarios before making a judgment.

Explore 28 other fair value estimates on Intuitive Machines - why the stock might be worth over 6x more than the current price!

Build Your Own Intuitive Machines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intuitive Machines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Intuitive Machines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intuitive Machines' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives