- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Intuitive Machines (LUNR): Assessing Valuation Following Marked Profitability Improvement in Latest Earnings

Reviewed by Simply Wall St

Intuitive Machines (LUNR) released its third quarter earnings, showing a sharply reduced net loss compared to last year, even though revenue ticked down. Investors are paying close attention to the underlying cost improvements this reflects.

See our latest analysis for Intuitive Machines.

After a rocky start to the year, Intuitive Machines has seen its share price rebound 9.7% over the past three months. However, the year-to-date share price return still sits at a steep -50.7%. This recent uptick suggests investors are beginning to recognize the company's cost improvements and operational discipline, even though its 1-year total shareholder return remains negative.

If Intuitive Machines' turnaround has you wondering what other opportunities are emerging, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With profitability trends improving and the share price still far below analyst targets, investors face a key question: is Intuitive Machines genuinely undervalued, or does the current price already reflect lofty growth expectations?

Most Popular Narrative: 38% Undervalued

Compared to the last close of $9.53, the most followed fair value estimate for Intuitive Machines stands much higher, shining a spotlight on optimism despite sharp losses. This wide gap is fueling debate and intense interest from investors on what's really priced in, as well as what might still be to come.

Vertical integration, proprietary tech, and entry into high-margin adjacent markets support enhanced profitability, differentiation, and long-term competitive advantage.

Want to know the surprising assumptions fueling this bold outlook? Behind this narrative are sky-high estimates for revenue growth, margin improvement, and a future profit multiple seldom seen in the sector. Curious how analysts justify a price target far above today's levels? Unlock the full story to see exactly what financial bets drive this call.

Result: Fair Value of $15.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on major government contracts and ongoing execution risks could quickly shift sentiment if delays or setbacks occur.

Find out about the key risks to this Intuitive Machines narrative.

Another View: What Do Multiples Say?

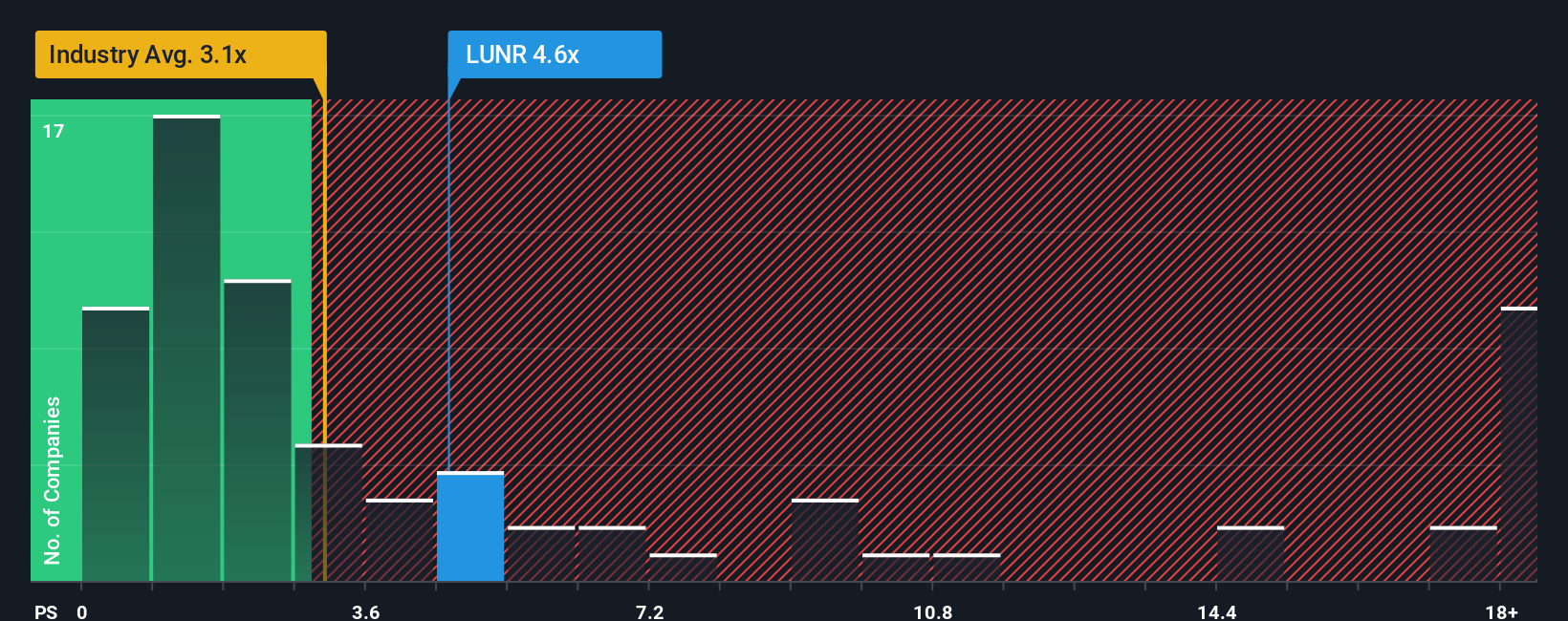

Looking at valuation through the revenue lens, Intuitive Machines trades at 5.2 times sales, noticeably higher than its peers at 1.8 times and the broader US Aerospace & Defense industry at 2.9 times. The fair ratio sits at just 1.6, suggesting the current pricing leaves little margin for error. Could high hopes for future growth be inflating this multiple, making downside risks more pronounced?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuitive Machines Narrative

If you think there's more to the story or want to take a closer look at the numbers yourself, you can craft your own view in just a few minutes. Do it your way

A great starting point for your Intuitive Machines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Move ahead of the market by acting on proven investment themes that could power your portfolio. Don’t let opportunity pass you by; these ideas are waiting for your attention.

- Tap into booming healthcare innovations by checking out these 31 healthcare AI stocks and discover companies blending artificial intelligence and medicine for real-world impact.

- Supercharge your search for value by digging into these 906 undervalued stocks based on cash flows, which highlights stocks whose strong cash flows could mean overlooked upside.

- Accelerate your gains with these 3577 penny stocks with strong financials, featuring companies that show remarkable financial fundamentals and may soon step into the spotlight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives