- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Exploring Intuitive Machines (LUNR) Valuation After Recent 28% Share Price Climb

Reviewed by Simply Wall St

Intuitive Machines (LUNR) has seen a steady climb in its stock price over the past month, rising nearly 28%. Investors are paying closer attention to what is driving this move and whether it signals a change in sentiment.

See our latest analysis for Intuitive Machines.

Intuitive Machines’ recent 28% surge over the past month has brought some welcome momentum, especially after a challenging start to the year. While the year-to-date share price return sits at -33.7%, the one-year total shareholder return is an impressive 60.3%. This highlights a company that has shown resilience and potential for long-term growth as sentiment shifts.

If you’re watching for sparks of momentum like this, it could be the perfect moment to discover fast growing stocks with high insider ownership.

With strong recent gains but a history of volatility, the key question now is whether Intuitive Machines remains undervalued, or if investors have already factored in expectations for future growth and profitability. Is there still a buying opportunity, or is everything already reflected in the price?

Most Popular Narrative: 17% Undervalued

The most widely followed narrative places Intuitive Machines' fair value at $15.43, notably above its last close of $12.81. This represents a considerable valuation gap that has investors debating whether the company’s strategic foothold in lunar and deep space markets justifies a much higher price tag.

Strategic vertical integration of satellite and lander manufacturing, along with proprietary advancements from the KinetX acquisition, enhances cost efficiencies, IP control, and technological differentiation. This supports higher net margins and competitive pricing power as the company scales recurrent service contracts across civil, defense, and commercial markets.

What is really driving this big valuation jump? According to reports, certain aggressive growth bets and margin forecasts could influence future earnings considerably. Want to discover the forecasts and financial expectations behind this bold price target? See why some believe the company’s growth curve could differ significantly from industry norms.

Result: Fair Value of $15.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on large government contracts and persistent operating losses could quickly shift sentiment if delays or setbacks occur.

Find out about the key risks to this Intuitive Machines narrative.

Another View: Multiples Tell a Different Story

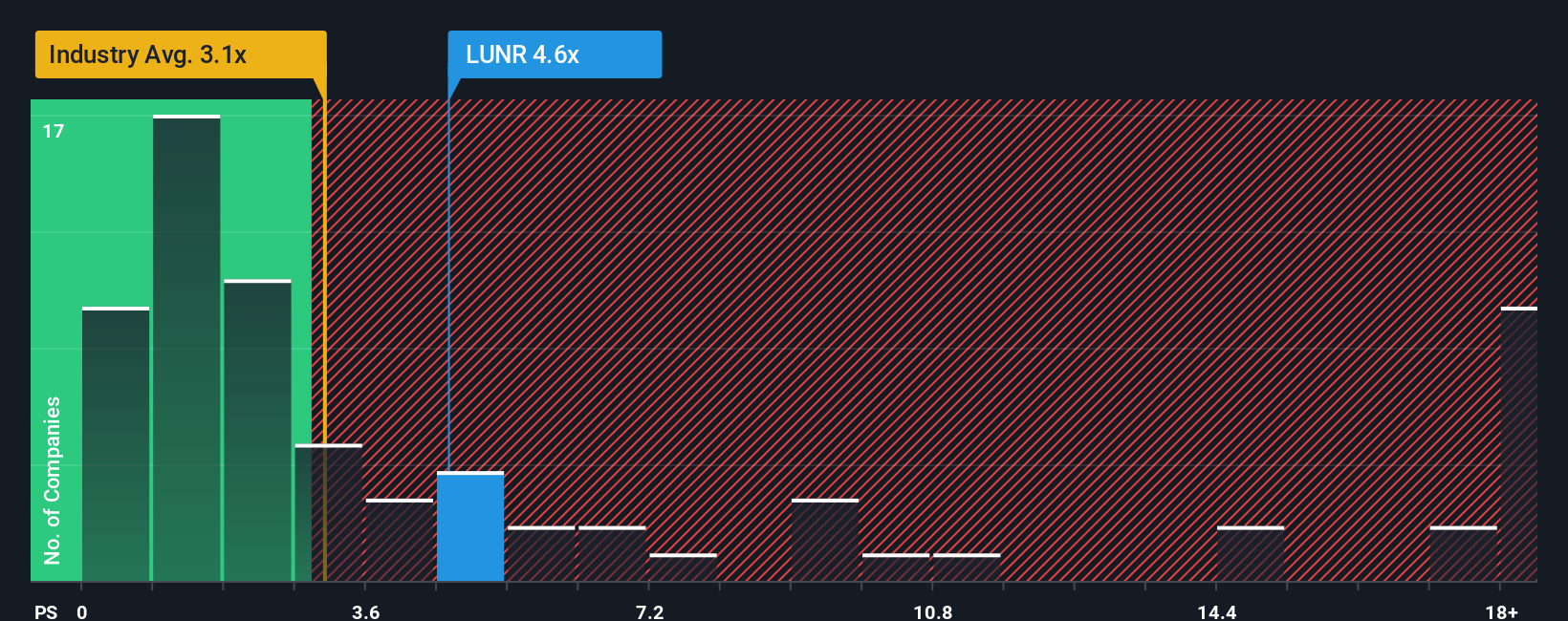

While the fair value estimate puts Intuitive Machines well below its potential, looking at the price-to-sales ratio paints a riskier picture. The company's current ratio of 6.7x is much higher than both the industry average (3.2x) and its fair ratio of 1.4x. This means investors today are paying a premium for every dollar of sales compared to peers and to what the market could eventually align with. With such a gap, could the premium evaporate if expectations cool, or is there still hidden upside others are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuitive Machines Narrative

If you have a different perspective or enjoy diving into the numbers yourself, you can quickly craft your own view in just a few minutes. Do it your way.

A great starting point for your Intuitive Machines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors move ahead by seeking out promising trends before the crowd catches on. Simply Wall Street’s screeners help you spot tomorrow’s winners today.

- Capture strong yields that beat the bank by checking out these 17 dividend stocks with yields > 3% to see which companies are rewarding shareholders with healthy payouts above 3%.

- Fuel your portfolio with the growth of artificial intelligence by targeting leaders through these 27 AI penny stocks who are revolutionizing industries with groundbreaking innovation.

- Power up your research with these 80 cryptocurrency and blockchain stocks to harness the momentum behind cryptocurrency and blockchain pioneers driving the digital frontier.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives